Need to Move But Can’t Afford It: 7 Tips

Living situations are sometimes less than ideal. A variety of things can happen that make you want to move, from financial troubles to an annoying roommate.

You could need to move but can’t afford it. If this is the case, the situation can seem frustrating.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

But there are many ways to reach your goals of moving even if it seems challenging at first. I moved out as a teen with no financial support from my family, before I had any savings, and was able to make it work (although it wasn’t easy, it can be done!).

Read these 7 tips for what to do when you can’t afford to move.

How Can I Get Money to Move Out?

There are a few ways to get money to move out including picking up an extra job, finding money in your budget, and looking into untraditional rooming situations. Here are a few things to consider when planning your moving fund.

1. Why do you need to move? Can you stay where you are until you have more money?

Before you decide to move out, think about your situation. Why do you need to move?

If it’s something minor or annoying, can you stay where you are until you get more money? This is usually a good way to handle moving if you can because it gives you more time.

But you may not always have this option. If your situation is urgent or you cannot stay where you are, you’ll need to move quickly.

2. Know your moving expenses.

Rent and utilities – Typically when you move out if you are renting, you will have some costs if you move before your lease is up. Know the amount you will need to pay.

You’ll also need the cash to pay for the next place you rent. Usually you will need a month’s worth of rent and then some extra money as a security deposit.

You also need to budget for utilities, as these will quickly come up. There may be other costs as well, depending on where you move to.

Cost to move – This will vary a lot depending on where you live, where you are moving to, and how much stuff you have to move. You can likely keep costs low if you aren’t moving far and can load things into your car to move.

But if you are moving to a new state or several hours away, you may need a moving truck, plus some people hire movers, and then there’s the cost of gas to get there, plus you may need to buy packing materials.

Deposits needed – As mentioned earlier, you may need to pay a security deposit when you move, and the costs of that depend on your landlord. If you have pets, you will also likely have a pet deposit to pay.

Insurance – Your new place will need renter’s insurance or homeowner’s insurance, so you need to save for that. Some people also like to have moving insurance, which you may want if you own a lot of valuable items.

Emergency contingency fund – In addition to the rest of the things listed here, you should save up some emergency money. When moving, last-minute expenses will likelyl come up, and it’s best to be prepared with some extra cash if you are able.

3. Create a budget.

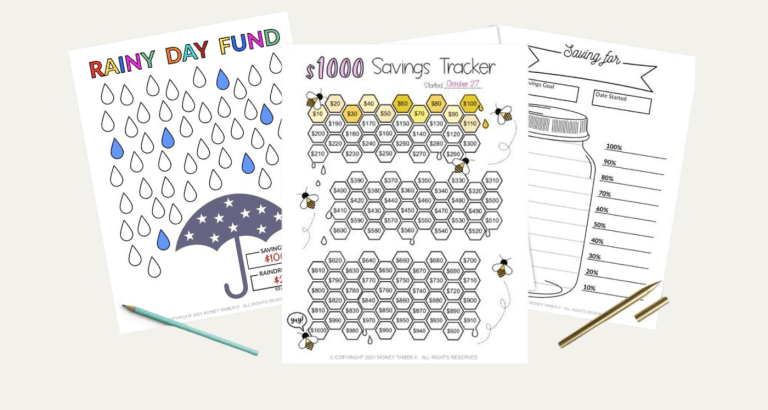

Next, you need to create a budget. You need an exact number of how much money you want to save, and then a timeline that helps you save that amount by the date you want to move out.

For example, if your target date is 3 months from now and you need to save $3,000.00, that’s $1000.00 a month.

Have a set time for budgeting each week or month. Sit down and look at the numbers as you make a plan for the coming days. Remember to look at your budget often and remind yourself of what you are able to save and spend.

4. Track all spending – cut all costs to save for your move.

Begin cutting back on costs that are not essential. Be frugal and stay organized so you know where all of your money is going.

Remember that this is temporary, and you won’t need to work quite as hard once you are able to afford your move. But until then, be very careful with your spending. Avoid eating out, shopping for non-essentials, and vacations.

Also, consider putting all the money you’re saving for your move in one place. A high-interest savings account is your friend.

That way it’s easy to keep track of how much money you’ve saved, and it may inspire you to save more money, faster.

5. Get a job or side hustle to help increase your savings and shorten the time until you can move.

If you really need to move in a hurry and you know it will take you some time to save up, consider getting a second job or starting a side hustle. This can help you save faster if you can add everything extra you make to your move savings.

A second job could be something like:

- dog walking

- social media / content marketing

- proofreading,

- online tutoring

- or anything else that you are skilled at and can charge money for. Or you can see about picking up extra shifts at your current job or looking for a night or weekend job for a limited time.

6. Sell things to help build your moving fund.

Take a look at your possessions and decide what can go. The best items will be things like electronics or even cars, which can greatly increase your savings.

But even small things like clothes and books can add up. Sell what you can and you will be able to move sooner.

7. Be persistent. Don’t lose sight of your goal.

Remember what you are working towards, and don’t give up. Remind yourself of the amount of money you need and congratulate yourself when you get closer to your savings goal.

Remember that working hard will pay off eventually, you just have to keep at it for a while.

How Do I Move Out ASAP?

If your current situation is unsafe, immediately move out. You can ask a friend if you can stay with them or go to a shelter.

After you’ve gotten to a safe location, you can make a plan about finding a new place to live from there.

But if you are just not happy with your current living situation, that’s different. Rather than doing anything drastic, think about what you can do to improve your situation, and work towards your savings goal so you can move out soon.

How Do I Move With No Money?

You will need some way to pay for expenses and rent before you can move. If your regular job leaves you with no extra income for saving, take on a side job for the time being. Save everything from your extra job to move as quickly as possible.

Think about moving in with family or a friend who might let you stay with them for free for a few weeks while you get some savings together.

Or if you can’t stay for free, ask if you can rent a room from a friend and pay for it at the end of the month. This will give you some time to save.

It’s always better to move after having saved up some money, but that isn’t always possible. You can still find a way to move out, just know that you may be playing catch up for a while and need to work more hours.

How to Afford Moving Out as a Student

Being in college means you are also likely paying for tuition in addition to needing money to move. First you should get a job if you don’t have one.

Even a part-time one can help you save up money, but consider online or night classes so you can work a full-time job if necessary.

Next, think about getting some roommates and renting a place together. This will likely afford you a larger space to rent and cost less each month than paying for something on your own.

To save even more, you might even be able to split other costs, like groceries, each month. With more roommates rent costs less and you can save, but it also means you’ll need a bigger place. Look for at least one roommate to live with to start.

Last, look for unconventional opportunities. Maybe rent a room at a friend’s house, or consider renting out a garage, guest house, or studio apartment.

While these options aren’t glamorous, they can get you out on your own faster. Plus, these may be cheaper solutions that can help you as you finish paying for school.

I Work Full-Time and Can’t Afford to Move Out

You may already be working full-time hours and don’t have much left over at the end of the month. This makes moving a challenge. After all, your prime work hours are already taken.

When you have a job and still can’t afford to move, remember these tips:

1. Be flexible.

Decide what is more important – renting a great place, or moving out of your current home. Since moving is obviously more important, be willing to accept that your first place may not be ideal. And that’s okay!

Save up the money to rent something affordable. It doesn’t need to be fancy. Once you are moved out and in a new space, you can think about saving for something more luxurious.

2. Get roommates.

If you need to move out and can’t afford it, consider asking a friend or two to split the rent and be roommates. This can cut your costs significantly and make it much easier to afford your move.

Remember to choose your roommates carefully. Look for responsible individuals who pay their bills on time and have good references.

3. Get a side hustle.

When you’re already working full time, the idea of taking on another job can feel exhausting. But the good news is it won’t be forever.

Take on a temporary side hustle, and save the money towards your move. You can get to your target savings amount faster, even if it means being tired and very busy for a few months.

If possible, try to take on a side gig that doesn’t require specific hours. Becoming a virtual assistant or freelance writer are good examples of this.

Related: Best Part-Time Jobs You Can Do Anywhere

4. Look for second-hand furnishings.

Moving costs aren’t just the rent and deposits. Often, there are other things you’ll need to pay for, like furniture.

To save on this, consider second-hand options. Check thrift stores or online to find the best prices for things like chairs, tables, lamps, and more. Just make sure that the items you find are in good condition.

Is $5000 Enough to Move Out?

Saving up $5000 is not easy, so congratulations on making it to this point. It may be enough to move out, but it may not.

It depends on where you live and where you’re moving to. So the city or state you live in is a big factor. To stretch your dollar further, be willing to move into a smaller space or even a studio apartment if possible.

You’ll also want to have some emergency savings in addition to moving expenses. You don’t want to deplete your entire bank account when you move.

Opt for at least three months of expenses saved, plus moving costs, before you move out. This will allow some breathing room in your budget.

Moving can be a big expense, but with planning and creative thinking, you can achieve your goal

Moving is no easy task. It takes time, effort, and money to make it happen. Whatever your reasons for needing to move, know that it is possible to achieve your goal.

You may need to get creative and be flexible about where you live, your furniture, and living with roommates. But know that your dedication and hard work will pay off in time.

Also, consider that this move does not have to be permanent. After some time and saving up some more money, you should be able to move again. This time to somewhere that is more aligned with your ideals.

You can make your move happen through side hustles, selling items, budgeting, and other effective strategies. Within months of this hard work, you’ll likely be able to afford to move out.

Related Articles:

Follow along on Instagram!