How to Save $10,000 in a Year

The secret to saving money isn’t just about spending less than you earn – although that’s a great place to start. It’s about cultivating good money habits.

It’s about implementing practices that involve staying out of debt or working to pay off what you owe. It’s about creating and sticking to a budget and finding ways to increase your income if it looks like you don’t have any money left over to save.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

It’s about being intentional with growing your finances. To save, you need to start with the end in mind.

Set a feasible financial goal you want to achieve and then take the necessary steps toward achieving financial freedom. Here are six foolproof tips you can use to learn how to save $10,000 in a year.

1. Break Down $10,000

Before you put a plan together, take a few moments and break down what it really means to save $10,000 in one year. As a whole, $10,000 might seem like a scary amount of money, but if you break it down, it’s not as daunting as it appears to be.

Here’s what I mean: $10,000 in a year translates to $833.33 per month. This may look like quite a bit of money to pull out of thin air.

Now, if you spread $10,000 over the 52 weeks in a year, it means you need to put away $192.31 every week. It doesn’t seem that scary now, does it?

If you break it down further to get the daily equivalent, it works out to $27.47 every day.

The whole point of this exercise is to ease you into the process. It makes the goal more realistic. It helps you understand the value of every dollar you make and how it contributes to your overall goal.

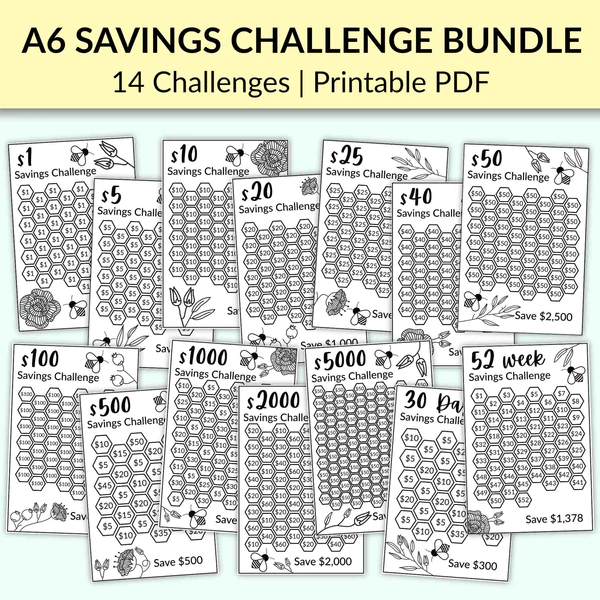

It helps if you use a visual tool to track your savings, such as these Savings Challenge sheets.

2. Pay Yourself First

This is the age-old rule of personal finances – pay yourself first. This concept is surprisingly easy despite being the most overlooked strategy when it comes to boosting your savings.

It means that as soon as you get any type of income, you need to channel a portion of it toward your savings or investment accounts. You are quite literally “paying yourself first.”

Keep in mind that the pay-yourself-first rule applies in all scenarios. You need to channel money toward your savings account before paying your bills or spending money on anything else.

To do that, you’ll need to break down your income to understand what percentage of it you need to save to reach your financial goal. Here’s an example.

So far, you know that to work toward your financial goal of saving $10,000 in 12 months, you need to put aside $833.33 every month, without fail. The question then becomes: What is my current monthly income, and what percentage of it constitutes the $833.33 I’m meant to save?

If you make $2,000, $833.33 makes up 41.67% of your earnings. Based on the pay-yourself-first rule, you need to put aside that amount first and then work with the remaining $1,166.67 left over to pay for your recurrent expenses such as rent, utility bills, gas, groceries, credit card debt, etc.

You can set up your bank account in such a way that 41.67% of any amount that’s credited automatically goes into a separate savings account.

That way, you don’t have to deliberate on how much money you “can afford” to save every time you cash your paycheck. It’s an easy system to set up, and any bank can do it for you.

3. Earn More Money

At the risk of stating the obvious, to channel $833.33 toward your savings account every month, you need to be making significantly more than that for saving money. It means that whatever amount you’ll have leftover needs to be enough to cater to your living expenses, including all monthly expenses.

Sometimes, it may not be feasible to put aside $800+ every month based on your current earnings; in which case you need to get creative. It’s time to put together a plan to make extra income.

Even if you already earn a salary that allows you to comfortably set aside $833.33 every month, this still applies to you. It lifts the pressure and helps you reach your $10,000 goal even sooner.

Either way, you need to get proactive. Here are a few things you can consider doing to boost your bottom line and save five figures at the end of 12 months.

I use this digital profit planner to plan and execute my profit goals!

Ask for a Raise at Work

You need to get proactive. If you don’t ask for what you need or want, don’t expect to receive it.

If there’s potential to make more than you currently are, ask your boss for a raise. Put together a list of all your accomplishments over the past year and use them to justify getting a salary increment.

If a raise isn’t in the cards for you at that point in time, find out what you can do to get it. For instance, if you need additional skills or training, ask for a performance plan so that you can start taking the necessary steps required to get that raise.

If a raise isn’t in the cards at all, it might be time to start looking for more lucrative opportunities elsewhere.

Start a Side Hustle

Sometimes, getting a raise or a new job may not be feasible. If that’s the case, starting a side hustle is your next best option.

You need to take advantage of the gig economy we live in and find work that you can do online, from home, or both. Who knows, your side hustle may even turn into your main hustle.

More than 65 percent of freelancers report earning more money doing gig work than when they worked in full-time employment.

Keep in mind that different side hustles require different levels of skill. Find something that makes use of your current skill set to start generating more income.

Before you know it, you’ll be closer to your hitting $10,000 goal than you imagine.

Learn a New Money-Making Skill

Another way to earn more would be to learn a new skill that can make you more money. Go back to school and get new professional credentials so you can negotiate your pay or do something different entirely.

For instance, one great high-income skill you can learn is entrepreneurship. You can then use those skills to build a business or brand and expand your income-earning potential.

Other money-making skills you can consider learning include web design, freelance writing, software development, sales, and several more.

Cut Down on Other Expenses

For extra income, you may also want to review any wasteful spending there may be such as an unused gym membership, a higher-than-average interest rate on a credit card, and meals you purchase outside of the home. Simple meal planning can save you money and cut down on your spending.

Related: 100 ways to save money every day.

4. Commit to Sticking to a Budget

The keyword here is “commit.” If you want to get serious about a saving plan, you need to set a budget and stick to it.

The setting part is easy for most people. It’s the “sticking to it” part that has many in a bind.

A budget is a spending plan. It gives you insight into where your money is going and ensures you always have money for the things that matter.

When figuring out how to save $10,000 in a year, a budget should always be at the forefront of that plan. If you never seem to have enough money to do the things you want to do – including saving – you need to create a budget as soon as possible.

It helps you set limits on how much you spend on entertainment, how much you splurge on items you didn’t plan for, how much you spend on online shopping, and how much you really spend on takeout. You get the idea.

You might even realize that, after moving a few things around, you do have $833.33 to spare after all.

5. Eliminate Unnecessary Expenses

In the spirit of budgeting, the next logical thing to do would be to cut unnecessary spending. Wasteful spending is the absolute enemy of progress as far as achieving financial goals is concerned.

It sabotages your efforts when it comes to realizing true financial freedom and security.

When was the last time you examined your expenses? By that, I mean looking at your card statement, receipts, etc., and identifying how much money you spent and what you spent it on.

The more expenses you can eliminate, the closer you’ll be to reaching your $10,000 goal.

Related: Easy no-spend challenge to save money

Let’s put it this way. If you want to add an extra $10,000 to your savings at the end of every year, all you have to do is cut back on $84 worth of unnecessary spending each month.

As I mentioned above, this could mean, switching to cheaper internet, meal planning and carrying more packed lunches to work, or simply cooking more to reduce the number of times you order takeout. It’s all about being intentional with finding more ways to spend less.

6. Have a Solid Why

Saving has to have an emotional component to it. As humans, our biggest motivation to do the hard stuff comes from having an emotional attachment to it – your “why.”

Ask yourself this: What’s your reason for wanting to save $10,000 in a year?

If you’re doing it “just because,” that’s a guaranteed way to fall off the wagon before you reach your goal. If there’s no solid reason why you need to have that specific amount of money within that specific duration, you’re less likely to achieve your savings goal.

Related: Reasons why you should save money

Maybe you need the cash to put a down payment on a house and kick off your journey toward homeownership. Maybe you want to set up an emergency fund since you have no fallback plan if things go awry.

Maybe you want to set up a college fund for your kids, and you now realize you’re running out of time.

Whatever your motivation is, remember that it’s worth it. You’ll look back in 12 months and feel proud of how much you were able to accomplish.

7. When in Doubt, Save

What do you do with the leftover money you have every month? Yes, it is possible to have money left over.

That’s why you need a budget – to experience that oh-so-glorious feeling of having extra money after you’ve saved and paid for everything else you need to.

Your first instinct might be to splurge on something nice – instant gratification, reward, and whatnot. While there’s nothing inherently wrong with doing that, might I suggest taking a different approach?

How about channeling that extra cash toward your savings goal? There’s no harm in reaching it faster than you had anticipated.

Start Now With What You Have

There you have it – how to save 10000 in a year. Remember, the idea is to put an extra $833.33 toward your savings or investments account every month or $192.31 every week.

This will involve setting a budget and sticking to it, cutting unnecessary spending, or making more money by picking up a side hustle or two.

Have a solid reason you want to save $10,000 in a year and then take the necessary steps to make it happen. It’s easier than you think. Believe you can, and you will.

Related Articles:

Follow along on Instagram!