The Budget Binder (56+ Printable Pages)

This ink-friendly design is chic and able to be printed again and again for multiple years’ use.

SALE 50% Off!$10 .00 $5.00

Are you constantly stressed from living paycheck to paycheck, not really sure where your money goes every month? Are you a beginner to budgeting and overwhelmed at where to start?

This is the only budget binder you’ll need for taking back control of your finances. This 56+ page printable budgeting planner is designed to make keeping track of your money easy including:

- Starting a budget for beginners that works

- Paying off debt

- Tracking your spending

- Saving an Emergency Fund

- Reaching financial independence

- Eliminating financial stress!

Format:

Let this budgeting binder help tame your money once and for all!

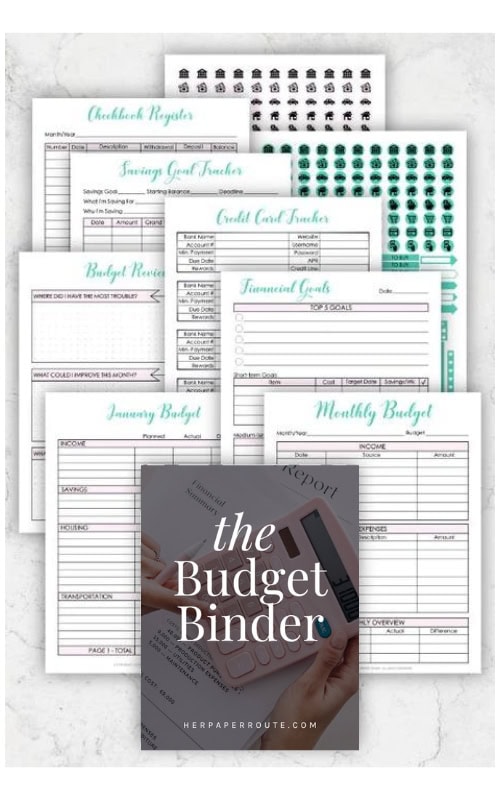

What you will receive:

- Money Tamer Budget Planner Cover

- Binder spine labels for 1in, 1.5 in, and 2 in binders

- Green, Purple, and Yellow budgeting sticker pages

- Monthly Budget sheet

- Financial Goals sheet

- Bank Accounts Tracker

- Credit Card Tracker

- Debt Tracker

- Savings Goal Tracker

- Expense Tracker

- Income Tracker

- Bill Pay Checklist

- Checkbook Register

- Notes page

- Annual Budget Summary

- Yearly Overview

- Budget Review

- 3-page Budget sheets for each month

- Monthly calendar

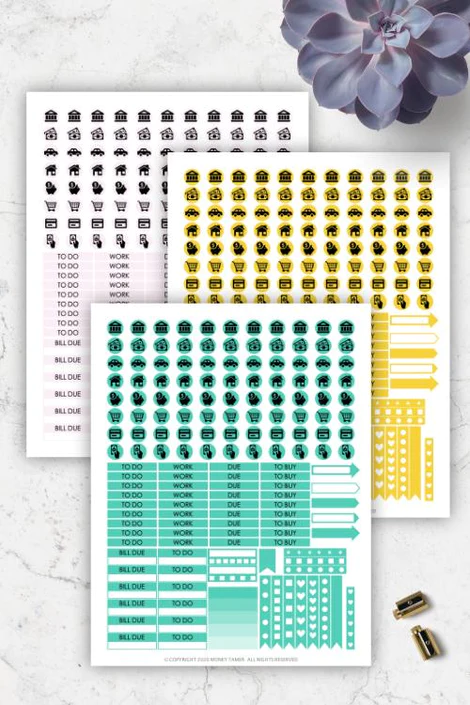

Colorful budget stickers for your budget planner, in 3 colors.

This budgeting printables sticker pack contains both PDF and PNG files for three colorful pages (light purple, green, and yellow).

Print them out yourself onto sticker paper and either cut them with a paper guillotine, by hand, or cutting tool. When you run out, reprint again and again.

These planner stickers will help you:

- Highlight and draw attention to important items in your budget binder.

- Be a visual reminder for upcoming tasks such as paying bills or putting money into savings.

- Make budgeting more fun so you’ll enjoy it instead of dread tracking your finances.

Sticker Sheets you will receive:

- Yellow template sheet

- Green template sheet

- Light purple template sheet

Format:

PDF & PNG, US Letter size 8.5x11in

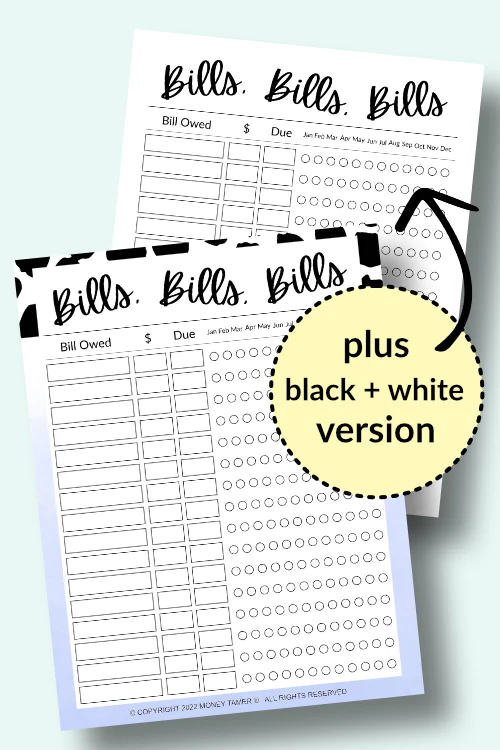

Bonus: Bill Tracker Template

Want an easy-to-use bill tracker template to track your bills and payments for the entire year? This BONUS printable bill tracker worksheet is easy to print at home and comes in both a colorful and black and white version. You’ll get a PDF with both versions to download immediately.

It will help you keep track of all your bills and payments throughout the year. To use, simply fill in the name of the bill owed, the amount, and the due date. Then every month, color in the circle for the month.

The colorful bubbles make this bill tracker a fast reference guide to make sure you’re paying all of your bills and don’t forget any. And since this is a digital worksheet, you can print it, again and again, each year.

What you will receive:

- Budget sheets

- Sticker template sheets

- Bonus bills tracker sheet

Additional Supplies Needed:

Please note, the files you receive will need to be printed onto sticker paper in order for them to work as stickers. After you print them, cut them out to the appropriate sticker size.

Also Included: A 3rd party release agreement so that you can bring the file to be professionally printed for personal use without copyright issues. Some home printers are unable to print borderless so if you don’t want the planner covers and other pages to have a small margin, professional printing is recommended.

*This is a printable file and no physical products will be mailed to you. For your personal use only. As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer | Advertise With Us

For the stickers you will need:

- Perfect for scrapbooking, Stencil making, and all your Paper Craft projects

- The 360° rotating blade and ergonomic grip design allow for smooth curves and crisp corner cuts.

- Goes through 100 percent inspection prior to shipping.

- uses hardened steel blades precision ground to exacts standards that will hold its sharpness for many uses. Has a stiff handle which allows total control of the cut

- Designed with Safety in Mind. Other designs rely on a scalpel sharp blade and applied cutting pressure, The Gyro-Cut blade is safe to touch and rotates to cut with less applied pressure.

- Compatible with all Silhouette cutting tools

- Eight printable sticker sheets

- 8.5 inch by 11 inch

Budgeting Basics

It’s never too late to learn how to budget or gain financial literacy. Life skills, such as money management, are often absent from school curriculums.

If you’re in a lot of debt and following Dave Ramsey’s Total Money Makeover, then the above printables will help you achieve your long-term and short-term financial goals. Another helpful product are cash envelopes for people following the cash envelope system.

What Is Budgeting?

Budgeting is when you tell your money where to go. Each dollar of your paycheck is assigned a category, such as car repairs or entertainment. Another way to think about budgeting is that you’re creating a spending plan.

There are a many different ways to budget and I’ll go over the most common questions for people starting a budget for the first time.

Why Is Budgeting Important?

Even if you’ve heard of budgeting or tried and failed in the past, you may not know fully why budgeting your paycheck is beneficial. Here are a few reasons:

1. YOU WON’T SPEND MONEY YOU DON’T HAVE

If you know how much money you have, they you know whether you can afford a purchase. This keeps you from racking up debt.

2. KEEPS YOU FOCUSED

Without a plan for your money, it all seems to disappear. Budgeting gives you an instant pay raise since you now aren’t buying tons of small frivolous purchases without thinking.

3. PREPARES YOU FOR EMERGENCIES

Part of effective budgeting involves setting up an Emergency Fund and sinking funds for upcoming expenses. An emergency fund is typically 3-6 months of expenses put into a savings account.

The purpose is to cover your household costs should you lose your job for any reason.

4. HIGHLIGHTS WASTEFUL SPENDING HABITS

Many people don’t even realize how much wasteful spending they do. This includes impulse spending or cumulative small purchases over time.

By having set amounts of money to be used for each category every month, once you run out, you’re done until next payday. If you keep finding yourself out of money before the month’s over, it’s a good indication that area of spending should be looked at more closely.

5. ELIMINATES MONEY STRESS

If you properly budget so that you don’t overspend, can pay off debt, and save up money, that will get rid of a significant amount of financial stress. Couples will have fewer money fights and you’ll feel peace knowing you’ll be taken care of in retirement.

What Is The 50/30/20 Budget Rule And How To Use It?

The 50/30/20 rule is a simplistic way of budgeting that doesn’t involve numerous budget categories. To split up your after-tax pay, allocate 50% towards needs such as rent, food, and utilities, 30% goes towards wants, and 20% is for savings or paying off debt.

What Are Typical Monthly Expenses?

Monthly expense categories can vary widely between families. Each person has their own idea of what is important to them and worth spending money on.

Here are some of the most common basic categories for expenses:

- Home

- Food

- Healthcare

- Child-Care

- Transportation

- Pet Care

- Debt Repayment

- Personal Care

- Entertainment

- Miscellaneous

Look back at your expenses for the past three months to see where you’ve been spending. If you didn’t track your money before, then keep track for the next month and spend as you normally would. This will allow you to see how much you’re truly spending in certain categories instead of guessing.

Why Use Monthly Budget Worksheets?

Printable worksheets are easy-to-use templates that save you a lot of time and keep you organized. It takes out all of the guesswork and you don’t have to worry about creating your own forms.

If you feel intimidated or lost about making a budget, then already-made templates that walk you through the process step-by-step are a great option.

How To Use A Budgeting Planner

After you download the planner PDF file, look through it to see if you’ll need all of the worksheets before printing it off. Some sheets you’ll need multiple of.

Print off the sheets you need and use a hole punch so you can place them in a 3-ring binder.

One benefit of downloadable forms are once you fill up a page, you can print another so you never run out. Another benefit is that the planners are undated so you can use them year after year. In the end, this costs less than needing to buy a new planner every year.

Follow the planner’s template and fill in all the relevant information. Make sure to include all your expenses. Usually, recording purchases daily by saving receipts is the easiest way.

Latest on the blog: