What Does ACH Stand for in Banking?

You’ve probably heard this term before. But what does ACH stand for in banking, and how does it affect your money? Most of all, can it make things easier for your finances?

Even if you haven’t heard of the ACH process before, you can still learn more about it and how it can improve your life. Find all the answers to your questions and gain more financial knowledge by reading this article.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

What Does ACH Really Stand For and How Does It Work?

What does ACH stand for in banking? ACH stands for Automated Clearing House.

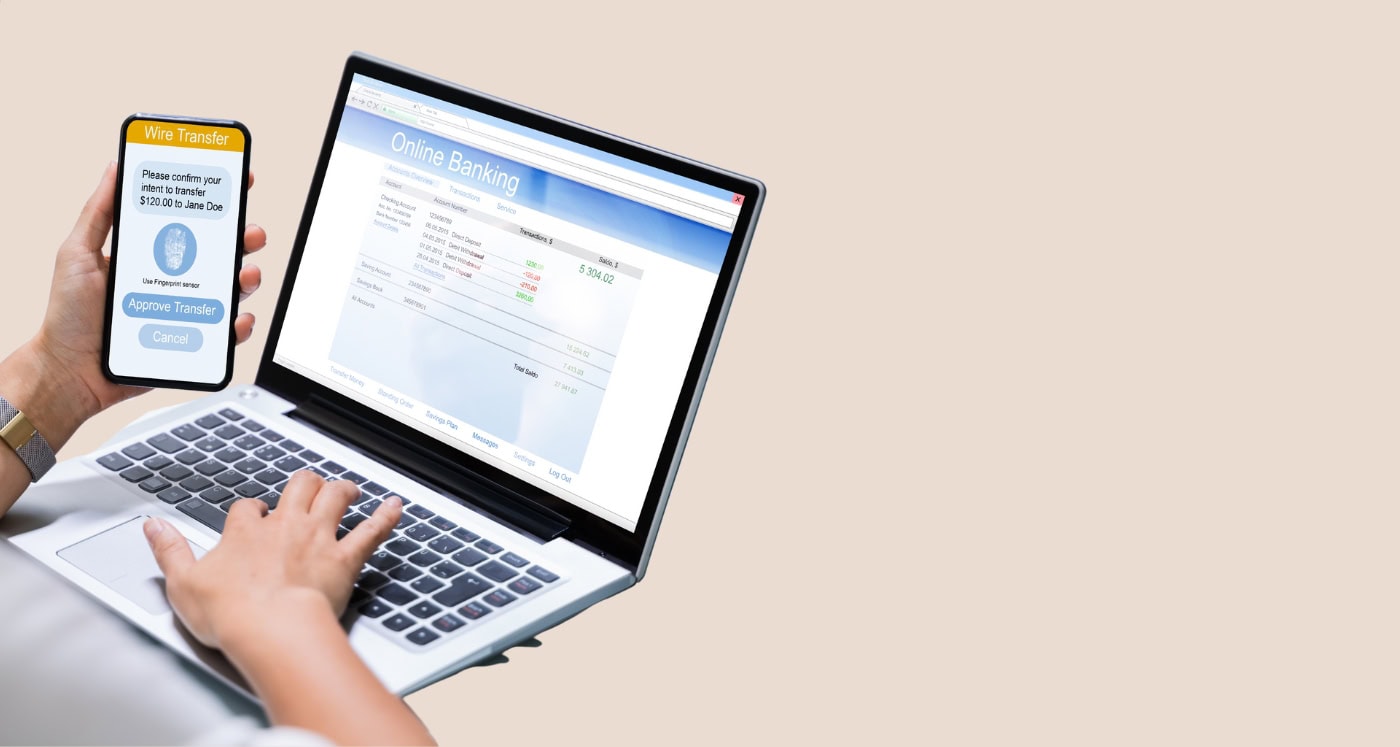

It’s basically a system that allows money to be moved between different financial institutions. It doesn’t require checks or cash, so it’s convenient and safe.

An originator sends a request to your bank for a payment from your bank account. This is referred to as the Originating Depository Financial Institution (ODFI).

Then the payment they requested is sent over to the Receiving Depository Financial Institution (RDFI). From there, the money is put into the account of the person who’s requiring the payment. (Whoever you’re trying to pay.)

It sounds complicated, but what it really does is move money around from various bank accounts to the intended recipients. You can easily send money to someone without physically giving them cash or a check. You can pay your credit card bill or receive money you earned from working.

What is an example of an ACH payment?

Maybe you’re thinking this would make a lot more sense with an example. Think of it this way: you likely use ACH payments all the time!

For instance, if you have a direct payment set up with a loan you’re paying off, or perhaps to pay your electricity bill, that is an ACH payment.

Or if you’re signed up for direct deposits with your work, that’s also an ACH payment. Basically, if money is being transferred electronically, there’s a good chance it’s an ACH payment.

Is ACH the same as a bank transfer?

Well, since we’re talking about transferring money from your bank account, is ACH the same as a bank wire transfer? No, these are actually two separate things.

They are similar, but some of the important differences are that a wire transfer allows you to transfer money internationally, and wire transfers also cost money.

What is needed for ACH payment?

How do you set up an ACH payment if you want to? A couple of things are needed for this.

You will have to provide your bank’s routing number, as well as your own account number, to get started with this process.

What is the purpose of an ACH?

What is the reason for all of this, anyway? Here are the main purposes of an ACH.

It automatically schedules a money transfer

If you like to set your bills and payments or your paycheck to auto-pay, this can be really helpful. An ACH can schedule your transfer for you, and you don’t have to think about it anymore.

It is completely electronic

There’s no exchange of cash, so you don’t need to be concerned about money getting lost or stolen. Using the ACH is a safer way to get money sent to you or someone else without incident.

It is a faster, more secure, and easier way to send money

Your money is generally safe with an ACH transfer, and it’s a very simple process to send money. ACH transfers usually take about 3 days which means they’re fairly quick, too.

It saves financial institutions money

The ACH process saves banks money, so it’s helpful for financial institutions and you, as well.

It is more convenient for the sender and receiver of the funds

The ACH process is just an all-around easier way to set up your payments and deposits. It’s convenient for you and the person receiving the money.

There’s no worrying about cash being lost, and no concern about forgotten payments. Basically, it adds convenience to your life instead of frustration.

How can ACH payments make your life easier?

When you use ACH for your money, it can actually make things much simpler for you. There’s no wondering when your check will be deposited or running to get cash from the ATM. Here’s how you can benefit from ACH payments.

Direct deposits

Worked hard all week, and you’re ready for your paycheck? When using ACH, there’s no concern about your boss forgetting to give you your check or a lack of consistency with when your payments come in. A direct deposit is one of the simplest ways to get paid.

By using direct deposits, you can know for sure that your paycheck will arrive around the same time, and there won’t be any issues with checks or timing. It makes receiving money a more secure process for you.

Plus, if you happen not to be at work the day you get paid, you will still receive payment without having to go in on your day off to grab a check.

You can make payments easily

Whether you need to pay your utility bill and you’re concerned about forgetting or you want to stay current on credit card payments, ACH can help. You can set up your payments, and then they’ll pay themselves automatically.

This saves you effort and keeps you from needing to remember every single due date in your calendar. You won’t ever have to deal with late fees or explain late payments again.

ACH is used all the time for processing funds, and it is a convenience that most people use quite often.

You may have used ACH before and not realized it or not known what this process was called. But it’s a regular part of life for most people. Since it makes finances so much easier and more convenient, it’s used all the time.

If you don’t currently use ACH payments, this might be a good time to give it a shot and see if it improves your financial life! It can definitely help you be more organized with your money, and help you to receive payments on time.

Follow along on Instagram!

![How to Cash a Check Without an ID [3 Legit Ways] 7 woman holding a check as she learns How to Cash a Check Without an ID](https://herpaperroute.com/wp-content/uploads/2022/09/How-to-Cash-a-Check-Without-an-ID-768x410.jpeg)