Personal Capital Review of Empower – Free Wealth Manager App

Personal Capital review. Personal Capital (now called “Empower” is a digital wealth management app that is leading the pack in a new breed of hybrid robo-advisor.

This wealth management app offers a unique service to high-net-worth investors by combining the robo-advisor algorithms with the personal touch of human advisors.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer | Advertise With Us

However, that’s not to say they don’t have something to offer investors at every level.

In fact, Personal Capital has some fantastic free tools that are great for everybody and will speed you on your way to having control of your finances.

Personal Capital Review – Free Digital Wealth Manager App

While testing for this Personal Capital review, I found that using Personal Capital is simple and effective. The platform links your banking, investment, retirement and credit accounts into one location.

This allows you to see a broad overview of your finances. No longer do you need to spend countless hours on spreadsheets trying to reconcile accounts.

Personal Capital Offers Clients A Modern Dashboard

The Personal Capital dashboard and interfaces are some of the cleanest and best laid out in the business. An accounts summary is displayed in an easy to read format.

The dashboard displays both banking and investing information. Additionally, reporting is quick and simple. At a glance, you can see everything from net worth to portfolio balances to budgeting information and cash flow.

Both the web and phone app version of the software offer a smooth, seamless design.

Related: How to start investing with just $5

Personal Capital Free Tools

The free tools that Personal Capital offers are some of the best available.Even compared to paid apps! Budget-minded individuals will love the free Mint.com-like budgeting and expense tracking tools.

The platform even tracks how spending habits change over time. However, someone looking only for budgeting tools might be better served by a site like Mint. Personal Capital is an investing platform first.

Seasoned investors will be happy to see all their accounts in one place. Additionally, investors can pick and choose which accounts to review.

Get a FREE copy of my Budget Planner, with money management tips, prompts, and fill-in-the-blank budgeting sheets you can start using right away.

Personal Capital Investment Performance Tracking

The site even offers a unique “You Index,” which tracks your investing account performance against standard benchmarks. Simply put, as I explored the app for this Personal Capital review, I found everything I needed and more. Personal Capital could be one of the best free platforms available for investors.

Even more free tools exist for retirement planning and asset allocation. For instance, the investment checkup gives insight into a portfolio.

It offers suggestions on how asset allocation could be improved, both historical and projected performance, and risk. In addition, there is a fee checker tool that suggests ways to reduce high fees.

Wealth Management

Personal Capital offers wealth management tools as well. These are for individuals who want more assistance with investing.

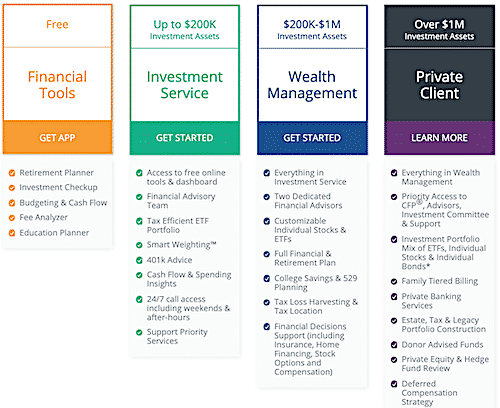

Three tiers of wealth management exist.

The lowest tier, “investment service,” offers access to premade portfolios and general advice for 401k’s and budgeting. Individuals with up to $200,000 to invest qualify for this tier.

Investors who have between $200,000 and $1 million to invest will find services similar to that of a traditional financial advisor.

However, the fees with Personal Capital are much less at just 0.89% of assets under management. Traditional advisors will charge 1% or higher of assets under management.

Investors with more than $1 million to invest will find even more services, including many of those provided by a CFP, like estate planning. Fees are on a sliding scale at this level and start at 0.89% and go down.

Related: Warren Buffett’s 7 Best Tips For Investors

Personal Capital Review – Pros and Cons

For the next stage of this Personal Capital review, let’s explore the pros and cons. Strictly speaking, Personal Capital is one of the best free tools available for investors today.

However, there are a few drawbacks that will apply to certain individuals.

Pros of Personal Capital:

- The fantastic easy to use platform that combines all your accounts in one place.

- Completely free tools are better than many paid tools available. Sign up and using the tools are entirely free of charge.

- Wealth planning fees of 0.89% of assets is much cheaper than a traditional financial advisor.

- The site generates fantastic reports for banking and investing to dig down into your finances.

- The unique “You index” is a fantastic way to benchmark investment performance.

Cons of Personal Capital:

- There is a minimum of $25,000 of assets to be eligible for wealth planning

- Individuals with less than $200,000 to invest may be better served by a traditional robo-advisor. Traditional robo-advisors offer similar services at this level at a lower cost.

- The budgeting tools are decent, but not as nice as software specifically designed for budgeting. A platform like Mint may better serve individuals looking for a primary budget and expense tracking tool.

Who is Personal Capital best for?

When testing the app for my Personal Capital review, I wanted to look at it from the position of a wealth management newbie, as well as a pro.

Do-it-yourself investors will especially love the free tools. The ability to see all your accounts in one place is a major time saver. Even a beginning investor will appreciate the free planning tools to help with asset allocation and to avoid fees.

High net worth investors will see significant savings in wealth management over traditional financial advisors with similar or even better levels of service, in addition to access of all the free tools.

How to sign up with Personal Capital

Joining Personal Capital is a breeze and completely free of charge.

To begin, the sign up is a five-minute process of filling out forms and verification emails. Then you connect your accounts.

You can connect nearly any type of account. For example, even connecting to non-traditional accounts like Fundrise or Lendingclub is a simple process.

Keep Reading

- How To Make A Budget And Pay Off Debt

- How To Get Rich Realistically

- The Trick To Being Good At Saving Money

- How To Make $100,00 As A New Blogger

- Free Toolkit For Entrepreneurs

Did you enjoy this Personal Capital review? Check out some more articles like this on the HerPaperRoute blog, and share/pin this with your network. Thank you for your support!

Follow along on Instagram!