How to Use FamZoo to Teach Your Child About Money

If you are a parent and especially one with a big family, managing family finances can be a challenging affair.

It only takes that many times of realizing you don’t have enough cash on hand on allowance payday, or arguments about someone having sticky fingers around someone else’s piggy bank before you decide to throw your hands in the air and call it quits. This is where FamZoo comes in.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

FamZoo’s hands-on aspect is its biggest draw. With it, your children get a real-time financial education because he or she is responsible for making financial decisions like spending, saving, and giving.

FamZoo For Allowance Review

The system is designed as such that you maintain full control and can supervise their spending habits and saving habits. FamZoo also makes it easier for you to keep track of how much each child has to spend and how you are staying on top of your budget.

In this FamZoo review, I go into FamZoo’s features and how it is a system that can teach your child (from preschool to teenagers) the realities of money management.

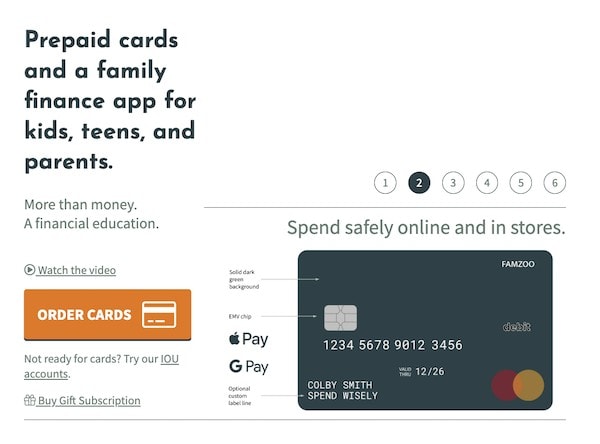

What is FamZoo?

The virtual family bank is the core of FamZoo’s product. With the virtual family bank, FamZoo recreates the banking experience in the home.

It thus mimics a real-world financial microcosm where you are the ‘banker’ and each child is a ‘customer.’ You set up a virtual family bank with a virtual bank account for each family member.

Through the use of either an IOU account or a prepaid card, your child can access their own virtual bank account, which you have visibility on via a shared dashboard.

Through FamZoo’s website and mobile app, you are able to manage and track your child’s spending and saving from anywhere with an internet connection.

FamZoo’s prepaid cards also differentiate themselves from other prepaid cards by allowing you to divert money into multiple virtual bank accounts for separate categories of spending.

Through multiple bank spending accounts, your kid learns to develop good budgeting habits and how to use a card, like a debit card or credit card, responsibly.

How Does FamZoo Work?

IOU accounts and prepaid card accounts are the two types of FamZoo accounts your kid can use.

IOU Accounts

A FamZoo IOU account tracks the money you are holding elsewhere on behalf of your children. The balance reflected on the IOU account is the money you ‘owe’ your children as a result of the money in those virtual family bank accounts.

The money here is merely virtual and representative and cash that your children get or spend is equivalent to the spending on your own bank debit card or credit card.

For example, your children may earn money from you for performing chores, or may hand you money they get from mowing their neighbor’s lawn.

Once the money is deposited in your bank account, you can credit your child’s IOU account. When FamZoo makes automated payments from you to your children, it also credits their individual IOU accounts.

Conversely, FamZoo deducts from your child’s IOU account for any automated ‘penalties’ or shared expenses from your child to you. If you make a purchase on your child’s behalf or hand over cash, you deduct the amount from your child’s IOU account to reflect the transaction.

Prepaid Card Account

A FamZoo prepaid card account gives your children real money, so be sure he or she can keep track of the card.

With prepaid cards, it gives your children a way to actually spend money on their own card with no risk of debt, while enabling you to see everything that they are spending on.

There is no need for you to worry about an overdraft – a purchase made when there are insufficient funds on a FamZoo prepaid card is harmlessly declined, and there is never a fee assessed even when it is an automatic recurring charge on the card.

Additionally, some of the advantages of a prepaid card include:

- The card can teach responsible ownership.

- The card can be locked immediately in the event of theft or loss.

- Your kids can enjoy the convenience of making online purchases.

- Hassle-free transactions as you can move money between you and your kids within a matter of minutes.

- You maintain full transparency on your kids’ spending habits and can teach your kids important skills when any teachable moments arise.

Now that you’ve understood the basics of how FamZoo works, the following goes into the features of this financial tool.Try out FamZoo for your own family for free!

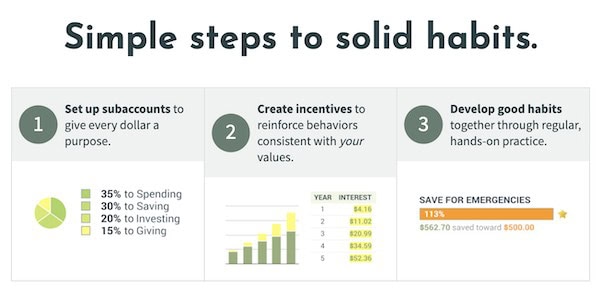

Allowances and Splitting Expenses

If you’ve ever struggled to regularly fund your kids’ spending, saving, and giving ‘jars’, then FamZoo makes it easy to automate the process and encourage good money habits that match your family’s unique values.

This split defines how the payouts to your kids are divided percentage-wise. For example, you may want to designate specific amounts for spending, saving, and donations.

It is also a good way to teach your kids the importance of saving when you match their saving contributions, or better yet, consult them on the spend-save-give allocation.

FamZoo is also designed to be an allowance management system. This means that you can set up a fixed amount of money to be paid to your kids as allowance on a recurring basis.

During set up, you can specify how much is paid to your kids and how often the payment occurs. If you are splitting expenses, FamZoo’s split deposits come in handy here as you can divvy up one-off deposits between your kids’ virtual family bank accounts.

Through giving kids some amount of discretion over their spending (there are no restrictions on the use of money in their spending accounts) and visibility on what they do with the money given, I’ve seen some incredible behavioral transformations and change of their spending habits for the better.

Kid’s Savings Challenge Bundle

A set of 5 kid’s savings challenges. This printable savings challenge bundle will help keep you motivated and on track to reach your money-saving goals. These are easy savings challenges that work great doubling as kids’ savings trackers.

Instances of them asking for money for anything and everything they want in the moment will lessen so much. There’s no more wondering how much was actually given to them in a month, and so on and so forth.

FamZoo’s online chore charts is another nifty feature that allows you to configure your very own family reward system. You can incentivize your kids by paying them for completing chores and other odd jobs.

When they don’t complete the chores, you can dock their allowance. When setting up chore rewards and penalties, you can choose from your existing allowance or split options. There are also options for ‘payroll’ withholding for saving or giving or imposing penalties for missed work.

FamZoo suggests a budget plan that is structured differently depending on your kids’ ages.

- The starter plan lets young kids with infrequent transactions track occasional deposits and purchases.

- The allowance and chore plan allows you to pay for things like chores or a regular allowance, and makes it easy to track how your kids earn income.

- The spend-save-give plan is focused on divvying up your kids’ income according to designated accounts, such as between the spending, saving, and giving accounts.

- The teen budget plan allows you to allocate income for present and future expenses, according to different budget percentages.

Parent-Paid Interest

FamZoo helps you to teach your kids the power of compound interest.

To encourage your kids to save, you pay compound interest on the current balance of your kids’ accounts, choosing from a compounding frequency of weekly, monthly, or annually.

FamZoo then automatically calculates and delivers the amount to be paid for each designated period.

The difference here is that you are responsible for defining the compound interest offering. To entice your kid to save more, you can use amounts and time-frames that actually make your kid pay attention.

What you are essentially doing is to offer a ‘mom and dad interest rate’ to motivate saving behavior in a way that traditional savings accounts can’t.

Instead of telling your kid to squirrel away money that makes them an additional penny a year in an account that they never see, the parent-paid interest feature on FamZoo is a far more attractive option that has the potential to encourage real change in saving behavior.

If you are wondering what is a good amount to pay and how often, FamZoo’s blog offers data on what other parents are paying as compound interest.

The average interest rates being paid by parents on FamZoo grouped by compounding period are as follows: 0.74 percent compounded weekly, 2.12 percent compounded monthly, and 6.51 percent compounded yearly.

You can also choose the compounding frequency, though the data on FamZoo’s platform suggests that weekly compounding is by far the most popular – 70 percent of the interest-bearing accounts paying interest weekly.

In comparison, 27 percent of FamZoo interest-bearing accounts pay monthly, and just 3 percent pay annually.

In case you’re worried about the reverse problem – that is, your children’s frequent saving doing your wallet some serious damage – FamZoo allows you to put a cap on the amount of interest paid.

There is also a ‘calculate interest’ tool that allows you to project what future interest payments might look like.

The choice of compounding frequency is entirely up to you, though it holds true that the power of repetition is crucial to building any habit.

Thus, be sure to remind your children frequently of the compound interest that they have accrued each time an interest payment rolls in.

Savings Goals and Informal Loan Tracking

If you need to lend some money to your children, FamZoo has a feature that allows you to track payments and interest.

Your child can also create personal savings goals, and you may also decide to create family goals like saving for vacation or college.

All FamZoo features

Positives and Negatives of Using FamZoo

Pros

FamZoo is an excellent teaching tool, and the ability to create multiple spending accounts allows you to teach the ‘cash envelope’ system that is integral to budgeting.

With society rapidly becoming cashless, however, physical cash envelopes are the outdated counterpart of digital currency.

This financial tool is a step in the right direction as it can help children understand money management and is a way to teach good money habits without the benefit of tactile bills in their wallet.

Here are some other ways to raise financially literate children.

With FamZoo, you can encourage spending within one’s means from a young age. Since all family members have an IOU account each, children of all ages in your family household can learn important money management skills.

With easy customizability and use, FamZoo can take the weight off your shoulders by automating a lot of the processes when it comes to your family finances.

It can sometimes be difficult just remembering to pull out the play money for family members in the middle of a busy weekend.

While the product is a paid-for service, FamZoo offers an extremely generous trial period of two months for the IOU account and 1 month for the prepaid card so you can try it out risk-free before committing to the service. What’s even better is that a credit card is not required to sign up for a free trial, so you don’t have to worry about your credit card being charged in the event that you forget to terminate.

Cons

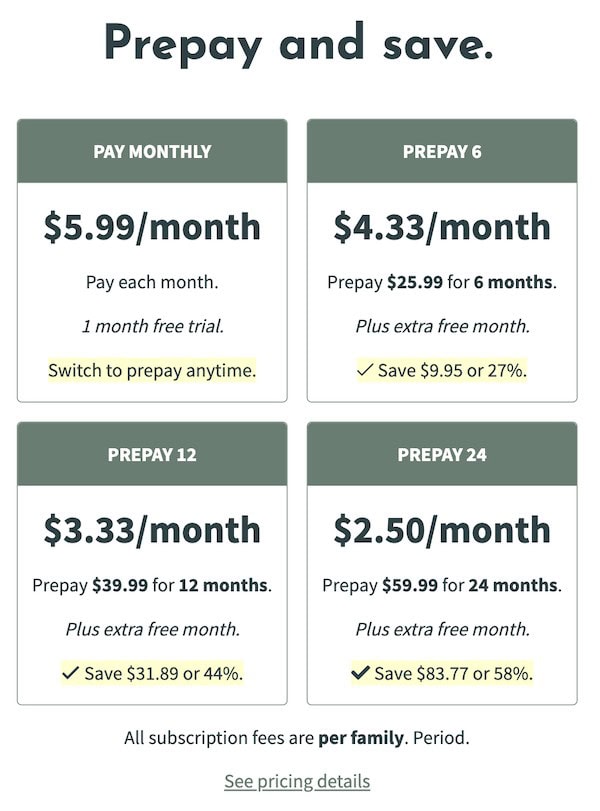

The downside of using FamZoo is that there isn’t a free plan available. If you choose to pay on a month to month basis, the subscription plan sets you back $5.99 per month.

There are also pay-in-advance subscription options available, which are six months ($4.33 per month), 12 months ($3.33 per month), or 24 months ($2.50 per month).

Besides the subscription fee, you may also need to pay some incidental fees. Retailers such as Walmart and CVS charge a small fee for reloading your FamZoo Card, and the amount charged can vary according to the retail store.

There are of course fee-free ways to teach children in your family about money. One fee-free way to teach is most obviously a free checking account at your local bank.

However, with this option, it may not be the easiest to track the money going in and out of your child’s account. If you don’t mind paying FamZoo’s small fee, I find that it definitely goes a long way in helping your child’s financial literacy.

Is FamZoo Worth the Money?

All in all, FamZoo is an invaluable tool for personal finance education given the realities of modern banking and a digital economy. By becoming the virtual family banker, you provide pertinent personal finance information, just like a banker in real life does.

It then becomes up to your children to learn to make important financial decisions, such as how the money in the accounts is managed, deciding on spending and saving goals, planning for future payments, as well as finding new ways to earn their keep.

By placing the onus of managing money on your children, they become more ready to face real-world financial challenges.

Follow along on Instagram!

![Where Do Millionaires and Billionaires Keep Their Money? [8 Most Common Places] 12 Where Do Millionaires and Billionaires Keep Their Money](https://herpaperroute.com/wp-content/uploads/2022/06/Where-Do-Millionaires-and-Billionaires-Keep-Their-Money-768x410.png)