9+ Easy Steps For Getting On The Same Financial Page As Your Spouse

Talking about money in a relationship can be hard, frustrating, and even ugly at times. For many couples, it’s a topic that they brush under the rug, or for others, it causes shouting matches.

It doesn’t have to end up this way.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

It never hurts to be on the same financial page as your spouse regarding such an important topic. Even if you and your spouse are doing well, it wouldn’t be a bad idea to follow some of these strategies that could only strengthen you further.

How To Get On The Same Page Financially As Your Spouse

The following are a number of ways to talk about finances with your spouse, and steps that you need to take to be responsible with your money and savings.

1. Avoid Going Offensive Or Defensive

When money comes up in a conversation between a couple, all too often there will be a change in tone and body language in just a matter of seconds. That’s because one partner goes into attack mode, while the other is bracing for the pounce.

As soon as one spouse begins saying, “Well you never…” or “Why don’t you…” a dam of frustration is about to break. All of a sudden, you’re not acting like a team. In fact, you aren’t getting anywhere at all.

Somehow you have to find a healthy way of communicating when it comes to finances. It doesn’t have to be a fight.

Remember that you are both wired differently, and you have to find ways of calmly pressing through your financial differences.

2. Be Slow To Speak And Quick To Listen

When younger, you were most likely taught, “If you can’t say something nice, don’t say anything at all.”

Sometimes we need to simply sit back and allow our partner to talk, and learn to zip our lips. The more we speak, the more frustrated we become.

In conversations, it can be hard to truly stop and listen to what your spouse is saying. Often, people tune out the majority of a conversation and put most of their energy into thinking about what they’re going to say next.

Find out why your spouse thought that the decision they made was a good one financially. Rapidly exchanging and multiplying words between the two of you will only make matters worse.

3. Take Baby Steps

You can’t realistically expect your partner to change overnight. If they’ve lived irresponsibly with their finances all their lives, it’s going to be a slow and sometimes painful process.

The largest behavioral changes aren’t made in large fell swoops. They’re made by changing small behaviors consistently and sustainably. Over time, these small behavioral changes compound into a much larger change.

Take baby steps and hopefully soon they’ll be on board with you.

Related: What to do when your partner is a spender

4. Don’t Have Financial Secrets

Whether you decide to have joint or separate accounts, the choice is up to you. Find out where your relationship runs into the least amount of snags when deciding.

If you do plan on keeping separate accounts, make sure that there are no financial secrets in the relationship, that will only burn you further down the road.

Financial secrets can encompass something large, like buying a car without telling your spouse first, or small things that add up over time, like taking money from the grocery budget to go out on lunch dates with friends.

Obviously, the price comparison between these two examples is vastly different. The effect the financial infidelity will have on your spouse is essentially the same though.

By refusing to keep financial secrets, you’ll both stay accountable and have a stronger relationship overall.

5. Set Goals Together

One of the first and best ways of communicating your finances and savings is by sitting down and making goals together.

Not only are you seeing that you’re working towards this as a team, but it also gives you a direction and where you hope to end up in the future.

Financial goal setting is great at getting a spouse a reason to stick to a budget or do the hard work of paying down debt. Often, a lack of goal will prevent you from planning long-term into your financial future.

6. Budget As A Team

After you’ve set your goals, it’s time to budget as a team. Sit down and write out all your expenses, and make sure that you have the money on hand for when those bills are due.

It’s also good to take a look at your bank statement history and see where you both need to improve.

Budgets don’t have to be restrictive, they’re simply a way to tell each dollar you earn what it should be doing. Think of it more as categorizing.

If you’re in good financial standing, you can budget a larger amount of money towards “fun money” or eating out at restaurants.

You can even set aside money monthly to budget for a luxurious dream vacation! See, that doesn’t sound restrictive, does it?

7. Revisit These Areas With Weekly/Monthly Budget Meetings

Just because you’ve set goals and a budget doesn’t mean you’ve arrived at being on the same page with your spouse.

Sitting down weekly or monthly, and having a budget meeting will readdress continuing issues and help you both also see the progress that you have made.

If you’ve saved $200 in a month, make sure you celebrate your accomplishment. These meetings should be fun and celebratory.

Budget meetings are helpful to plan expenses you know are coming up or brainstorm how to deal with an unexpected expense the prior month.

Keep them short, simple, and fun!

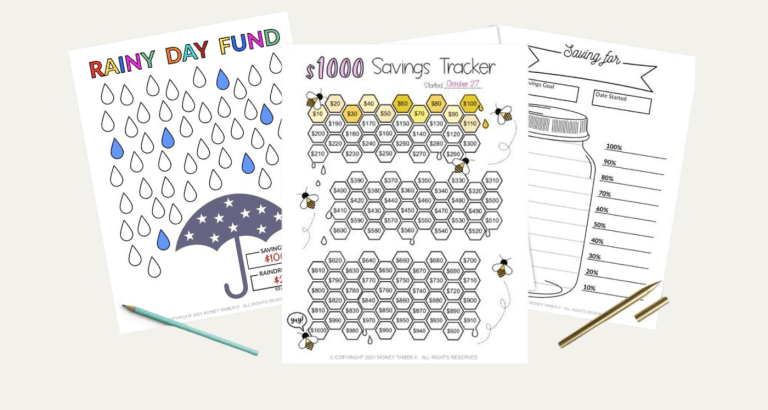

8. Gather Up An Emergency Fund

Life sometimes hits us hard with the unexpected and emergencies that will cost us a small fortune. Needing new tires, an unforeseen medical emergency, or a broken AC unit is no small ordeal.

Many times, we don’t have the money to get us out of those jams. Credit cards are usually our first resort, and end up costing us far more over time with the high-interest rates.

I suggest you both to start saving an emergency fund as quickly as you can. Dave Ramsey recommends that you save at least $1,000. This beginner emergency fund should cover most small emergencies until you’re out of debt and on more stable financial footing.

As soon as you have reached that goal, having a fully-funded emergency fund with enough money to cover 3-6 months of expenses is a smart move on your part.

Related: Examples of When You’ll Be Glad You Have an Emergency Fund

9. Have Financially Responsible Mentors

It’s not a bad idea to have a couple or a mentor that’s financially responsible, that wants the best for both of you.

They may have learned ways of communicating as a team effectively over the years, which would be useful to you.

It’s possible that what you’ve been telling your partner has been going in one ear and out the other. Your chosen mentor may have the tools and experience to get you and your partner to hear one another.

10. Find Easy & Painless Ways To Save

If you and your spouse just can’t seem to get anywhere when it comes to your savings, I have a few ways that might help.

In order to free up more money on your regular bills, such as your cable or phone bills, call them up and negotiate with those companies. They don’t want to lose your business, and in most cases are willing to renegotiate your contracts for much less.

It costs far more for a company to find a new customer, after you factor in advertising and introductory rates, than it does for them to retain an existing customer by giving them a discount.

Not eating out as often, is another way to save a boat-load of money. If you don’t know how to cook, it’s time you take a few basic lessons.

Having an automated savings account might be another good option for the two of you. Your bank can automatically take an agreed-upon amount from your paychecks each week, and set it aside in your savings.

You both have to agree not to touch the money that goes into that account. You’ll be surprised how quickly your savings begin to add up.

Getting On The Same Financial Footing As Your Spouse – Conclusion

Depending on your background, speaking openly about money may not have been a normal occurrence. It can be scary and emotionally charged.

The above steps will guide you and your spouse through ways to be on the same page when it comes to finances and saving. My wish is that you can use these tips and build a stronger relationship to become better at saving for your future.

What other ways can you work together when it comes to your savings account?

Related Articles:

Follow along on Instagram!