Payoff Debt Snowball Calculator – Dave Ramsey Plan For Finances

I am sure that you have heard of the debt snowball method, also referred to as the Dave Ramsey plan, at some point.

If not, allow me to give you a brief overview of what it is and how you can use the debt snowball calculator to pay off your debts fast.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

If you are serious about paying off debt and living a financially peaceful life, keep reading!

What Is A Debt Snowball? What Is The Debt Snowball Method?

In Dave Ramsey’s book, The Total Money Makeover he talks about 7 steps to paying off your debt and achieving financial bliss.

The debt snowball is one of these financial steps. The debt snowball, in essence, is the prioritization of your debts from the smallest to the largest.

You start off with a certain amount that you can budget each month to pay off your debts. Whatever works for you.

There is also a very handy workbook that accompanies his book, to help keep you on track.

You take all of your balances and pay the minimums, except the one with the lowest balance. That one you pay more to pay it off the quickest.

The debt snowball method works like this: Once you have the smallest debt paid off, then you apply the balance you were paying on that one to the next smallest balance.

You keep going in this fashion until off of your debts are paid off.

Related: How To Stop Living Paycheck To Paycheck Without Losing Your Sanity

Using Dave Ramsey’s debt snowball method you achieve a quick win, so to speak.

If you have a debt with a lower balance and you see that you can fully pay it off, it will give you the satisfaction and motivation to keep going.

Why The Dave Ramsey Debt Snowball Plan Works

With the debt snowball plan, you are also focusing on using the extra money you have budgeted towards paying your debt off quicker.

Otherwise, you end up spreading yourself thin and feel like you aren’t even making a dent in paying down your debts.

When you are achieving quick wins, you will be more likely to stick with whatever it is you are trying to do.

Think of it like getting fit. When you lose that first 5 or 10 pounds and you can see a change in the way you look and feel, that gives you the motivation to keep going.

Same thing with your debts.

If you have a credit card with a $500 balance that you feel like you have been paying off forever, wouldn’t it be great if you could pay it off in a few months and be done with it?

…Exactly.

How Does A Debt Snowball Work, On A Tight Budget?

What if my budget doesn’t allow me to utilize a debt snowball calculator?

Well, when was the last time you really evaluated your budget? Be honest!

If you haven’t already read my how to stop living paycheck to paycheck post, go read that first. As well, download my free debt snowball spreadsheet and budget planner right now:

Access it via the form below:

Ok, now back to your concern about not having enough in your budget.

There are always ways to cut expenses here and there. Whether it is not going out to eat or dropping that gym membership that you never use.

Take a good long look at where your money goes every month. Take a look at your bank statements, you might be horrendously surprised!

When you get lazy with your budget, things can start to add up really quickly.

- Then, start cutting things out.

- Make sure everyone in the family is on board.

- Eating out and entertainment costs are a great place to start.

- Make sure you are really concentrating on your goals of paying off your debts when you do this.

Don’t feel like you have to become a hermit just to become debt free.

Try making a visual that you can keep with you or in plain sight as a reminder of your financial freedom goals. You know, like those giant thermometers that you see when people are fundraising.

After you are good with sticking to your new budget and have realized that it is not as bad as you thought it was going to be, take the next step.

Getting Yourself Into A Better Position To Pay Off Debt

This is the fun step: How to make more money.

Explore the HerPaperRoute blog for hundreds of ideas on ways to make money online, and work from home, various ideas to start a business, and more.

Now back to your debt…

How To Start Your Debt Snowball Payoff Plan

Let’s use the debt snowball method to illustrate how you can start paying off debt.

Take any extra money you make, and pay it towards your first debt. I doesn’t matter if it’s $5 or $500, every dollar counts here!

Once your first (lowest balance) debt is paid off, move on to the next one with the lowest balance. Let’s make sure we are on the same page here:

- Debt #1-paid minimum and used all extra income to pay off

- Debt #2-paid minimum until debt #1 is paid off

- Now everything that was being paid on debt #1 is not being paid on debt #2

You will keep doing this until all of your debt is paid off.

Free Debt Snowball Calculator

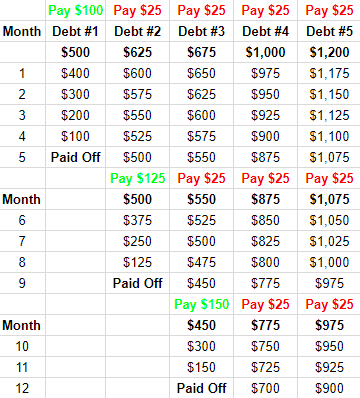

I made a little chart to show you how this works.

In the example outlined below, there are 5 different debts, and you are paying a total of $200 each month to pay them off.

In this example, the total amount of debt of $4,000 is being paid off in 20 months, not too bad 🙂

Keep in mind that this does not take into account any interest paid on the balances.

Obviously, everyone’s situation is different and your debts will look different than what I have outlined here. This is just an outline to help wrap your mind around how you will be paying off your debts.

To test out your own debt snowball calculator, enter your details in the debt payoff calculator at NerdWallet:

Using The Debt Snowball Method Quick Tips

If you are consistent and stick with it, using the debt snowball method to pay off your debts can be extremely effective.

The debt snowball method can be used for any type of debt: credit cards, medical, home and auto loans, and student loans.

“I love living paycheck to paycheck and never being able to do anything!”

You say that all the time right? Probably not, nor does anyone else.

Once you start digging yourself out of that hole, you are going to want to keep digging. Debt is not fun.

Having those looming monthly payments every month is not fun. Paying late fees when you forget to pay those monthly payments are not fun.

But you know what is fun?

- Being able to go grocery shopping without having to check how much money you have because you just paid all your bills.

- Being able to take a vacation without having to wait for your tax rebate.

- Never having to tell your kids they can’t do something because you can’t afford it.

Living paycheck to paycheck without having any wiggle room is hard!

And you have full control to end that cycle.

When you have paid off your debts you no longer have to worry about “making ends meet.” You are able to provide things for your family without any help or the weight of the world sitting on your shoulders.

Debt Snowball Calculator – Conclusion

What is that quote about insanity…doing the same thing over and over and expecting different results?

You need to start by taking the first step and get control of your budget. This is how using Dave ramsey’s debt snowball method can help you pay off debts faster.

Once you have gotten this under control you can start with your lowest balance debt and chip away at it with your “extra” cash.

Every debt you pay off will get you closer to your goals of financial freedom. All while creating stability in your financial situation.

Keep Reading

- How To Get Rich, And Stay Rich

- 10 Good Money Saving Habits To Develop

- How To Make A Budget (Free Budget Planner!)

- My Guide To Starting A 6 Figure Blog

- How I Made $135k In My Second Year As A Blogger

Follow along on Instagram!