Creative Visual Ways To Pay Off Debt & Make It Fun!

If paying off debt is one of your goals, then use these seven creative ways to pay off debt using visuals. Visuals offer additional motivation on your debt payoff journey.

Visualize a future free from debt. You’d be free of stress wondering how you’re going to make this month’s payments.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

You can pay for vacations, and enjoy them, because you don’t have a looming credit card bill when you get back.

Using visual trackers makes it easier to stay focused on those days when all you want to do is quit.

Don’t become complacent and content with debt. By figuring out what’s truly important in your life, you’ll set out on a course of focus instead of doing daily tasks that don’t matter in the long run.

Unique Debt Payoff Visuals That Make Paying Off Debt Exciting

“In absence of clearly defined goals, we become strangely loyal to performing daily acts of trivia.“

You don’t want to look up 5 years from now and realize you’re in the same financial predicament you are right now.

The following debt payoff visuals will make paying off debt fun and active for the entire family. Teaching your kids how to live a debt-free life will show them how to have a healthy relationship with money.

1. Debt-Free Charts

Debt charts are perfect for visualizing your goals. When placed in a prominent location, such as the side of your fridge, you’ll be reminded of your debt payoff goal frequently.

Debt-free printables can be customized depending on which type of debt you’re paying off. They can even be used for savings funds and sinking funds.

Check out the debt-free charts you can print off from home right now.

2. Savings Jars

Savings jars are perfect for sinking funds. If you know of an upcoming expense, then putting a set amount of money towards each fund monthly will make sure you don’t get into more debt.

If you’re still in debt, savings jars shouldn’t be used to save for vacations since all “fun money” is better spent paying off debt. They’re perfect for Christmas present funds since that expense comes around yearly.

Once out of debt, making special money jars with savings for vacations is a fun way to get children involved.

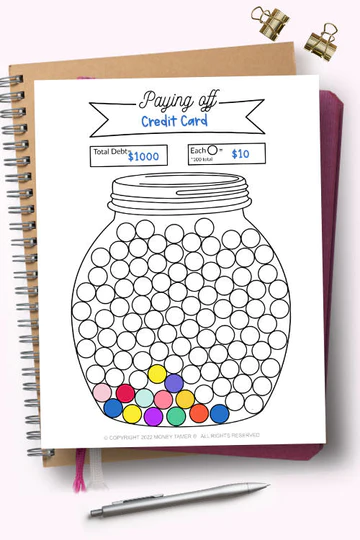

Prefer a savings jar you can color? This savings jar coloring worksheet is great for kids and adults.

It’s great for collecting pocket change or allowance.

This glitter money jar is versatile enough to be reused as an adventure fund jar. Once one adventure is over, reuse this money jar to save for the next!

Better yet is that you probably have everything you need in your home already to create this jar. You can use these jars for your own family savings jar challenge with each family member.

3. Paper Chains/ Paper Clip Chains

This is another easy debt payoff visual that you can make in under 5 minutes.

If using to pay off debt, decide what value each paper clip or loop of the paper chain represents. This will determine how many links long your chain needs to be.

4. Jar With Rocks Or Marbles

Another easy visual that is child-friendly! You can use a glass vase or jar and either rocks, marbles, or decorative stones.

Have two jars: one labeled DEBT and one PAID DEBT. Decide what monetary value each stone represents and remove it from the debt jar to the paid debt jar when you pay down a debt.

Make it fun – use a digital jar coloring sheet!

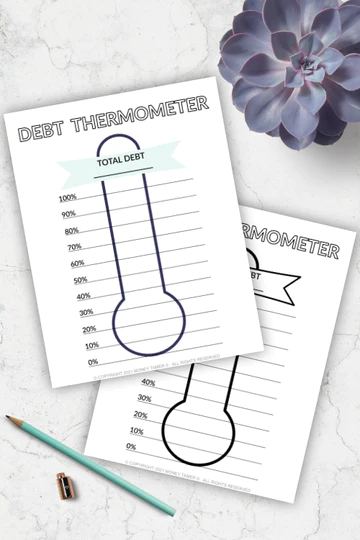

5. Debt Payoff Thermometer

A debt payoff thermometer can be drawn on paper or chalkboard. If you have a wall with chalkboard paint, this would be a standout way to stay focused. As you pay down debt, you’ll fill in more of the debt thermometer.

You can grab a debt thermometer printable here.

6. Sticky Note Wall

Label a bunch of sticky notes with varying amounts of money. If you add all the dollar amounts written on the notes, it should equal the total amount of your debt.

Post the notes on a wall or side of your fridge. Remove the note as you pay off the debt. A benefit of this debt payoff visual is that the dollar amounts vary.

You can have a “win” and remove a sticky note if you saved $12 and another time if you saved $30. It offers more variety and you can make smaller wins to snowball your motivation.

7. Money Vision Board

A money vision board is more than just a debt payoff visual. Your board is a financial freedom vision board since you’re looking toward your future goals as well as focusing on the current debt payoff goal.

Your vision board should include debt free charts if that’s how you’re tracking your debt payoff but also include other visuals that motivate you.

It could be a picture of your family, an ad from a tropical location you hope to visit once out of debt, or a motivational quote. This is a more encompassing visual motivator that combines a few of the previous visuals.

8. Bullet Journal Page

Bullet journals are becoming more and more popular by the day. One of the reasons is due to their extreme customizability.

Bullet journals are blank pages with small equally spaced dots. This allows you to make grids, lines, and pretty much anything, using the dots as a guide.

One of my favorite visuals comes from Clever Fox. They created this bullet journal as a way to save for a vacation but it can just as easily be used to pay off debt.

Using debt-free payoff charts and creative visuals will catapult you on your debt-free journey. Having clear goals and constant visual reminders is the perfect way to stay focused.

- ADVANCED DAILY PLANNER FOR EFFECTIVE TIME MANAGEMENT: Clever Fox Undated Daily Planner 2nd Edition is much more than a standard time planner. It’s an effective tool for managing all vital areas of your life. Featuring comprehensive daily, weekly, and monthly planning pages, this daily schedule planner helps you stay focused and organized, however busy your days get.

- SET GOALS & INCORPORATE THEM INTO YOUR AGENDA: Boost your productivity by defining your global life goals and breaking them into smaller goals to work on every month, week, and day. Begin each new day by listing your daily priorities and creating a detailed schedule with everything you need to do. This way, you can complete the most critical tasks first and ensure you get the most out of every minute.

- BUILD A FULFILLING, BALANCED LIFESTYLE AND FEEL HAPPIER: We often forget how important a good work-life balance is for our well-being. That’s why this daily task planner prompts you to plan activities outside work, learn new skills and habits, support your health and relationships, and take the time for yourself whenever needed. This way, you can build a healthy, balanced lifestyle, avoid burnout, and ensure you feel happier daily.

- UNDATED, COLORFUL PAGES & PREMIUM MATERIALS: This time block planner lasts 6 months and has undated pages, with a new color scheme each month. The daily to-do planner comes in A5 format and measures 5.8 by 8.3 inches. This undated hourly planner has a premium vegan leather hardcover, thick 120gsm no-bleed paper, an elastic band, a pen loop, 3 ribbon bookmarks, and a pocket for loose notes. The time management planner comes with a gift box, 6 sheets of stickers, and a detailed user guide.

- GUARANTEE & RETURNS: We hope our daily hourly planner will help you transform your life for the better. We will happily exchange or refund your daily to-do list planner for work if you have any quality issues or are not completely satisfied with your daily planner organizer for any other reason. Reach out to us via an Amazon message for an easy refund of this time-blocking planner.

Creative Ways To Get Out Of Debt Using Debt Payoff Visuals – Conclusion

Some of the best perks are that these visuals are mainly free or inexpensive and can involve the entire family. Your children will be excited to help you color in the next segment or remind you that something isn’t in the budget.

Let me know in the comments how you stay motivated paying down debt and if you’ve tried any of these visuals.

Related Articles:

Follow along on Instagram!

![Can You Lose Money In A Roth IRA? [And Ways To Prevent This] 16 An envelope with cash inside and the words Can You Lose Money In A Roth IRA printed on the top](https://herpaperroute.com/wp-content/uploads/2021/11/Can-You-Lose-Money-In-A-Roth-IRA-768x410.jpeg)