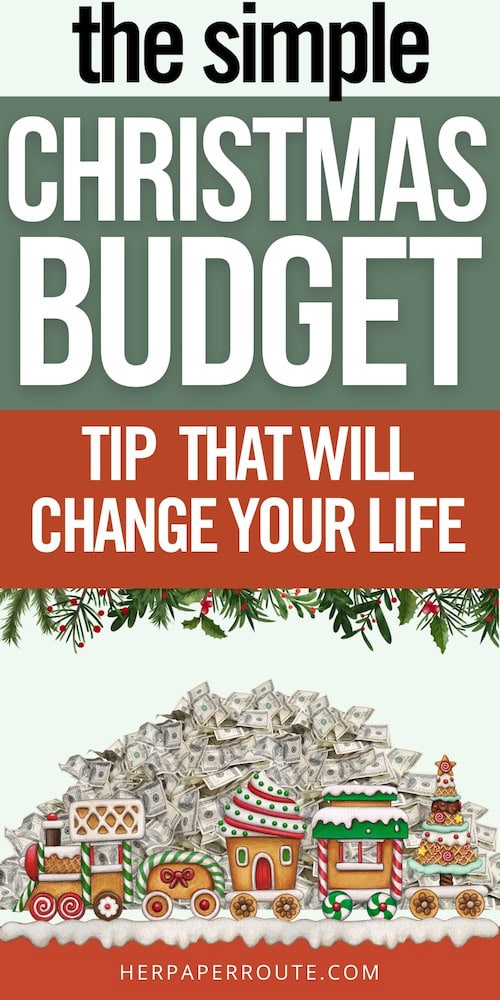

Christmas Budget Tips To Stay Out Of Debt During The Holidays

Christmas is a wonderful time filled with parties, family, and fun but can easily turn stressful if you’re caught without a Christmas budget.

People typically underestimate the amount they’re going to spend on Christmas gifts.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

They also don’t account for all of the other holiday expenses that happen every year.

How To Give Christmas Gifts On A Budget

Budgeting for Christmas starts as early as January 1st and will save you a LOT of stress later in the year.

It’s easy to get caught up in gift-giving holiday festivities but these tips will keep you from going into Christmas debt.

✅ For an easy way to stay organized, check out my Christmas Budget Planner. It comes with bonus holiday cash envelopes that can be used as sinking funds!

Why Do People Overspend Around The Holidays?

1) Buying Gifts For Multiple People

For

Christmas is the time for giving. Even when you plan out your gifts, inevitably a few more people or gift-giving situations will pop up.

You’ll have an office Secret Santa event or forget about your child’s teacher’s aid. It’s easy to feel obligated to give gifts to everyone who gave a gift to you, even if they weren’t on your original list.

2) Retailers Amp Up Their Marketing

The average person spends a lot of money on gifts for their family and friends. From the day after Thanksgiving through Christmas, many stores offer their best sales of the year.

In turn, this often leads to us spending more than we had intended. We perceive additional value to an item when we perceive we are getting it at a great price. While out shopping, it’s easy to pick up a few items for ourselves as well.

- Quick Set Technology: slide the tree sections together and the pre-wired pole-to-pole connection enables automatic lighting and eliminates messy cords. No extra plugs necessary

3) Holiday Tipping Expected

Around the holidays, tipping as a form of gift-giving is somewhat expected in certain professions.

Tipping is usually more commonplace in the service industry. If it’s a business or person you regularly use, then

Depending on the profession, it may be better to give an alternative gift to cash. You don’t want your meaning behind the cash being misconstrued when it comes to teachers and accountants.

4) Traveling To Visit Family

The holidays are all about family and coming together. Unfortunately, you and the other 327 million Americans are trying to travel during the same season.

This significantly drives holiday travel prices up. The best flight savings tips are to be flexible with your travel dates, purchase your tickets early, and try to use discounts or mileage points to lessen the cost.

Related: Experts Share Their Budget Travel Tips

5) Multiple Holiday Parties

You have office parties, family parties, friends’ parties, neighborhood parties, and the list goes on. You may even have parties for charitable organizations to attend during the Christmas season.

It may be appropriate to bring a hostess gift to family and friend parties. Work parties might have a white elephant gift exchange. Charities usually have tickets to attend and/or silent auctions.

Add those costs to the cost of your outfits, valet, and scheduling

How To Stay Within Your Christmas Budget

1) Create A Christmas Savings Fund

Since you know Christmas is the same day every year, it’s smartest to make your Christmas budget in January. While this may seem early, it makes saving up FAR less stressful and limiting.

Look at how much you spent in total during the holidays the year prior. Whatever that number is, divide it by 12. This is how much you’ll need to save monthly to have enough in December.

✅ These Christmas cash envelopes work perfectly as sinking funds. They even include a money tracker on the back.

If you want your Christmas budget to be $1200, you’ll need to save $100 a month for 12 months. That’s only $25 a week! Completely doable with the sacrifice of a few lunches out.

Comparatively, if you procrastinate and now only have 4 months to save, y

This may not be as attainable depending on how tight your budget is. It’s like adding in a car payment.

Related: Use This To Make Your Own Christmas Budget Savings Coloring Chart

2) Make A Christmas Gift List

Make a list of EVERYONE you want to get a gift for. Include other holiday expenses like tipping and office gift exchanges.

Throughout the year as relationships change, you may need to edit and change a few of the names on your list.

You should factor in one or two generic “just in case” gifts on your list. Inevitably, you’ll be invited to something unforeseen so it’s good to have factored that into your budget already.

3) Set Up A Christmas Gift Budget

Now that you have a list of everyone you plan to buy Christmas gifts for, it’s time to figure out the gift budget.

You’ve already decided how much to save in your Christmas sinking fund so that is the maximum amount that can be spent in total. Here is a list of additional sinking fund categories you need in your budget.

Now you need to decide how much to spend on each person. The simplest method is to divide the total Christmas fund amount by the number of gifts you need to buy. If your total budget is $600 and you need to get 20 gifts, that equals $30 a gift.

The Christmas Budget Planner

Keep your holiday spending in check with the Christmas Budget Planner. Plan ahead, stay organized, and enjoy the magic of Christmas without financial worries!

Usually, people will spend more on gifts for their immediate family. In this case, you can set the budget for some of the gifts higher and then divide the remaining amount amongst the office party and acquaintance categories.

Related: If You’re Worried About Impulse Shopping, Use These Tips

4) Earn Extra Money

The holidays are the perfect time to work overtime, start a pet sitting side hustle, work a seasonal job, or sell stuff you no longer need.

Earning extra money will give your gift budget more leeway and be less restrictive.

Extra income will also make your monthly savings goals lower. If you have a side job, you may only need to save $50 a month throughout the year for your Christmas gift fund.

11 Additional Tips For Staying Within Your Christmas Budget

- When shopping, make sure to bring your list of gift ideas and the budget for each person. Look for deals that fit that person and are within your budget.

- Don’t get caught up in sales. Stick to your list.

- Take advantage of sales, online and in-store.

- If going to a store, bring cash only to avoid overspending.

- Shop online to save time, reduce stress, and more easily comparison shop.

- Save on wrapping paper and gift bags. Go to the dollar store, save gift bags you’ve been given in the past, be creative and use newspaper comics or brown butcher paper.

- DIY gifts to save money. Homemade gifts like body scrubs and spa gifts can be made in larger batches to save time and money. If you have special talents, like photography, you can gift a photo shoot session.

- With children, less is more. They can only play with so many things at once. Limit buying each child 5-6 gifts maximum.

- Do alternatives to gifts. Invite people over for dinner, volunteer together at a charity, or hang out at a festival.

- Talk to family about minimizing gift-giving, setting a limit, or no gifts. You can draw names so each person only buys one gift. You can also set a $30 limit, keeping expenses lower.

- Instead of mailing Christmas cards, choose an online version. You’ll save on printing and stamp costs but still be participating in the holiday.

Overall Reason To Stay Out Of Holiday Debt

Christmas and the holiday season is meant to be about giving and helping. It’s a time to visit family and friends.

If you’re financially stressed and constantly worried about expenses, you will not be able to enjoy Christmas. This will affect the people you spend time with too. I’m sure they would rather spend time with you enjoying the season, and forego getting a gift.

Debt-Free Christmas Holiday Budget Tips

Once January rolls around, residual debt from holiday overspending will start the new year off on the wrong financial footing. There aren’t any gifts or holiday events worth the stress of debt.

Let me know in the comments if you’ve implemented any of these tips to keep your Christmas budgets under control. Don’t forget to check out the Holiday Budgeting Printable to stay extra organized this year!

Related Posts:

- New Year’s Money Resolutions To Help You Win Financially

- Already in debt? Use these tips to get out of debt no matter your income.

- Creating Coloring Chart Visuals For Your Christmas Savings Fund

Follow along on Instagram!

![How to Categorize Expenses [Understanding Your Personal Spending] 11 How To Categorize Expenses properly so you always have profit](https://herpaperroute.com/wp-content/uploads/2022/09/How-To-Categorize-Expenses-768x410.jpeg)