How to Save $5000 in 3 Months

Saving up can be hard, especially when all you’re trying to do is keep your head above water on rent, groceries, and recurring utility bills. In such instances, finding that extra cash to squirrel away for a rainy day or financial emergencies is often the last thing on your mind.

Have you thought that maybe, just maybe, you’re going about it all wrong? That – with the right strategy and best practices, you might be able to find some extra cash hidden in your budget.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

It’s not going to be easy, but that is not to say it is impossible with a little budgeting and patience.

If you’re wondering how to save 5000 in 3 months, these six proven tips will help you cultivate good a financial foundation and put you on a solid path to growing your savings in no time to better reach your financial goals.

1. Break Down $5,000

First things first – what does saving $5,000 in 3 months really look like? Let’s break down that figure to make it less daunting.

Depending on your budget, the idea is to save roughly $1,670 every month for three months. That translates to around $420 every week for 12 weeks.

Once you have a clear goal of what you’re working toward, it becomes easier to take the necessary budgeting steps to make it happen.

Next, think about how much you can save and invest each month. This app makes it super easy to start investing any amount no matter how small. Plus, that link gives you a $20 bonus when you make your first $5 min investment!

2. Increase Your Income

The easiest way to meet your goal of accumulating $5,000 in 3 months is to make more money, and the best way to do this would be to get a side hustle.

Now, if the current size of your paycheck allows you to comfortably tuck away $420 every week for 12 weeks or $1,670 every month for three months, then good for you.

The reality is, if you’re looking for different ways to save 5000 in 3 months, chances are you’re having a bit of a hard time trying to figure out where it’s going to come from.

If your current budget is already stretched out to the max, and you don’t see any feasible way to save $1,670 every month with everything else going on, you’ll need to put on your creative hat and come up with a way to make some extra cash on the side.

If your job allows it, you can pick up some additional shifts and put in more hours. First, you need to figure out if it makes sense. Here’s what I mean by that.

If you’re looking to inject an extra $420 a week into your current income stream, the question you need to ask yourself is this – how many extra hours per week, at the current hourly rate do I need to work to make $420 at the end of every week?

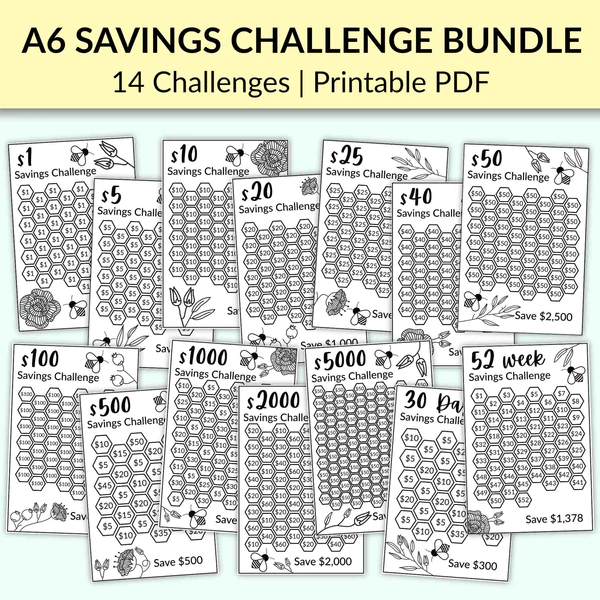

Use these savings charts to help you!

Once you figure that out, you’ll be able to determine whether it is a feasible option for you to explore. If the extra cash you make still falls short of your weekly target, it might be time to explore other options that can make you a lot more money outside your regular working hours.

You can also start meal planning to help cut down on your grocery bill and eliminate eating take-out more often than necessary. What about other living expenses?

You can also take a closer look at your cable, internet bills, phone bill, and other expenses to see where you can possibly cut down to save money. Sometimes something as simple as signing up for automatic payments on your accounts is enough for a discount.

Here are a few side hustle ideas that have the potential to bring in $1,000-$2000 a month.

Affiliate Marketer

Affiliate marketing is a popular way to make extra cash online. Anyone with a decent online audience can do it.

If you already have a sizable following on social media, you can talk about, post, vlog, blog, or do a podcast about a specific product. You would then direct your audience to buy the product in question through a specific link or code, and you would earn a small commission on each purchase.

The precise amount of money you make from each lead depends a lot on the type of product you’re selling. Generally, digital products tend to have higher affiliate rates than tangible ones.

If you have a large audience, you will have more power to negotiate higher commission rates.

Uber/Lyft/Delivery Driver

This is also another great way to make some extra cash on the side outside your regular full-time working hours. If you have a clean driving record, a new-ish car, and a smartphone, you can start driving for Uber, Lyft, or any other rideshare service.

They give you flexible hours, and you can make money at any time of day or night, driving on any day of the year.

Alternatively, you can get a delivery driving gig with Amazon or with on-demand food delivery services like Uber Eats, DoorDash, GrubHub, etc.

The precise rate you earn depends on a lot of factors, including demand, time of day, and location. You get to set your own hours, which is ideal if you’re employed full-time.

Freelance Writer

If you have a way with words, a pretty solid grasp of grammar, impeccable research skills, and strong knowledge of specific topics, consider working as a freelance writer in your free time.

If you have expert-level knowledge in specific niche markets, it is possible to make a solid income from this side hustle. You can pitch for work on popular freelance sites like Fiverr, where you get paid to write.

Related: How to Make Money on Fiverr

If you have a flair for putting up pithy posts on social media, you can offer your services to companies looking to boost their online reach. Expect to make anywhere between $15 and $50 per hour for expert-level content.

Consultant/Tutor

Do you have any useful skills? If the answer is yes, there’s a good chance you can monetize them.

Whether you’re great at playing the guitar, piano, or violin, an excellent tennis player, a tax expert, or a math guru, there’s someone out there who can benefit from your experience.

The amount of money you make from consulting or tutoring all comes down to how experienced you are and the rarity of your skill. Experienced consultants can bring in upwards of $80 an hour, depending on the industry they’re in.

If you’re tutoring young students, you can make anywhere between $15 and $20 an hour. Advanced-level tutors can expect $30-$50 an hour.

Virtual Assistant

If you consider yourself an organized person consider becoming a virtual assistant for an individual or company that needs help staying on top of everything.

As a virtual assistant, your work would revolve around scheduling business meetings, booking flights for overseas travel, sending errand reminders, and everything else involved in keeping schedules.

Related: Becoming a Virtual Assistant with No Prior Experience

The exact amount you make will depend on the complexity of the tasks you perform and the number of hours you work. Most virtual assistants make anywhere between $15 and $25 an hour.

Market Research Participant

If getting paid to critique things sounds like a dream come true, participating in market research could be right up your alley. Several companies are willing to pay top dollar for honest, real-life feedback from potential consumers on the products and services they offer.

This might mean spending 30 or so minutes reviewing a product or spending up to two hours filling out surveys.

Rates vary depending on the industry and the size of the project, but it is possible to make up $20 or more an hour simply by doling out your views.

Other things you can do to boost your income include renting out a room in your home, starting an online business, pet sitting and babysitting, advertising on your car, and selling things you don’t need on Facebook, Craigslist, or eBay. There are infinite opportunities for side hustles.

3. Get a Financial Advisor

Sometimes, you need a little extra help getting your finances in check to kick start your savings goal journey, and that’s okay.

That’s where a financial instructor comes in – to help you iron out the kinks in your financial habits and determine what might be standing in the way of achieving true financial freedom.

If you’re serious about finding ways on how to save 5000 in 3 months, a financial coach can work with you to analyze your accounts, such as credit card statements and bank statements, to pinpoint the problem areas and find practical and realistic ways for you to save extra cash.

They’ll help you cultivate good money habits and make better financial decisions, so you can manage your finances better. They can give you actionable steps you would never come up with on your own.

4. Pause the Subscriptions

Before you launch into a full-blown panic attack, I said “pause,” not “cancel.” It is temporary.

Remember, your goal is to have $5,000 saved up in 3 months, which is a short amount of time. To do this, you might want to consider temporarily cutting out some of the subscription services you have to cut down to help with cash flow.

These include things like Netflix, Spotify, Hulu, Amazon Music, Pandora, and any other media streaming service you’re signed up for.

It also includes pausing social media, magazine, and newspaper subscriptions that might be running. Clothing, makeup, and cooking-related subscriptions also count.

If you’re what would be considered a “big subscriber,” meaning you’re signed up to five or more paid services, you could be looking at hundreds of dollars worth of savings every month that can be put aside and placed into your savings account.

5. Renegotiate the Existing Rates on Your Long-Term Contracts

If you’ve had the same service provider for a while, it might be time to renegotiate the rate on your existing contract.

This involves getting in touch with your insurance provider, cell phone company, gym, cable company, and any other service for which you’ve been a long-standing customer and asking them to revise your rates downward. You’ll need to do your homework first.

Find out if there are any promos or specials they might be running, particularly those targeted at new customers.

The reason for this is simple. If they are willing to offer new customers a discount of X%, they should be willing to extend that same offer to a longtime, loyal client – namely, you.

It costs a company more money to get new clients than it does for them to retain current customers. Use this knowledge to your advantage when trying to negotiate better rates.

You also want to do a bit of research on what their competition is doing. Are they running some lucrative promotions?

Are their rates more competitive? Ensure you’re armed with all this information before dialing their number and asking them to review your rate.

When you do, ask to speak to someone with authority to renegotiate terms. If that doesn’t work, ask them to transfer you to the cancellations department.

You need to be willing to transfer to their competitor though if they won’t give you a better rate. Otherwise, they’ll know they don’t need to do anything to retain you as a customer.

As far as car insurance premiums go, you have the right, to be re-rated every year. This shouldn’t be a problem if you have a clean driving record and good credit.

Talk to your insurance provider about it to qualify for a discount and enjoy lower rates.

6. Create and Stick to a Budget

If you want to save $5,000 in 3 months, you’ll need to get serious about creating and sticking to a budget. You need to track all the money that’s coming in and manage where it’s going.

Start by tracking your expenses using a budget planner. Set a realistic budget listing all your expenses over the next three months.

Find ways to cut down on unnecessary spending to identify ways of freeing up money you can channel toward your savings. Think – pausing subscriptions, cooking more and reducing the frequency of takeout, staying away from online shopping sites – you get the idea.

While sticking to a budget might seem a little daunting at first, don’t lose sight of why you’re doing it in the first place. It will help you cut back on wasteful spending and direct your money where it really matters – your savings.

Prepare for the Unexpected

If the past few years taught us anything, it’s that life is unpredictable. Always prepare for the unexpected.

A foolproof way to do this would be to have a tidy little sum of money tucked away in your bank account for an emergency fund or unexpected expense that didn’t come up while you were budgeting.

Whatever your reason for trying to figure out how to save $5,000 in three months might be, a combination of the strategies detailed in this guide will help propel you toward your savings plan goal. Go after it. You deserve it.

Related Articles:

Follow along on Instagram!

![9 Frugal Tips Learned From The Tightwad Gazette [Still Relevant Today!] 9 piggy bank full of cash and Frugal Tips Learned From The Tightwad Gazette](https://herpaperroute.com/wp-content/uploads/2021/11/Frugal-Tips-Learned-From-The-Tightwad-Gazette-768x410.jpeg)

![How To Save For a Home While Renting [7 Simple Steps] 13 young renter learning How To Save For a Home While Renting](https://herpaperroute.com/wp-content/uploads/2022/06/How-To-Save-For-a-Home-While-Renting-768x410.jpeg)