Paying Off Debt Tips To Motivate You + Free Budget Workbook

Paying off debt is an honorable goal that anyone should have. But how do you get out of debt? Is there a secret to becoming debt free?

Well, yes. I’ll share it with you in a moment. Using my debt-tackling strategies and my free, printable budget workbook bundle, you will be able to slay your debt with confidence.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

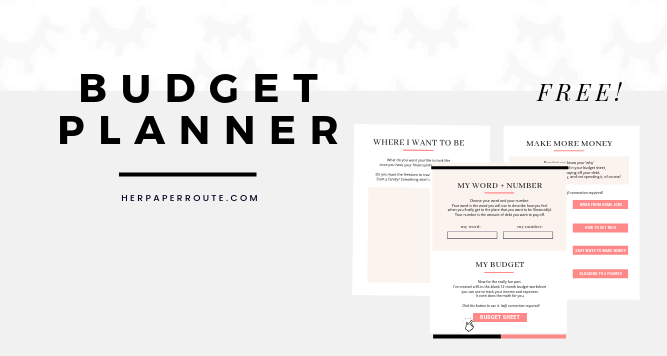

Free Budget Bundle: Worksheets, eBook and more!

I’ve created a handy printable budget workbook you can use while reading this article. Inside the bundle is an online budget worksheet as well, which tracks your income and spending. It automatically does the math for you, all you need to do is fill in your monthly expenses and profit and you will get a clear picture of how much money you have coming in and out.

Download your free budget workbook bundle below to get started.

With this visual budget worksheet, you can reach your debt-free goals sooner than you think.

What Is The Secret To Paying Off Debt?

Honestly, the secret to paying off debt is motivation. Without motivation, a reason to stay focused, a ‘why‘… becoming debt-free is nearly impossible.

Motivation is going to keep you positive as you battle the ups and downs of paying off debt. Seriously, you need to be able to motivate yourself.

You need to kick your own butt and make yourself do the work you need to do. You must have a clear end goal at the forefront of your mind that keeps you on the path to financial freedom.

If you aren’t willing to self-motivate and do the work to find your ‘why’ then you aren’t going to get rid of your debt. So get real with yourself and come up with that ‘end goal’ reason for why you want to pay off your debt in the first place.

It won’t always be easy, but if you are willing to do the work, life will become less hard soon. Let’s get going! Let’s find your ‘why.’ The thing that will push you forwards when things get hard.

Motivation Tips For Paying Off Debt – Bonus

Once you’ve downloaded your free budget planner above, you will have the tools you need to motivate yourself to do what you need to do to get your financial life together.

You will know your ‘why’ and you can now start paying off debt.

The next natural step to becoming debt-free is to start making more money, and not spending it!

Here’s how to make more money right now:

- Follow this realistic guide to getting rich

- Develop the money-saving habit

- Use the Debt Snowball Method to pay off your debt faster

- Read through this list of passive income ideas and try some of them

- Learn about these high-paying work from home jobs you can do online

- Increase your job salary, by knowing the do’s and don’ts of how to ask for a raise

- Here’s a list of ways you can make $100k a year as a blogger

- Start a blog and monetize it into a profitable business

- Learn these 12 tips for becoming a millionaire

Make paying off debt and budgeting fun and easy

If you are anything like me, I am a visual person. I like to write things down, doodle little pictures, and really be able to visualize my goals.

I have put together this budget planner to help you do just that!

Listen, I know saving money can be difficult, especially if you are already living on one income or are living paycheck to paycheck.

Believe me, I’ve been there!

There is a quote by Peter Drucker (the founder of modern management) that I really try to live by both with my finances and my business:

If you can’t measure it, you can’t change it.

It simply means this, if you are trying to change something, you need to measure it.

Creating goals that stick

You can’t just say “I’m going to save more this year.”

I mean, technically you CAN say that, but how far are you really going to get?

Now, instead of saying “I’m going to save more money this year,” set a S.M.A.R.T goal.

- Specific

- Measurable

- Attainable

- Realistic

- Timely

Therefore, a S.M.A.R.T goal would look something like: “I’m going to set aside $10 per week into my savings until I have saved $1,000 for an emergency fund.”

But in order to see if you are reaching these goals, you need to track or measure them. Just like you would weigh yourself every week if you were trying to lose weight.

A budget planner to fit your needs

This is where our planner comes in handy.

For each month there is a goal sheet, much like a little monthly vision board. There is a spot for your money vision, dates to remember, and money goals.

I like the dates to remember part because, with kids, there are many varying expenses. This helps me to remember when one-time payments are due (like dance pictures or annual fees for things).

After that, there is a monthly budgeting sheet which you can use online, from your Google Drive, so it goes with you everywhere.

This is essential for anyone that is tracking their money. Make sure to include your savings goal in the “expense” category.

Now that you have established that saving is a priority in your budget, the savings pile worksheet will help you to visualize your savings goals.

Are you saving up for a down payment for a house, your emergency fund, a family vacation? This is the place to put that down.

It’s easier to stay on track with a budget when you have a solid plan.

The weekly agenda helps you to keep your life in order and your finances on track.

You’ll also find space to use a s a reflections page. I think this is super important because you should look back on the month and reflect on your wins and losses.

What did you do well? Did you hit your savings goal? Awesome-write it down. Did you go over budget on something-write that down too!

Make sure you are celebrating your wins and checking in with yourself on how you can improve on any hiccups.

Lastly, there is a money-making tips page. Because part of being money wise is striving to consistently make more money!

How To Get The Budget Workbook Bundle

If you are interested in getting a copy of our budget planner, you can get it for free inside the HerPaperRoute Toolkit!

You will also get an email from me each week with a helpful money management and/or business tip to help keep you motivated and on track to reach your goals.

More Money And Budgeting Planning Tips

- 7 Ways To Pay Off Your Student Loans Fast

- 21 Passive Income Ideas

- How To Get Blog Sponsorship Deals (Even As A Newbie!)

- Pay Off Your Debt Fast with the Snowball Method!

- How To Stop Financial Stress For Good

Follow along on Instagram!