Budgeting Tips To Manage Debt And Personal Finance

Budgeting Tips To Manage Debt And Personal Finance: We could all use a money check-in once and a while. Whether you are in the red or green, it’s important to figure out how to budget and manage your finances correctly.

Here are some budgeting tips to help you manage debt and personal finance.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

Budgeting Tips To Manage Debt And Personal Finance

By guest writer Marvin Power

One important aspect of personal finance management is to deal with your debt which is inevitable and a sure thing to occur in your life.

To ensure that you do not fail in any payment of bills and accumulate debt, you will need to have a fair bit of amount in hand every month to pay off your monthly bills.

This may sound easy but in reality, it is not.

Only proper budgeting and due diligence will help you to achieve your goals.

There may be times when you will need to make some changes in your lifestyle and your spending psychology and other aspects so that you can manage your debt well and prevent it from building up.

These changes may be simple in most of the cases but at times you may feel you were better off without these made.

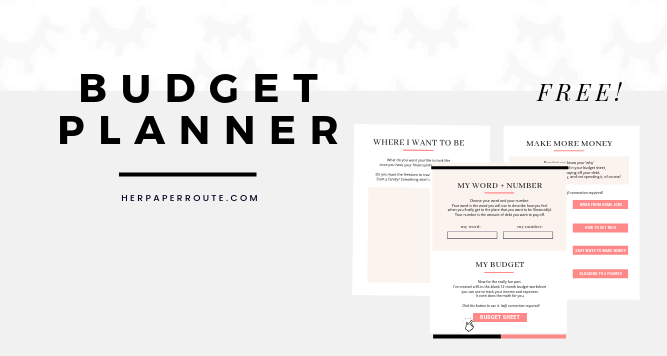

Free Budget Planner

Get a free copy of the budget planner today! Manage your budget and start spending and saving wisely. Plus, this budget sheet does all the math for you!

Budgeting Tips

It is not a difficult task after all to prepare a personal budget and follow it if you follow the following steps:

- All you need is to have a clear and well defined budgetary goal for it. This is the foundation stone to build up a financial condition.

- In addition to that, you will need to list your income from all sources including stocks, shares and investment.

- Apart from that, you will also need to note down all your expenses and keep a track of it to know where the hard earned money is going every month.

- Educate yourself on the Best Budgeting Apps and use them to your advantage.

Following these steps will make it easier for you to set specific financial benchmarks that will be affordable for you to deal with whether it is for buying a house or a car or even starting a new business venture.

Debt Consolidation

If you have to take on a loan for this purpose your budget will ensure that you pay off your debts comfortably over time.

You will not need to face uncontrollable debts and stay awake all night worrying about how you can arrange for funds to pay your upcoming bills.

Related: How This SAHM Earned $135,000 From Her Blog Last Year

You will not have to contemplate on taking a larger debt consolidation loan or go for a settlement negotiation with your creditors and even apply through national debt relief for some immediate respite.

Preparing Your Budget

Preparing a well-planned and precise budget is the first important step to control and manage your personal finance.

However, this not as simple as you may think and most people do not have any clue about it or the spreadsheets and tools available on the internet.

Most people think it is just a simple sheet that includes all your monthly expenses on one side and income of the other that may be accurate or seem to be an accurate representation of numerical values.

However, in reality, a proper budget is much more than enumerating your expenses and income of a month.

It must ideally demonstrate your cash flow in and out so that you can easily pinpoint the areas that are problematic and needs immediate addressing or reforms.

Related: 6 Must-Have Traits Of Successful Entrepreneurs

Budgeting Tips: Calculate Income Correctly

There are few specific steps to design a proper budget for your finance management and it all starts with your income. The steps to follow are:

- Calculating your salary on an hourly basis for each month

- Taking only the actual income and not any potential returns on investment

- Excluding any expected windfalls

- Spreading any quarterly or annual income over each month and

- Considering the portions set for your savings as well.

[adsense]

Budgeting Tips: Calculate Expenses Correctly

To calculate your expenses once you are sure about your income you must focus on the following specific steps to ensure good practice and a flawless personal budget:

- Start with the fixed amounts of household expenses such as rent, cable and internet bills, mortgage, other loan payments

- Next, focus on the variable expenses to list them all in your spreadsheet. These variable expenses may include groceries, utilities and other miscellaneous expenses.

- Add all these expenses and subtract it from your total income so that you will know about the amount of money left in hand.

When you know the money saved, or even not saved, you have to do a few other things as well.

If the cash in hand figure is positive, that is if you have money remaining in hand after making all your monthly expenses make sure you use it for paying off your debt further.

You may also create an emergency or retirement fund as well.

On the other hand, if the figure happens to be negative, you must go back to your variable expenses to find out any specific ones that you can do without, at least for the time being till you pay off your debt or debts.

Ready to start A 6 figure blog of your own?

HerPaperRoute’s ultimate guide to creating a money-making blog is yours FREE today ==> Sign up here!

Managing Spending Psychology

The long and short of the story is that you will have to focus more on your spending as that is the only segment out of the two in your budget that you can control, amend and alter.

Though you can also increase your income by working overtime, curbing your expenses is the most feasible, easy and effective way to save money and earn more from the perspective of economics.

Therefore, managing your spending psychology is the key factor in personal finance as well as debt management.

Related: Good Money Saving Habits To Learn

For this you must have a specific mindset, and reconcile all your purchases, focus on ways in which you can limit it.

Identify your overspending habit and change it so that you can create a fund to pay off your debts easily every month.

the PROFITABLE entrepreneur TOOLKIT

everything you need to start and monetize your online business. Over $3600 in resources, yours FREE!

Budgeting Tips To Manage Your Debt And Personal Finance, In Conclusion

Follow the budgeting tips of experts to spend less and the most significant of all is to make cash purchases only.

When you use your credit card, you will inevitably end up spending more as you will make purchases that are not required.

By resorting only on cash purchases, on the other hand, will compel you to spend on your needs rather than on your wants and spend more as a result and incur more credit card debt.

Lastly, bring a responsible friend with you whenever you shop. A friend who knows about your overspending attitude may help stop you from making any unnecessary purchases.

___________

Marvin Power is a freelance writer who has been writing for various blogs. Marvin has previously covered an extensive range of topics, including debt, Money, Finance, and start-ups.

Keep Reading

- Side Hustle Ideas – Have You Tried These?

- 30+ Legit Ways To Make Easy Money Online

- Why I Spent $23,000 On My Blog Last Year

- How To Start A Money-Making Blog

Follow along on Instagram!