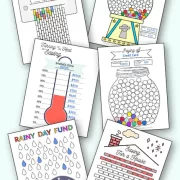

Debt Payoff Savings Challenge Bundle

6+ awesome debt pay-off coloring sheets plus bonus low-income savings sheets.

SALE 50% Off!$5 .00 $2.50

A debt payoff and savings challenge bundle that gives you the head start you need for paying off your debt fast and saving money. The debt trackers can be used for your debt snowball to include credit card debt payoff, student loan payoff, car loan payoff, mortgage payoff, and more.

The savings challenge trackers can be used for a vacation fund tracker, sinking fund tracker, emergency savings, rainy day fund, pet emergency fund, home improvement tracker, or any of your savings goals.

These coloring sheets are unlabeled so you can use them for any amount of money. Great for saving for your next vacation, emergency fund, baby steps, gifts, car fund, or anything else you’re saving towards. This versatile savings tracker is in the shape of a mason jar and has space above to write in your savings goals.

And since the worksheet is unlabeled, you can reuse it for different savings goals throughout the years. Or print multiple copies off at a time and use them to track your sinking funds.

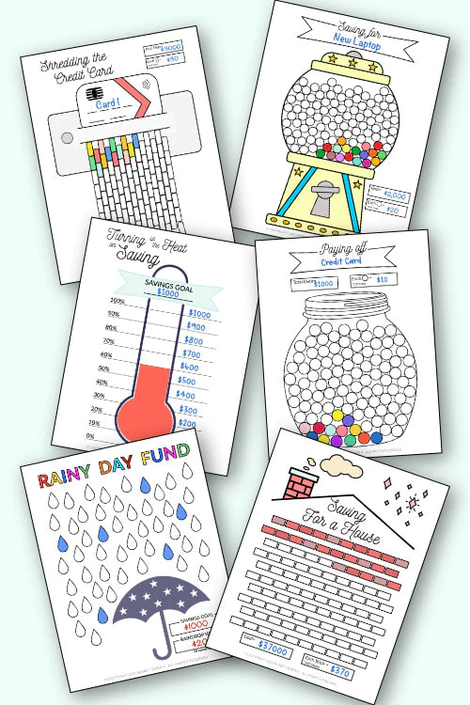

Included in this bundle are six different debt payoff and savings challenge worksheets:

- Debt Payoff Tracker Jar Printable

- Debt Snowball Tracker

- Rainy Day Fund Tracker

- Credit Card Payoff Tracker

- Savings Thermometer

- House Downpayment Savings Tracker

- Gumball Savings Tracker

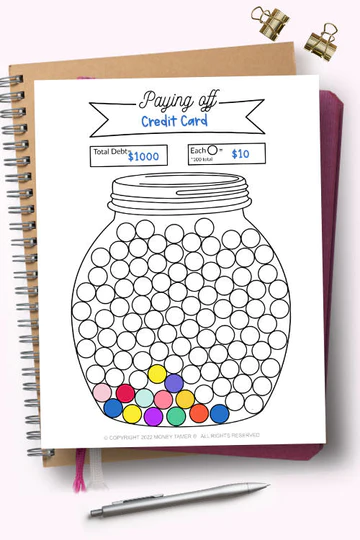

Debt Payoff Tracker Jar Printable

A simple, yet fun, printable savings tracker that you can download right now and start using immediately at home. This savings jar printable is filled with 100 marbles that you color in as you save.

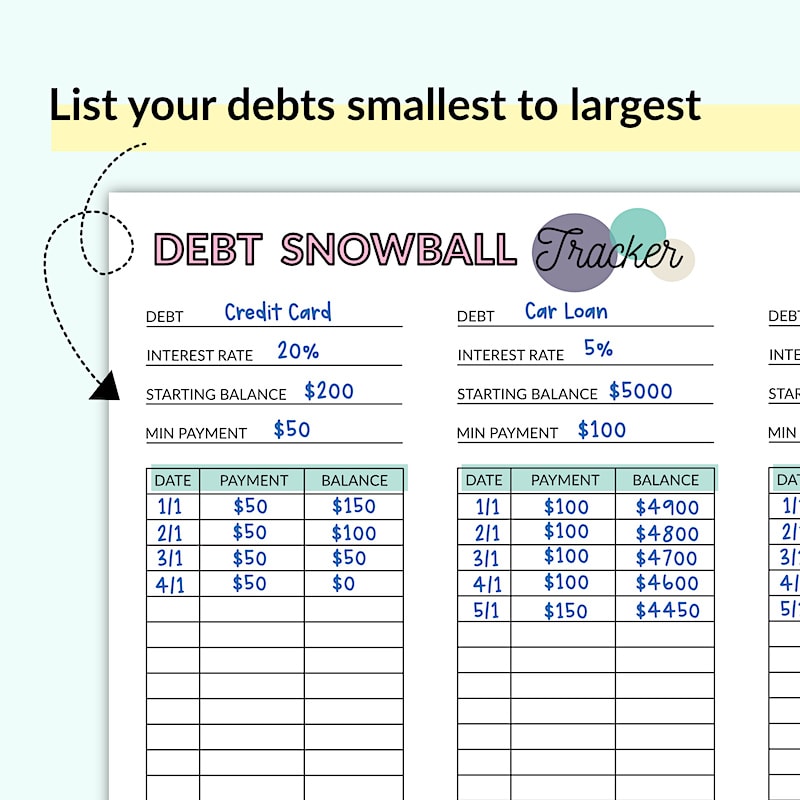

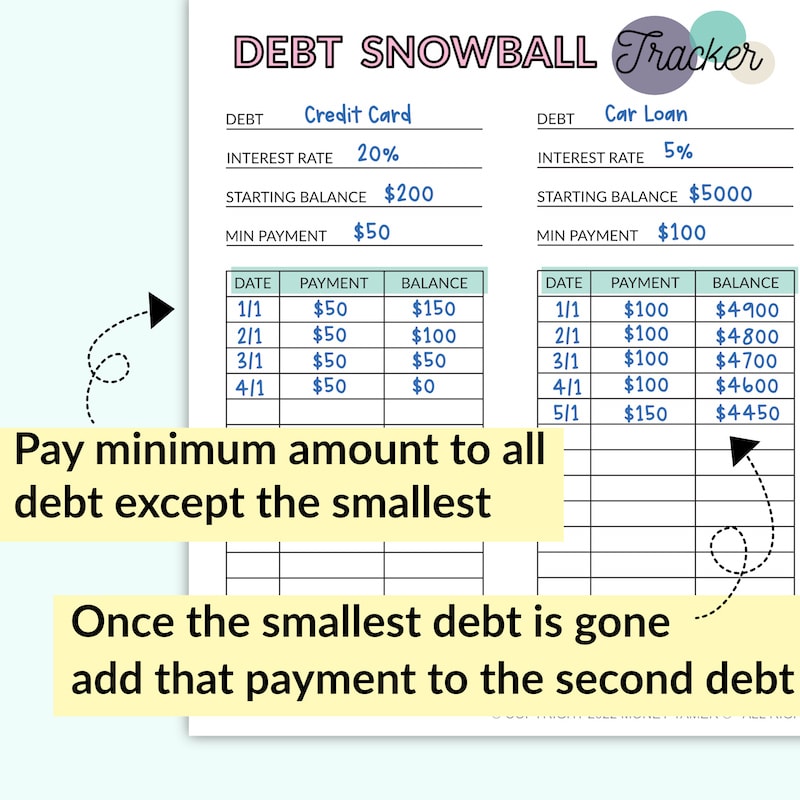

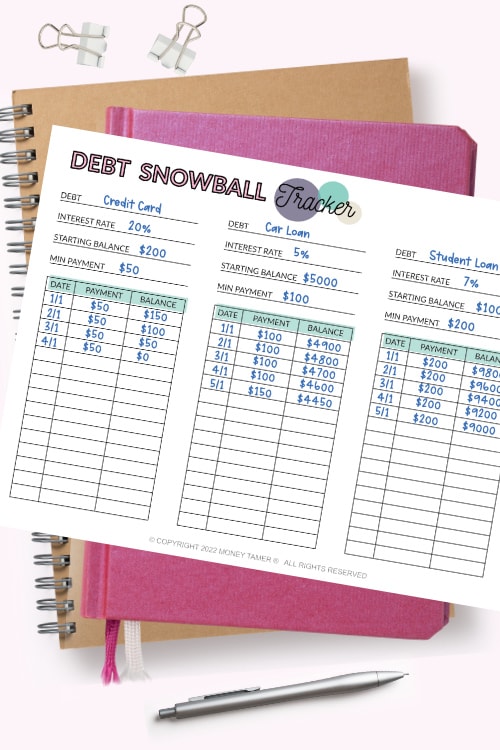

If you have more than one debt that you’re trying to pay off, never fear, the debt snowball tracker is here!

It’s a common question to ask “How do I track my debt payoff?” It can get confusing trying to keep track of all your debt. Which debt should you pay off first? How much should you be paying every month?

snowball tracker printable

With this snowball tracker PDF, you’ll list your debts smallest in balance to the largest. Then you pay the minimum amounts on all debts except the smallest debt. For the smallest debt, you put all extra money you can find towards paying down the principal.

Then once the smallest debt is paid off, you add the amount you were paying to that debt to the second smallest debt. Your goal is to vigorously pay whatever your smallest debt is at the time, irrespective of the interest rate, and then snowball the payment amounts to the next smallest debt once the debt you were focusing on is gone.

Rainy Day Fund Tracker

A fully customizable rainy day fund savings tracker. Figure out your savings goal, then divide that number by the number of raindrops (50) to get each raindrop’s value.

As you save, color in the raindrops until your savings goal is reached. You can use this rainy day fund printable again and again. Great for if you’re doing a starter savings fund, and then again later when you’re increasing it to a 3-month or 6-month cushion fund.

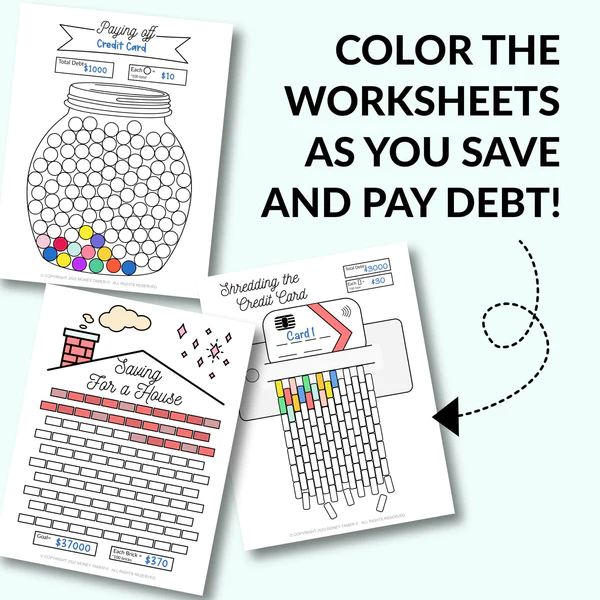

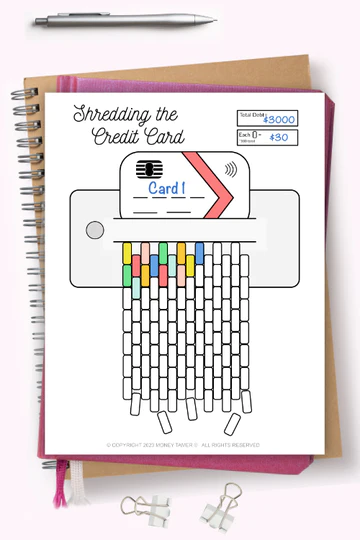

Credit Card Payoff Tracker

Get on top of your credit card debt payoff by using this credit card payoff tracker printable. No matter how many credit cards you have, you can print off a credit card debt challenge for each one and color in the shreds as you pay down your debt.

This is a motivating visual to help you along your journey toward becoming debt-free and reaching financial freedom.

This debt challenge printable has 100 “shreds”. Divide your total debt amount by 100 in order to determine how much each shred is worth. Then as you pay off your debt fast, color in the corresponding shreds on this payoff tracker.

If you have multiple credit cards, label each money worksheet with the name of the credit card to keep track easily.

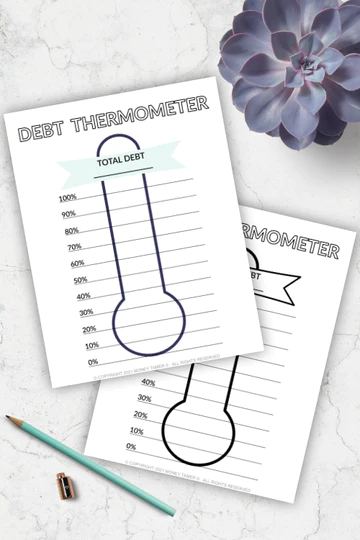

Savings Thermometer

Paying off debt can be hard but it can get easier with a debt-free coloring sheet. Use this debt payoff printable to track your payoff journey. The debt thermometer is only labeled with percentages so you can fill it in to customize it for each specific debt.

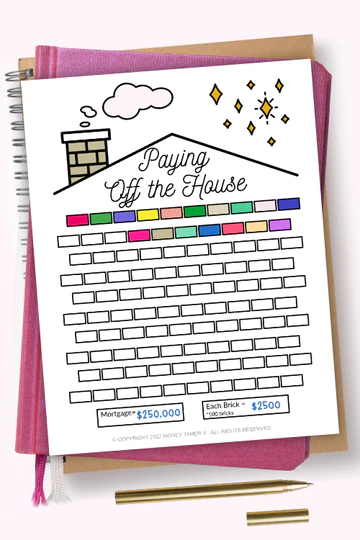

House Downpayment Savings Tracker

Are you ready to aggressively pay down your home mortgage? This mortgage payoff tracker printable is completely customizable to any amount of debt you have to pay off. There’s no better feeling than being completely debt-free, including the mortgage.

This mortgage coloring sheet is unnumbered so that it’ll work with all mortgage amounts. There are 100 bricks total to color so divide your total debt amount by 100 to see how much each brick is worth.

For example:

- $100k mortgage = $1000 each brick

- $250k mortgage = $2500 each brick

- $300k mortgage = $3000 each brick

As you put money towards the principal, color in each brick using colored pencils, markers, crayons, or any art supply you prefer.

You can color in the stars, smoke, and chimney scene at any time since they’re for decoration purposes.

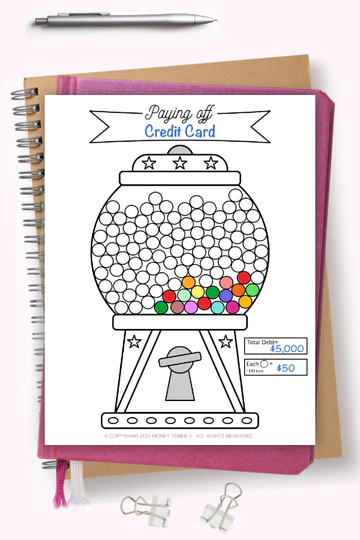

Gumball Savings Tracker

A fun and motivating savings challenge tracker in the shape of a gumball machine. This savings coloring worksheet comes in black and white and is unfilled, allowing you to use it for any savings goal amount.

There are 100 gumballs for you to color in. Divide your total savings goal by 100 in order to get the dollar amount per gumball. Then as you save, color in the gumballs.

The gumball machine can be colored any color you want or left blank. Since this savings worksheet is blank, you can use it again and again for different savings challenges, like saving for a vacation, travel fund, new laptop fund, birthday presents, or any sinking fund. You can even use it as a starter emergency fund worksheet or 30-day savings challenge. The uses are endless!

Plus, when you order now you’ll also get these SIX bonus sheets!

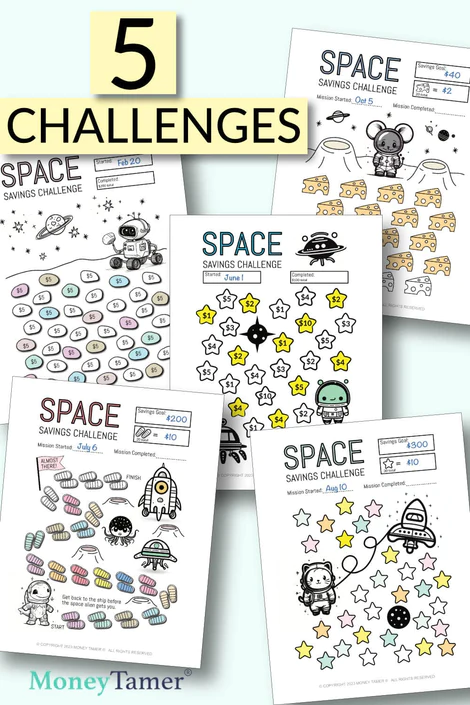

Spark your saving goals into hyperdrive with this Low Income Savings Challenge Space Bundle. This bundle includes 5 unique savings challenges, perfect for a low-income challenge with a space savings mission twist. Save $200, save $100, or set your own savings goal – the universe is your oyster!

The BONUS Savings Challenge Bundle includes:

- Alien Stars Savings Challenge (Save $100 Goal)

- Rover Rock Savings Challenge (Save $200 Goal)

- Astronaut Mouse Cheese Savings Challenge (set your goal, 20 objects)

- Astronaut Lizard Footsteps Savings Challenge (set your goal, 20 objects)

- Astronaut Cat Stars Savings Challenge (set your goal, 30 objects)

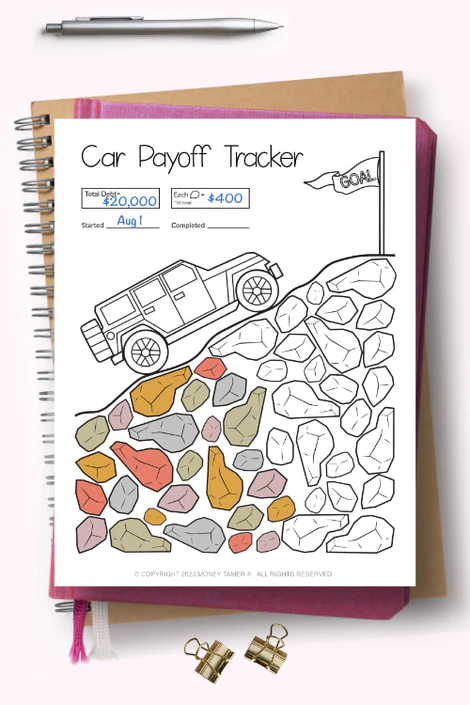

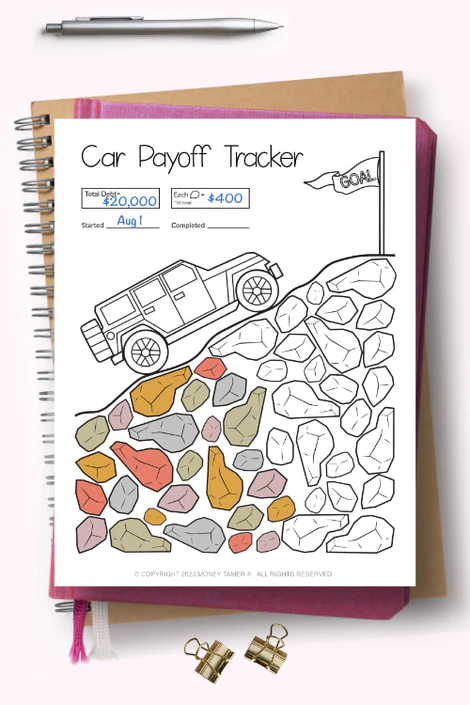

- Car Loan Payoff and Car Savings Chellenge

About the bonus space sheets: These savings tracker printables are unique and adorably space themed. Adults and kids alike are sure to enjoy. Once you finish a challenge, reprint it to start it again. Each challenge will help you on your journey toward your financial goals faster than warp speed. Reach for the stars and make your savings dream come true.

About the car savings sheets: This car payoff tracker worksheet helps you visualize your progress. This debt tracker provides an easy-to-use and visually appealing layout that allows you to see your car loan decreasing month by month. Celebrate every milestone as you get closer to being debt-free.

There are 50 rocks so divide your savings goal by 50 to get the dollar amount each rock equals. As you save, color in the corresponding number of rocks. Keep going until you reach your savings goal.

Be in complete control of your car savings goals with the Car Savings Tracker! This printable PDF helps you save for a brand-new car, used car, or your dream car and stay on budget. Easily set a targeted savings amount, track your progress along the way, and watch your car goals become a reality. It’s time to start living your car dreams!

Why The Debt Payoff Savings Challenge Bundle Works

All of these money challenges can be used to get your personal finance on track. Visual debt and savings trackers help you set clear money goals and keep you motivated as you color in the worksheets.

After you complete a savings challenge or debt payoff, reprint a new tracker when you want to start again.

Check out the additional bundles, debt payoff trackers, and savings printables in the shop.

Format:

PDF Document, US Letter size 8.5x11in

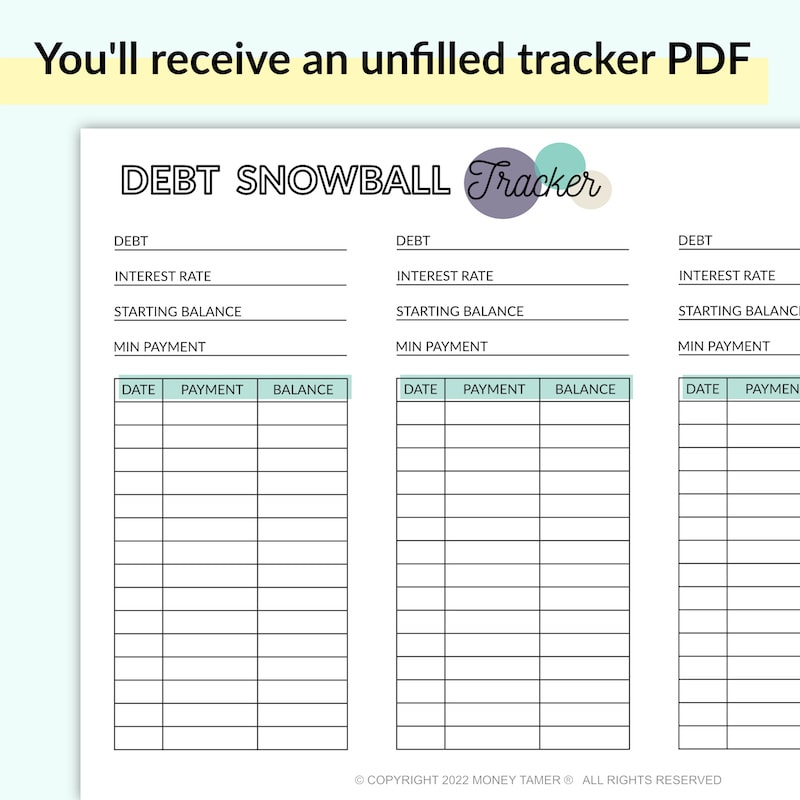

What You’ll Receive:

One PDF copy of the unfilled debt payoff trackers and savings challenge printables, One PDF copy of the space lowincome savings challenge and one PDF copy of the car savings printables.

*This is a printable file and no physical products will be mailed to you. For your personal use only.

Debt Tracker Printables

Unique and creative debt-free charts, debt payoff trackers, and debt color sheets to help keep you motivated while paying down debt. If you’re looking for a fun way to stay motivated while paying down your debt, these coloring sheets will do the trick.

Each debt-free chart is printable and comes in a PDF format. They can be customized to your individual debt and reused over and over again. If you want a little inspiration along your debt-free journey, coloring in these worksheets will help keep you focused and motivated along the way.

Sorry, there are no products in this collection.

Can you live debt-free?

Yes! It is possible to live debt-free but it does require a change in how you’re currently living. In order to live debt-free, you can’t spend more than you make. You’ll also have to be fine living without the instant gratification that credit cards and other loans provide.

How can I become debt-free?

The fastest way to become debt-free is to live on less than you earn and maximize your income. It sounds simple but takes a lot of mental energy. This may require looking for ways to make money, moving to a new location, changing jobs, or spending a lot less on food, to name a few.

How to Use Debt-Free Charts

All of the debt tracking printables are blank for you to fill in yourself. They come in a PDF format you can download instantly so you can print-at home.

1. Download and print your debt coloring sheet on your home printer.

2. Write the total amount of debt you’re paying off on your chart in the proper location.

3. Then divide the total amount of debt by the number of sections there are to color. Most of the worksheets will say how many sections there are to make the math easier.

4. Once you have the debt amount per section, label each section. For some trackers, there will be a shape key you can label instead of having to label each section.

5. As you send payments to your debt and pay if down, color in the corresponding sections of your debt free chart until you’re finished.

6. Congrats, that debt is gone! Now you can reprint the same worksheet to use for your next debt or scroll back up to find a different coloring sheet.