12 Month Emergency Fund: Do You Need One Or Is It Too Much?

With how tumultuous the job market has been, it can be hard to find any extra money in the budget to save. But if you’re able to save, even a tiny amount, you’ll feel more secure and less stressed.

Times are tough, which means you should plan a little bit further ahead. While the job uncertainty makes it difficult to know how everything is going to turn out, at the very least, you can stay prepared.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

So this begs the question, do you need a 12-month emergency fund? If you’re a single income family and are in a job sector with a lot of insecurity, it may be worth it to temporarily have a 12-month emergency fund until the job market settles down.

What Is A 12 Month Emergency Fund?

When the unexpected happens, you are forced to react. While you can’t predict what can happen, having a little money set aside is always a difference-maker.

This is why I offer a potential solution – the 12-month emergency fund. This emergency fund is money you save to cover an entire year’s worth of bare-bones expenses. If it’s taking longer for you to find a replacement job or need to change job sectors, you will have enough saved that you can live off of through your search.

Reason For A 12 Month Emergency Fund

If you were to get laid off and unable to find the right job in the next few months, you still need a way to pay your bills. It’s generally recommended that you have at least a 3-6 month emergency fund but recent job sector closures, furloughs, and company closings have made job searches take longer for an equivalent paying position.

If you want to be financially sound, you need a long-term plan. The 12-month emergency fund is a safe method to stay in the clear and not worry about going into debt.

It’s less about having a year’s worth of money available in the moment and more about how you can cut back on expenses and make the right moves.

Related: Example Scenarios Where Having an Emergency Fund is Essential

Where Can You Put Your Savings?

Before I talk about how you can save your money, I should mention where that money should go. There are a number of places you can safely put your emergency fund into. Each of them has different advantages. Below, I’ll go over each of them and how they work.

High-Yield Savings Account

First off is a high-yield bank account. With this type of bank account, you can easily access your funds at any time. You also earn interest for each deposit you make, more so than with regular bank accounts.

Consider a bank with no monthly fees to save money. Do keep in mind any transfers could take a few days. This type of account usually doesn’t include a debit card or checks.

Money Market Account

Another option is a money market account. They are like a basic savings account, with the main difference being higher yields, sometimes higher than high-yield bank accounts.

These are easy to use since you can access them anytime from anywhere. This type of account may have a debit card or the ability to order checks.

The one downside is the fees, which can take away from your returns. Some money market accounts have a minimum balance you need to stay above for the best rates. Nonetheless, I highly recommend this one if you want an easy account to manage.

Certificates of Deposit (CDs)

Lastly, there are certificates of deposits, otherwise known by the initials CD. The rates are fixed for a certain length of time, but the return is guaranteed.

CDs aren’t the best place to put an emergency fund since the money is locked into the CD depending on how long you chose. If you had an emergency before the time period was up, you’d need to cash out your CD early and pay a fee.

Recently, CD rates haven’t been any higher than high-yield savings accounts so you won’t be earning more in interest and have the threat of paying a fee if you need to access your money.

If you want to go this route, I wouldn’t put the entirety of your emergency fund in CDs since they won’t be available to use during an actual emergency.

Now that you know what bank accounts are available, you can start making a plan for saving up your emergency fund. It might seem complicated, but I assure you it’s not. There are many easy ways to build towards your emergency fund goals.

Are You Sabotaging Your Budget?

See the budgeting mistakes that are holding you back in this FREE Budgeting ebook. Fix these and your budget will blast off!

How To Plan Ahead With An Emergency Fund

If you are considering a 12-month emergency fund, let me be the first to tell you that the amount you need to save depends on the person.

You might be a single person living in a studio or raising a family of five children. How much of an emergency fund you need entirely depends on your household income.

Track your overall spending and maintain a reasonable budget. It includes your rent, food and water, energy bills, and medical expenses. If you have children or pets, take that into consideration.

You need to figure out the minimum amount you can spend in a month if you cut all extras. Once you do, multiply that by 12 for your total amount to save.

Chances are if you lost your job, you’d be able to find temporary work in a different field. It may not pay as much as your old job but having savings to cover the difference gives you great peace of mind.

5 Steps For Saving A 12 Month Emergency Fund

Below is a step-by-step guide on how you can save up a 12-month emergency fund.

Step #1 – Calculate Your Current Expenses

This is the first step to any emergency fund. Use a budget planner to track your monthly expenses. Tracking your expenses and income allows you to see where your money is going and whether you have any money leaks.

If you’re spending too much on takeout food, you can plug that money leak by making a conscious choice to cook more at home.

Separate your monthly expenses by wants and needs. Your needs should include rent, energy costs, insurance, phone bills, groceries, and transportation.

Your wants should include potential activities such as clothing, gym memberships, restaurants, travel, and entertainment. Every month take a look at what your income was and the expenses of each category that month.

Budgeting has lots of benefits including making it easy to adjust spending from one category to the other. You can use your budget to figure out which expenses you’re able to cut back on. Everything is clearly marked on your budget so there are no surprises.

Step #2 – Create Long-Term Goals

Now that you have available data, I suggest using it as a reference guide for your goals. When I say goals, I mean what can you do to provide yourself more money for an emergency fund?

Below are some recommendations for goals I would use:

- “I want to put (x amount) into my emergency fund this month.”

- “I need to cut back on my unused subscriptions.”

- “I want to lower my energy costs by (x amount).”

- “I need to prioritize which spending is more important to me.”

- “I want to pay off my current debt.”

For short-term goals, you can try to see where you currently are one month from now. Once you compare and contrast the previous month with the current one, you can see where your money is going.

When thinking about intermediate goals, track your progress over the next six months to one year. For example, your goal could be to have an emergency fund by the end of the year.

Even if it sounds difficult, stay dedicated, and don’t give up so easily. If you go slower than expected, you’ll still be farther than had you never started at all.

If you have a current goal you didn’t meet, don’t get discouraged. All it means is you need to cut back on other areas if you want to save money.

Ultimately, you need to carefully think about what you want to achieve in the next 12 months. You can save money over time.

Even if it’s little by little, it adds up eventually. Use it wisely by putting it in your emergency funds.

Step #3 – Consider Big Moves

I talked about saving money by spending less on the little things, such as paying for too much coffee. If you really want to save money, you should consider bigger moves to make.

I’m talking about things you need to think carefully about, like downsizing your home. Again, I’m only offering a suggestion, but if you’re in dire straits and need to save money fast, you have to make sacrifices.

At the very least, don’t plan on vacations this year or the next. Only make big financial moves like getting rid of a second vehicle if, and only if, you really need to.

Step #4 – Keep Track Of Your Progress

A few months pass by, so now what? Like I said before, make sure you keep an eye on your financial spreadsheet every month or so.

Want somewhere to track your money across all accounts? Grab this free financial dashboard to track your savings, retirement, net worth, and more!

Constantly update it, so the numbers are accurate. I know it might be repetitive, but it’s important for your emergency fund. It is better to be over-prepared about your current finances than under-prepared.

You can also make slight adjustments here and there. If you want to meet your goals, I recommend keeping more needs and fewer wants. That’s not to say you can’t have “wants” but use your money wisely.

The best part about keeping track of your progress is when you make progress. It’s such a good feeling to have when you meet your goals and save a little bit of money at the end of every month. I encourage you to maintain progress every chance you get.

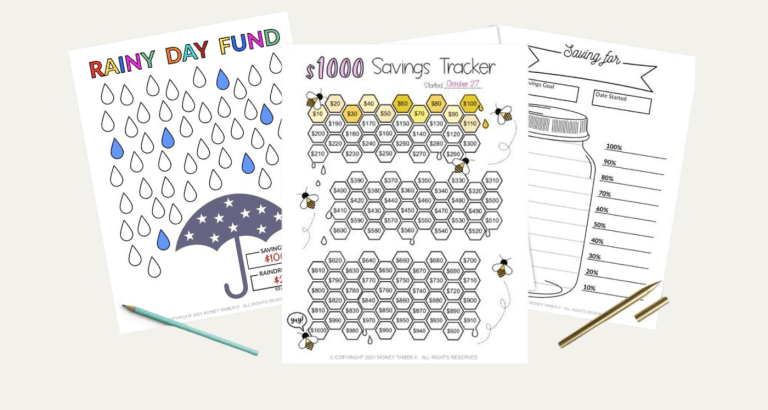

Related: Creative visuals for tracking progress

Step #5 – Save Your Tax Refund

Once you fill out your taxes this year, why not transfer the refund to your emergency fund bank account? You need to stay prepared for any given situation, whether it’s a lay-off or moving into another area.

Using your tax refund to fund your emergency savings is a good way to stay ahead of the next few months. You can get much closer to your goal as a result.

Conclusion

If I have job instability or a family to take care of, I would set up a 12-month emergency fund just to be safe, even if only temporary. You and I live in unprecedented times with the current state of the world.

In an uncertain economy, you should be prepared for any challenges along the way. I recommend an emergency fund, so you don’t have to worry about payments constantly.

You can get a better idea of your financial situation by tracking your money in a budget binder. It’s a useful guide to figure out where your money is currently going and how to save a little bit extra.

A 12-month emergency fund means you can cut back on unnecessary expenses, have money left over to spend on current costs, and stay one step ahead. I would set reasonable goals, keep track of my financial data, and put extra money aside in my bank account.

Setting up an emergency fund allows you to be more responsible and not worry about the future. Take action in the present and see if a 12-month emergency fund is right for you.

Follow along on Instagram!

![Where Do Millionaires and Billionaires Keep Their Money? [8 Most Common Places] 12 Where Do Millionaires and Billionaires Keep Their Money](https://herpaperroute.com/wp-content/uploads/2022/06/Where-Do-Millionaires-and-Billionaires-Keep-Their-Money-768x410.png)