How to Quietly Grow Wealth Without Anyone Noticing

Hoping to quietly grow wealth without anyone noticing? Building wealth doesn’t need to be flashy. In fact, it can be your little secret – a quiet, strategic journey to financial independence that flies totally under the radar.

Maybe you’re tired of feeling like you have to justify every dollar saved, or you just want financial stability on your terms without a parade. Maybe you are in a bad relationship or work situation, and you need getaway cash to leave. Regardless, this guide to secretly growing wealth is you.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

This article breaks down quiet, strategic ways to build wealth without anyone noticing – perfect for women who need a private escape fund or a financial cushion that’s all their own.

These tips go beyond basic budgeting and dive into tactics that help you grow your money on the low. Well, no matter if you’re planning an escape from a tough situation or just want a life with less financial stress, this guide has you covered.

Financial Independence as Your Secret Superpower To Escape A Bad Situation

Need to build wealth so you can leave a bad situation? Whether it’s a tough relationship, an unfulfilling job, or a living situation that doesn’t serve you, having financial independence can be your path to freedom.

There’s something seriously powerful about quietly stacking your coins without anyone being the wiser. When you prioritize financial independence on the down-low, you’re giving yourself a safety net – and believe me, it can be life-changing.

Living cheap to secretly build wealth isn’t about giving up on joy or pretending to be broke – it’s about making conscious choices that add up over time.

Below, you’ll discover easy ways to cut expenses, stash cash, and even earn extra income quietly, putting control back into your hands. Take the first step toward a secure future with these tips to financial freedom and discover how you can quietly prepare to make a clean break whenever the time is right.

Here’s how to build financial independence like it’s your little secret weapon.

1. Cash-Only Living

Let’s start with something simple but surprisingly effective: cash. When you’re buying things with cash, you control what you spend without leaving a trail. Plus, it limits those impulse buys.

People will think you’re just “sticking to a budget” when, in reality, you’re pocketing cash flow and avoiding those “can I borrow your card?” situations that expose your financial game plan.

So where do you get cash?

2. Anonymous Savings Accounts

If you don’t have your own bank account – get one. Now. Creating an “out of sight, out of mind” savings account can be your best move. Consider online-only banks where you can save secretly without anyone seeing it on joint statements.

With a Wealth Simple account you can earn over 2.75% interest on your cash savings, as well as open trade accounts for stock market investing, and managed investing accounts.

Give it a low-key name like “Grocery Budget” or “Rainy Day Fund” to keep it on the DL if anyone does catch a glimpse. This way, you’re building a cushion without anyone realizing just how much you’re tucking away.

3. Secret Emergency Fund or Escape Fund

An emergency fund is freedom, and building one up without prying eyes is key.

Start small: skim a few dollars off every grocery trip or opt into cash-back programs and direct those rewards straight into an anonymous account. This fund is your safety net if you ever need to make a swift exit or just want extra peace of mind.

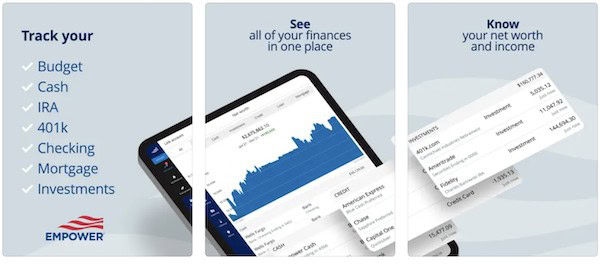

4. Smart Budgeting Apps with Privacy Options

You can budget without anyone having access to your plans. Look for apps that offer password protection, such as facial recognition to open it, and anonymous labeling.

With your funds organized in a secure, private place, you’ll keep track of your spending and saving goals while ensuring no one can dig through your financial data.

The Undercover Budget – Where to Cut Back Without Anyone Noticing

Making smart cuts doesn’t have to mean making sacrifices that people will notice. With a few clever lifestyle edits, you’ll be stacking cash in ways that are practically invisible.

5. Food Hacks

Batch cooking and meal prepping are heroes here – not only saving you money but also time. Use discount grocery apps to find deals, buy in bulk when you can, and watch your grocery bill drop without anyone raising an eyebrow.

6. Invisible Lifestyle Edits

Swap streaming subscriptions for a library card – free ebooks, movies, even music! Hit up thrift stores online to keep up appearances without breaking the bank, and use discount beauty apps for your skincare and makeup needs.

The trick is to quietly reduce spending on things no one else is keeping track of.

7. Thrifty Transportation Choices

There’s no need for flashy rides or costly commutes. Look into rideshare credits or even consider a used bike for getting around if that suits your lifestyle. Public transit, where available, is also a huge saver. These small tweaks cut costs without tipping anyone off.

8. Energy-Saving Hacks at Home

Utility bills can sneak up, but there are ways to bring them down. Simple tricks like using LED lighting, unplugging devices when they’re not in use, and timing your appliance usage during off-peak hours save money and cut down on consumption. The best part? These changes fly completely under the radar.

The Secret Savings Growth Plan – Investing on a Budget

Investing might sound like a luxury, but it’s totally doable on the cheap. This is where we quietly start growing your wealth without waving a “financial freedom” banner.

9. Fractional Investing in Index Funds and ETFs

Even with a small budget, you can start investing in things like index funds and ETFs – and fractional investing is your friend here.

Many online platforms let you buy into big funds with as little as $1, so you’re diversifying your money quietly. A few dollars here and there add up, and no one has to know you’re making moves.

10. Micro-Investing Apps

Micro-investing apps are awesome for stealth wealth-building. Round up your spare change and have it automatically invested. It’s small, low-stakes, and hardly noticeable, but over time, it grows. Look for apps that keep everything confidential so you’re investing without a spotlight.

11. Stash Away Unexpected Money

Whenever you get a little extra – like a birthday gift or unexpected refund – make it a habit to save it. Avoid the “treat yourself” mindset and think long-term. Secretly stashing extra money here and there becomes a powerful tool for building up a hidden stash of wealth without anyone catching on.

Building Financial Power When in A Difficult Relationship

For anyone in a tough situation or unsafe relationship, financial independence isn’t just a goal – it’s a lifeline. Having a secret escape fund and income options can make all the difference. Here’s how to set yourself up for freedom, one small step at a time.

12. Financial Security for Independence

This is to reiterate the importance of tip #3, your emergency fund, or escape fund. An “escape fund” might sound dramatic, but it’s one of the smartest moves you can make if you ever need a way out.

Start by setting up a personal savings account that no one else can access, ideally one that doesn’t send paper statements.

Small, consistent deposits add up quickly, especially if you can automate a portion of your income or secretly funnel cash-back rewards into this fund.

13. Stealth Accounts and Digital Wallets

If you’re worried about others noticing your financial moves, digital wallets and online banks are perfect for discreet saving. Apps like Wise, PayPal or CashApp let you hold funds without tying them to a traditional bank account.

Transfer bits of money here and there, stash gift cards, or sell unused items and direct that cash into these wallets. This keeps your financial assets separated from shared accounts, providing you with a safety net only you know about.

14. Income from Flexible Side Hustles

Remote work is your best friend if you need income without anyone noticing. Freelance gigs, online tutoring, or even micro-task sites are all ways to bring in cash privately.

Look for tasks that you can work on at night or during times when it won’t raise suspicion. Not only will this build your financial independence, but it also gives you a purpose and a goal that’s all your own.

Take a look at this big list of side hustle ideas.

15. Legal Protections and Financial Resources

Research any local financial support resources or organizations that specialize in helping people in difficult relationships which could be with a domestic partner, or with an employer.

Many places offer free legal advice, info about emergency funds, or safe financial planning support that is confidential and tailored to your needs. Knowing what’s available can help you plan your escape without feeling alone.

Side Hustles That Fly Under the Radar

Bringing in extra income is one of the most effective ways to build wealth – quietly. Side hustles let you save without making noticeable changes in your primary job or home life. Here are a few low-key options that add up over time.

16. Freelance Gigs and Remote Work

Whether it’s virtual assisting, content writing, or graphic design, freelance work is ideal for quietly building income streams. Since freelance gigs are often project-based, you can choose jobs that fit your schedule and lifestyle.

Plus, most freelance platforms keep your finances secure and private, allowing you to land gigs and earn without drawing attention.

17. Digital Products or Printables

Creating passive income products like printables or digital templates is a stealthy way to grow wealth. Platforms like Etsy allow you to set up a shop with minimal personal exposure.

You make something once – like budgeting templates, calendars, or planners – and sell it repeatedly, creating a flow of income without needing to advertise it to everyone.

18. Online Surveys and Research Participation

While these won’t make you rich overnight, online surveys and paid research can be a steady stream of quiet cash for completing small tasks. It’s a low-stakes hustle that keeps extra income flowing without demanding too much time or attention.

The Secret Benefits of Stashing Cash and Growing Wealth Quietly

When you’re focused on building wealth privately, sometimes the best tactics are the simplest ones. Small changes that feel low-key and personal can yield some serious financial power over time.

19. Resist Lifestyle Inflation

One of the fastest ways to build wealth is by not upgrading every aspect of your lifestyle as your income grows. If you’ve been getting by comfortably on a modest budget, keep at it.

Instead of splurging on status upgrades, bank those raises or extra income sources. This keeps your finances low-profile while adding up in the background.

20. Invest in Yourself First

Financial independence isn’t just about stacking cash – it’s about investing in skills and experiences that make you more resilient and resourceful.

Sign up for free or low-cost courses, pick up a skill that could become a side hustle, or take care of your physical and mental health in ways that keep you strong for the long run.

No one needs to know that you’re leveling up in ways that’ll pay off big in the future.

21. Grow Your Financial Knowledge

Finally, while you’re saving and investing under the radar, get into the habit of learning more about wealth-building strategies.

Read up on smart investing, follow financial influencers, and look for forums where others share their stealth-saving techniques. The more you understand the game, the better you’ll be at playing it without tipping anyone off.

How to Live Cheap and Secretly Stack Wealth Without Drawing Attention – Conclusion

Secretly building wealth can be incredibly empowering. When you make smart, low-key choices to save, invest, and grow, you’re setting yourself up for a future where you call the shots – without anyone else even knowing.

Financial freedom doesn’t need a spotlight; it just needs a plan and a little patience. So keep stacking, stay subtle, and let your financial independence be your own best-kept secret.

Follow along on Instagram!

![Check Stolen From Mail and Cashed [What to Do Right Now!] 13 check stolen from mail and cashed what to do now](https://herpaperroute.com/wp-content/uploads/2022/09/Check-Stolen-From-Mail-and-Cashed-768x410.jpeg)