Essential Tips For Helping Someone With Financial Problems

Financial troubles can hit the people around you at any time.

It’s often difficult to know the best ways to help out a friend or family member who needs help with their financial problems.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

You want to be helpful, but not enabling. There may be added layers of awkwardness, shame, and guilt.

How To Help Someone In Financial Crisis:

Money creates a minefield of relationship issues that can be hard to navigate. The following suggestions help friends and family who are having financial troubles but also protect what’s best for you.

Give Cash Gifts

The most straightforward way is to give money to friends in need. This is a great option if you have the means and know it will be a one-time occurrence.

Don’t try to word it as a loan to make them feel better about the situation. The last thing you want is for your friend to feel indebted to you.

Loans given to friends and family make life awkward. The giver starts to resent the person they gave the loan to if they’re taking too long to pay it back.

What if the loan recipient decides to go on a vacation before repaying your money? Someone who gives the loan has no authority over how the recipient spends their money.

These types of situations will kill a friendship. Is your friendship worth losing if they aren’t EVER able to pay the loan back? Give a cash gift instead.

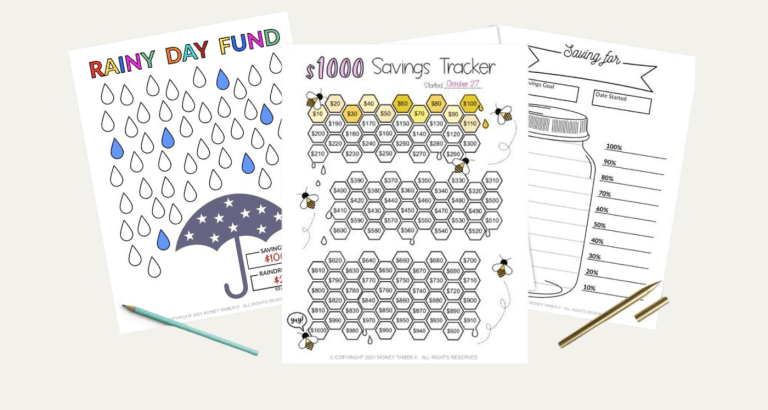

Help Them Create A Budget

If your friend or family member is new to managing money, offer to help them set up a budget. This will allow them to keep a handle on future months’ income.

If you have a family member who is constantly asking you for money, you can make a rule that you’ll only give money one more time AFTER you sit down to make a budget with them.

These budget planners and cash envelope wallets are helpful for budgeting and managing finances.

Setting this budgeting rule will either do one of two things: anger them or they’ll agree.

The people who agree are actually looking for help. If they’re going to you for money, they obviously think you’re good with finances to have some saved. These types of family members are grateful for help reining in their expenses.

The people who get angry with you or who try to guilt you into giving them money don’t want to be helped, they want handouts.

These are usually the same family members who have a lot of drama happening around them.

People who think boundaries don’t apply to them are the ones who have a strong negative reaction when you set them.

If this sounds familiar, you can decide to stop the cycle. It’s time for YOU to change and stop enabling THEIR poor financial choices.

Give Non-Cash Gifts

If your friend unexpectedly lost their job, you may feel weird about writing them a check.

Generally, non-cash gifts are more accepted. You can write a nice card and include a grocery or gas gift card inside.

Pass Along Hand-Me-Downs

Children’s clothes are expensive and they don’t seem to fit into them for longer than a few months.

As your child outgrows their gently used clothes, pass them along to family members with slightly younger kids.

Offer Services: How To Help Others Without Money

Sometimes helping a friend out with money isn’t possible. There are other ways you can help that will save THEM money but cost nothing except time.

1) Babysitting

Even if it’s so the parents can run errands, free babysitting is ALWAYS appreciated.

Hiring a sitter can easily double the cost of an outing. Having a trusted friend or family member will help take away some of their stress.

2) Network To Help In Their Job Search

If your friend’s career is in the same niche as you, asking around in your network could open up a lead.

Many companies are more likely to interview a candidate if they come with an internal recommendation.

Make sure the person you’re recommending’s work ethic is something you want your name to be tied to.

Related: Online jobs that you can do from home.

3) Offer Any Skills You May Have

If a family member lost their job and is trying to make ends meet with multiple part-time jobs, it may be difficult for them to keep up with things around the house.

Offering to mow their lawn or fix a leaky faucet can save them the cost of hiring someone or working until exhaustion.

4) Invite Them Over For Dinner

While not HUGE monetary help, you’re giving them a break from cooking.

Much like the reasons we go to restaurants, you’re offering a mental break and

5) Point Them Towards Local Resources

Some people become depressed and don’t know where to look after they’ve lost their job.

Researching and sharing local resources they can use takes the burden of researching off their plate.

Employment Agencies

- Temp work agencies are great for getting fast work. Once you’re hired, you will fill short-staffing vacancies for companies. Generally, these jobs are not specialized but are good if you need to work now.

Career Help Centers

- Career help centers can help with your resume, job training, apprenticeship programs, and identify career goals. They’re a great resource if you’ve been out of the employment hunt for quite some time.

Job Recruiting Services

- Did your friend have a specialized skill set? Job recruiters knowledgeable about their field would be a good place to start.

- Usually, it’s the employer who pays the recruiter for finding a client.

Financial Coach

- If your family member has a well-paying job but is constantly asking for money, a financial coach could be helpful.

- Financial coaches don’t offer specific investing advice. They work with the person to change their bad money behaviors to reach their goals.

- Financial coaches also teach the basic principles of handling money including budgeting, debt reduction, saving, and the general idea of investing.

- Attending a financial course is also an inexpensive option.

Ways NOT To Help Someone With Financial Problems:

With all the information out there, it’s hard to know what ways are best to help someone experiencing financial issues. The following are the things I’ve found that don’t work.

1) Personal Loans

While it may seem like a helpful idea, it creates a business relationship. You are now someone they are in debt to which can cause resentment.

2) Co-Signing Loans

Even if your family member swears they’ll never default, co-signing still isn’t recommended.

Similar to personal loans, it creates a business relationship. You are a partner on this loan. If they default on a payment, it will affect your credit which will cause animosity towards them.

If you co-signed a car loan and they default, you can’t decide to sell the car on your own unless you’re the sole person on the title. It creates a lot of mess and stress.

If a bank doesn’t trust them enough to give them a loan on their own, they shouldn’t be getting that item.

3) Provide Employment

This can work in some situations but only if you know the person’s work ethic. By hiring a friend, you’re now their boss and must have a different relationship at work.

If you hire a family member and it isn’t working out, family

4) Attach Strings to Your Help

This included favors and “owe you ones.” This is a manipulative tactic that preys upon your friend’s vulnerability.

Don’t be that person! This is another way they will feel indebted to you.

The Main Takeaway: Always Take Care Of Yourself First!

NEVER give more than you should. Even if you have extra money, that doesn’t mean it’s a free-for-all.

Savings and retirement are both important to plan for.

✅ Making sure you’re set up financially will ensure that YOU don’t become a financial burden on someone else.

If You’re A Friend Without A Lot Of Money:

On the flip side, you may be a friend who is in

Here are some things you can do to ensure you keep your social life without overspending.

1) Be Clear About Financial Expectations When Going Out

It’s easy to plan a group event that’s vague about costs. Once you’ve committed, you find out that it’s far more expensive than you had planned.

Make sure the cost of the event fits in your budget. If you’re unsure of the total cost, ask for a breakdown in pricing.

You may be surprised that you aren’t the only one in your friend group who was wondering but was hesitant to ask.

2) Pay For Your Own Food Instead Of Splitting It Evenly

When large groups go to restaurants, the standard seems to be to split the bill evenly all-ways. If you order a salad with water while others order drinks with the chef’s special, you’ll be paying for more than what you ordered.

- Bring cash that you can give to prevent an equal split that’s run on credit cards. Many restaurants won’t allow multiple credit cards to be used unless its an equal split since its too time-consuming.

- Another option is to have one person pay and everyone else directly transfer the money to them via an app. Whatever way you choose, make sure you account for the tip.

3) Offer Things To Do That Are FREE

If you still want to hang out but your budget can’t afford any costs, find things in your area that are free to invite people to.

In the summer, there are outdoor festivals to go to. Boardgame nights or going on a hike are some other free options.

Above All Else, Be Understanding

We are taught to expect thanks after we’ve helped someone. Be aware that this may not be the immediate reaction.

Receiving help can make people feel embarrassed and humbled.

Helping Financially Struggling Families – Conclusion

While helping someone through a financial crisis, relate to them and share your own struggles. The biggest takeaway is not to judge.

Have you helped or been helped through a financial crisis? Let me know in the comments what did or didn’t work. Did it cause any issues with friends or family?

Follow along on Instagram!