10 Things To Stop Buying To Save Money Fast

If you are tired of living from paycheck to paycheck, then this list of things to stop buying to save money is for you. I’ve been trying to do better and spend less on unnecessary things this year, and there are quite a few things I stopped buying to save money.

The great part is, I don’t even miss them. (well, most of them)

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

10 Things To Stop Buying To Save More Money

Here are the 10 things to stop buying in order to save more money. If you have any ideas of other things to stop buying, drop them down below!

1. Coffee-To-Go

Don’t worry, I’m not going to tell you to stop drinking coffee. Being wise with money isn’t about restricting yourself from things you love altogether. It’s about finding alternative ways to have it that are more budget-friendly. Or simply moderating how often you buy it.

If you are guilty of going to a local coffee shop to get your iced coffee every day rather than making your own at home, it might be time for an intervention.

I get it. I love Starbucks too. But I made a pact with myself that I will only buy Starbucks once in a while, or when I’m traveling. The rest of the time, I make coffee at home.

I invested in an espresso machine, and haven’t looked back. And I’m a big coffee drinker so this saves me A LOT OF MONEY.

My poor dad often said: “I’d rather be happy than rich”. My rich dad said, “Why not be both?”

Robert Kiyosaki, Author of Poor Dad Rich Dad

2. Non-Revenue Generating Items

A revenue-generating asset is something you buy, that then makes you more money. It’s an investment.

For example: if you buy a house and rent it out for profit, or if you buy a website that earns $1000 per month in affiliate revenue, these would be revenue-generating assets.

Whereas a non-revenue generating asset is something you buy and get $0 back from it. It’s a dead-end purchase. Think groceries, Netflix, clothing, and handbags.

Sure, you could re-sell your used clothes after you’ve worn them but they won’t make you MORE money than you paid, and they don’t bring in recurring revenue.

Buying websites, real estate and other things that MAKE me money are things I like to invest my money in.

So I make an effort to limit how many dead-end purchases I make so I have more money to invest with. Learn more about buying revenue-generating websites.

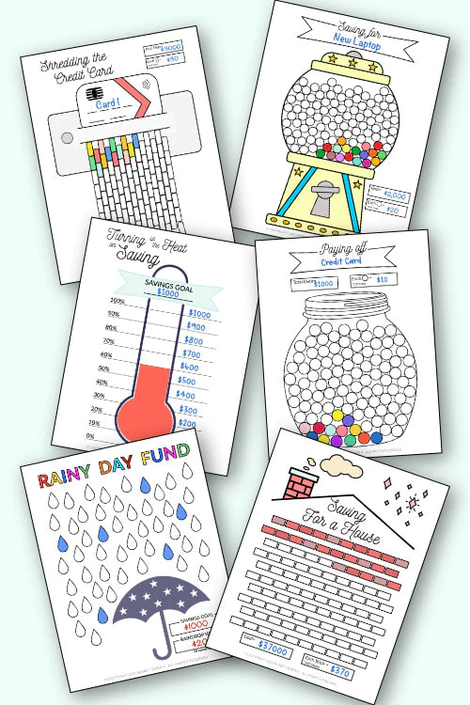

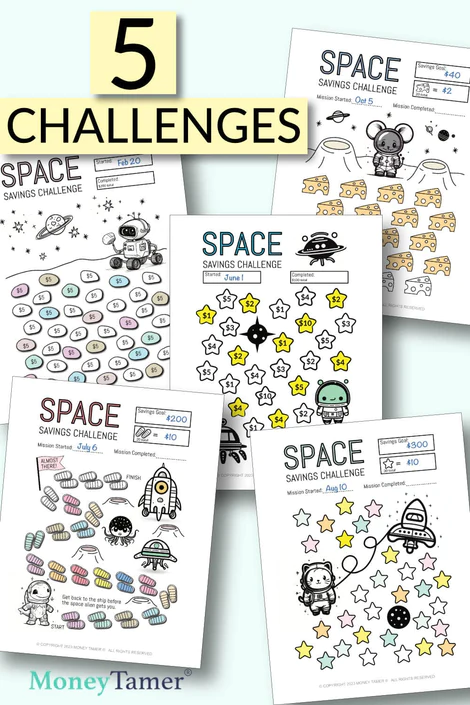

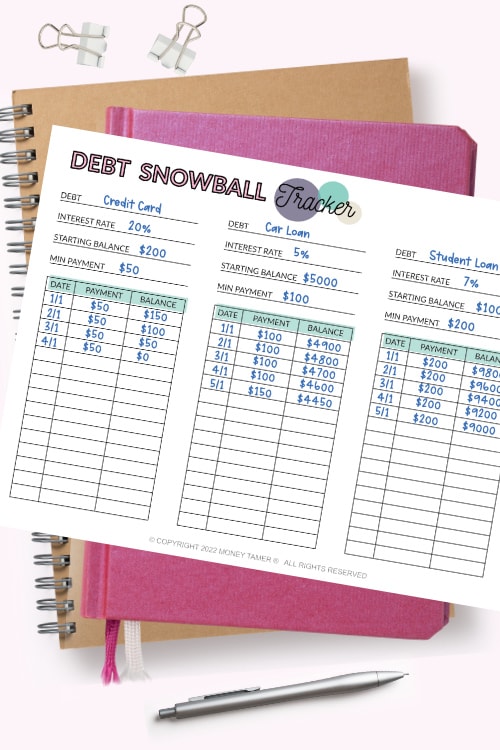

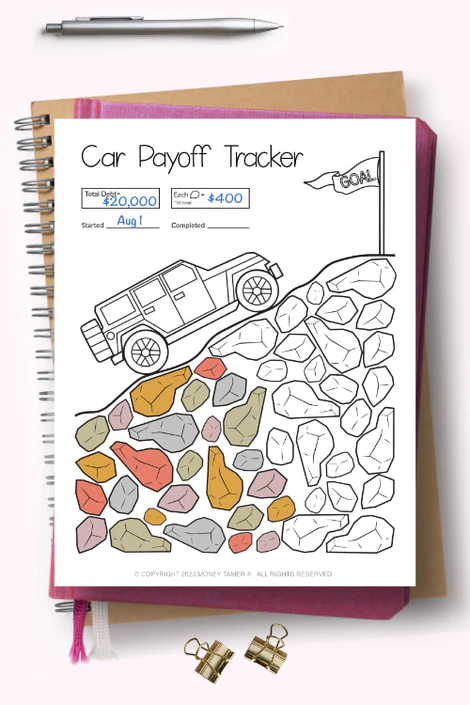

Debt Payoff Savings Challenge Bundle

6+ awesome debt pay-off coloring sheets plus bonus low-income savings sheets.

3. Hard Copy Books

I used to buy so many hard-copy books! But I no longer do. I still read books because I think they’re a great financial investment as you gain knowledge and grow your human capital in general.

However, nowadays I listen to audiobooks through Audible. It’s a great way to consume content passively when you are driving to work or when you are working out.

Listen to two audiobooks for FREE by signing up for an Amazon Audible 30 day free trial here.

You might enjoy: 101 Money Affirmations for Wealth, Finance, Abundance and Prosperity.

4. Soda, Sugary or Alcoholic Drinks

My glow up has included steps toward financial, mindset, and health improvement.

Although I never really drank sugary drinks anyway, I recently made a promise to avoid them, along with energy drinks, most fruit juices, and all alcohol. The interesting part is that the average American consumes over 44 gallons (166 liters!) of soda every single year.

I live in Canada, where the tap water is good to drink, so that saves me a lot of money.

5. Fast Food

This is an even bigger problem than coffee. If you order takeaway/delivery food just once a week, you are probably spending a few hundred dollars a month.

This is not only bad for your health, but fast food is much more expensive than cooking a home meal. I still order delivery on special occasions, but that’s it.

6. Overspending Just Because It’s “On Sale”

I see so many people confused by this. When an item is on sale and you buy it for $200, you say that you got a great deal and that you saved $300. But in reality, you’ve spent $200.

Just because something is cheaper, it doesn’t mean you must buy it. Things that are 20% off are actually 80% on.

Unless that item was on your watchlist and you were waiting for the sales period to buy it, you didn’t save money, you spend money on something you didn’t want.

Don’t look for sales, rather, look for things you need on sale. The sales period is a great time to buy things that you actually need. At least that’s my view on it.

- Audible Audiobook

- Robert Kiyosaki (Author) – Robert Kiyosaki, Kim Kiyosaki, Blair Singer (Narrators)

- English (Publication Language)

- 09/01/2022 (Publication Date) – Nightingale-Conant (Publisher)

7. New Tech

Although I run a tech blog and I love gadgets, I’m not one to buy a new iPhone every year. In fact, if my current iPhone is still operating well 4 years in, that’s great.

There was a time when every new tech upgrade meant a major upgrade with a ton of new features to play with and to make your life more efficient and faster. But now I feel like every upgrade is a minor upgrade for companies to make some money, especially phones.

8. Sneakers / Shoes

When I was in high school I had a weekend job. I would use my paycheck to buy new skate shoes almost every month! What a waste of money. Now it’s not the case anymore, and I am happy with just a few pairs of shoes.

9. Branded/Designer Items

Did you know that one of the easiest ways to tell someone is broke, is if they wear clothes with brand logos all over them? Logo clothing cheapens you!

Real millionaires don’t walk around wearing clothing covered in brand logos – that’s like promoting other brands, but unpaid.

In fact, many wealthy people don’t wear designer clothes at all, but rather, they invest in quality, timeless capsule wardrobe pieces.

10. Bottled Water And Plastic Plates.

I used to buy bottled water all the time. Not only is it a huge waste of money, but also it’s very bad for the environment.

Plastic plates are great if you hate washing the dishes, but just like bottled water, it’s a waste of money and also bad for the environment.

Never Go Shopping Without A List

If you go to the grocery store without a list, you will likely forget what you need to buy and will be more likely to buy things you don’t need. Just because it was in front of you. Write a list, or even better, shop online!

10 Things To Stop Buying To Save More Money – Conclusion

Thank you for reading this list of 10 things to stop buying to save money. Want to know 100 more ways to save money every day? Then read THIS!

Follow along on Instagram!