How To Talk To Your Spouse About Money – 16 Honest Tips

Cringe! Knowing how to talk to your spouse about money is a skill that requires practice. Discussing finances with your partner can be an uncomfortable situation for many couples.

So don’t feel too bad if you tend to avoid having money talks in your own relationship. But if you are open to changing that, awesome! I’ll tell you why you’ll benefit by doing so, and what you can do to make it less awkward in a moment.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

Why is it so crucial to talk about money matters? Studies show that finances are the Number One cause of marital conflict! Those same studies show that financial conflict is the top reason couples end up splitting the property and going separate ways.

Furthermore, it’s important to remember that money talks are a required conversation because it’s the conflict around money, not money itself that causes the problem.

How To Talk To Your Spouse About Money Without It Getting Weird

How a married couple or a couple living together deals with issues related to money is the primary predictor of how successful their relationship will be. Conflict around how to handle money is one of the most frequently cited causes of divorce.

I’m sure you have heard the statistic before…45% of marriages end in divorce and most of those are a result of fighting about money. Which is sad really, but that doesn’t have to be you.

Part of the reason that money consistently ranks as a top cause of divorce is that the conflict is not really about money. Money symbolizes love, security, power and control.

How we earn it, spend it or save it, indicates our deeply held values and beliefs.

In the closest human relationship, marriage, how we deal with money can become a battleground.

Couples who learn how to talk productively about money can greatly increase their chance of marital satisfaction, and success in living arrangements besides marriage.

Taking the time to learn how to talk to your spouse about money is important.

Even if you have argued about money in the past, it is not too late to fix it. And congrats to you for taking the steps to figure things out before you become another statistic!

So, here are some tips for ways to have the money talk with your partner, without it becoming a looming, awkward cloud over your marriage.

How To Talk To Your Spouse About Money – 16 steps For Successful Money Talks

Let’s get comfortable talking numbers with your significant other, shall we? Read on for 16 steps to dealing with money in a healthy way in your relationship.

1. Prepare Yourself

Prepare for the talk by gathering information about the current situation. This is critical for making a viable plan for managing together in the future.

Keep in mind that your money behaviors are set early in life. Successful couples learn how to accept each other and work together instead of trying to change each other.

2. Do It In Private

First off, conduct the get-together in a private place, because things may get a little testy even between the most compatible couples. Second, make sure to cover some essential points.

3. Time It Right

It’s best to do so when times are good rather than when there is a crisis. Don’t have the money talk during a fight or when times are tense. And never try to discuss money at the end of a stressful day.

Choose a time when you are both at your best. Counselors who work with couples suggest weekends because there are fewer looming job pressures.

4. Open On The Positives

If you are just starting out on the money conversations, plan an opening that will set the stage. For example, praise your partner for something you admire about how they handle money, and indicate that you want to improve your own habits.

If you are just starting out on the money conversations, plan an opening that will set the stage. For example, praise your partner for something you admire about how they handle money, and indicate that you want to improve your own habits.

5. Communication is Key

This happens all too often, talking about money is taboo, or it can feel icky.

Well, get over it!

If you are in a relationship with someone you should know about their financial details. Especially if you are getting married to that person!

You should know the details of each others:

- incomes & debts

- assets

- credit card debts

- student loans

- if you have borrowed larger sums of money to people that are still owed

- child support

- and anything else related to your finances

Make sure you put it all out there. Don’t be afraid.

If you trust that person enough to be in a relationship with them, then you should trust them enough to talk about your finances (and theirs).

Being able to share these details with another person helps to build a team mentality. Think of it like a relationship exercise in trust.

I’ll show you mine if you show me yours kinda thing! Also, it can really be a load off of your shoulders when you feel like you don’t have to hide anything from your partner.

Related: 4 Awesome Ways To Make Money With A Blog

6. Get on the same page

Back to the team mentality. When you are in a relationship with someone having common goals helps to strengthen the relationship. This applies to finances, kids, living situations, and even where you want to eat out for your date night.

Obviously, you are not going to agree on the same things all the time, but having common goals in mind can help tremendously when it comes to your finances.

Make sure you are talking with one another about your goals and expectations.

How does money fit into these?

Do you plan on buying a house, having kids, traveling, when do you want to retire?

These are all big life events that revolve around money. Don’t just assume that your partner can read your mind and know what you want or that you want the same things. Be very clear with one another about these big decisions.

I’m not saying you have to plan out your entire life here down to the very last detail, that’s preposterous

But think about it.

- Want to purchase a house?

- What kind?

- Living in the city versus living in the country has some different expenses involved.

- Planning on having kids?

- Is one of you going to stay home or do you plan on both working?

- Will you have an in-home nanny or take them to a daycare?

- Will they go to public or private school?

All things that can drastically impact your financial situation.

7. Get it all out in the open

This part can be kind of painful, so make sure you are both in a good mood when you go over this! (Maybe grab a glass of wine or a beer before you dive into this part).

Make sure you know all of your expenses. Yes…ALL OF THEM!

You might be unpleasantly surprised as to where your money goes and even more surprised as to where your partner spends their money. You can check out my previous post on How to Stop Living Paycheck to Paycheck without Losing Your Sanity that goes over how to really dive in and track your expenses to find out where they are going.

Make sure you are tracking everything! Trips to the gas station for quick lunches, Starbucks, eating out, personal care-like getting your hair and nails done, random crap your boyfriend/husband buys from Best Buy or Amazon.

When you do this you may realize that your partner (or yourself!) is spending $50-$80+ a week on lunches at work. Yeah, not cool!

This is also a great way to find areas that you can cut down on. For example, I found a way to save over $19,000 per year when I stopped buying these 8 things.

8. Have A Credit Strategy

Some people use credit cards almost exclusively, and pay one bill at the end of the month. Others have only begun to use debit cards after being dragged kicking and screaming into this century.

Be sure to know who is who in this scenario, and come to a solution that leaves both parties feeling listened to and empowered.

That’s one piece of the credit puzzle. The other piece is to be totally honest about your own credit history. We have all erred in the past. Bring those errors to the front and talk about what needs to be done to make things better.

9. Be Open About Student Debt

Student loans can be a financial hurdle. If the plan is to jointly file taxes, those payments could go up once you are married.

It has to do with an instant income increase. As for who is responsible, federally funded student loans belong to the student alone. But, if you refinance those loans, the other spouse can be on the hook for them.

If you have student debt, here are some ideas for ways you can pay back student loans faster.

10. Who Is The Spender And Who Is The Saver?

Who is who? Or are you both savers or both spenders?

In most relationships, one partner is the spender and the other is the saver. Savers are sometimes smug. Spenders are sometimes less than prudent.

Can these types of relationships last and be filled with love and not stress? Do the people in these relationships really complement one another?

The answer is yes, relationships work with a spender and saver for the most part and both partners are happy.

The Spender

The spender is usually the one in the relationship who does the spending. This is the same person who sees something on sale and does the “random buy”.

This is also the same person who goes home to the saver and tells them what they have purchased and how proud of the bargain they are. The spender in the relationship is the one who makes the purchases without giving it a second thought, mostly anyway.

The Saver

The saver in the relationship is the person who feels they need to pinch the pennies. This is also the same partner who cringes when the spender walks out the door to make a purchase.

The saver is the person who saves at every corner and worries about the bills being paid on time. The saver may also be the one laying awake at night worrying about being able to pay the bills on time.

Can we really live together and survive?

This is the question that many ask. Although they may love each other, the differences in spending attitudes can drive the relationship apart. Who is the right one and the wrong one when it comes to the spending of money?

There really isn’t a right or wrong answer here. What needs to happen is open communication when it comes to the budget.

How do we handle this type of relationship?

There are things that must be accomplished to help the spender and saver couple. Although there are steps listed here, it is important to realize that without a good line of open communication financial problems will likely develop and a relationship can be doomed.

- Be forgiving of the other partner. The saver may get upset that the spender has overspent again and how the situation is handled will make a difference. Being understanding is the first thing that the couple should be working on. There are going to be bumps along the way, so relax a bit and look at things from the other perspective.

- Set up a spending plan and stick to it. This is where you will both have to be disciplined. On the budget come up with a solution if one partner or the other does not adhere to the agreement. The spending plan should also include savings.

- Allow some leeway. There will be times when the spending may go overboard a little. By each partner giving in a little bit there will be less room for arguments to take place.

Spender Responsibilities

- Always give your partner the receipts for any items purchased.

- If you know you will be buying something make sure to tell your partner before the purchase takes place.

Saver Responsibilities

- Let your partner know what bills are coming up to be paid, and how much money it will cost.

- Do not keep the finances a secret. Let your partner work with you on the plan so that he or she knows where everything stands financially.

The spender and the saver complement each other when there is open communication and a plan of action.

The most important thing about the spender and the saver is to remember one important thing. There are no extra points for being one or the other, and neither one can win all the time.

11. Make A Budget

I know..snoooore. But honestly, having a monthly budget and a plan for when it is acceptable to bust the budget (a little) is a key to marital bliss.

The plan can be as simple as picking a dollar amount either spouse can spend without needing to call home first. Higher amounts will require closer communication.

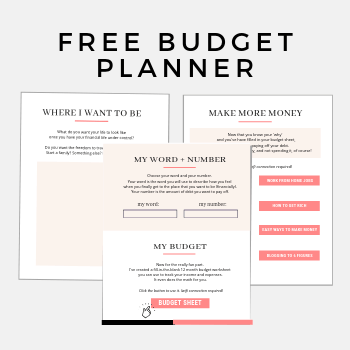

To make budgeting fun, I’ve created a budget planner book that you can download and use for free. It helps you plot out your income expenses so you know exactly where your money is going.

It also includes a smart spreadsheet that does all the math for you! Get your copy here:

Budgeting Planner + Book, Free Download:

12. Strategize and Plan

So here is where the rubber meets the road…so to speak.

Talk with your partner and find out what will work best for the two of you as far as how to manage and track your money.

So often people feel like they can’t move forward with a plan because they don’t have enough money. This is really not the case for most people. It is a matter of they don’t know how to manage the money they already have.

There are tons of ways to manage your finances with your partner. The good old envelope method, using apps or software like Personal Capital or Mint.

Don’t forget about your bank accounts either. Is everything in a joint account? Do you have multiple accounts for personal, business, savings, spending?

If you do decide to keep separate accounts, just make sure that you both have access to each other’s accounts. For several reasons.

Knowing about each other’s accounts can negate any further stress in the event of a tragic situation, such as a death or serious illness.

If you have separate accounts and your partner pays certain bills-like the mortgage-and you can’t access that account to pay the mortgage, say goodbye to your house!

So make sure for security reasons you know about separate accounts and the details for each.

Also make sure you discuss other aspects of finances, such as lending or borrowing money to friends and family. I don’t really like borrowing or lending money to or from people, but I know that things happen and people get into binds.

Just make sure that borrowing money to others will not cause you strain or arguments over finances.

13. All things being equal

If we want to learn how to talk to your spouse about money, it’s crucial that both partner’s needs and concerns are considered.

Going back to my previous point about having access to each other’s account, make sure the money management is not one-sided.

When it comes to decisions about money, plan them together and discuss any changes in previously made plans. Make sure again, you are both on the same page.

When it comes to joint assets and accounts, make sure both of your names are on there. Again as a safety net.

- Also, make sure that there is a record of all the accounts, assets, liabilities and all financial-related things are listed in one place that you can both access.

An easy way to do this is to use the free LastPass Chrome extension to house passwords and vital information. You need one password to log into LastPass and all of your info is saved and you can easily access any of your accounts from one place.

A good old fashioned pen and paper spreadsheet works well too.

Because heaven forbid something should happen to either one of you, the other one will not have to worry about not being able to pay bills on time or access accounts in your absence.

14. Plan for the worst and hope for the best

Obviously, we don’t like to think about our significant other or ourselves passing away, but it is something you need to be prepared for.

Advanced financial planning for the inevitable is the responsible adult thing to do. It is highly recommended that you speak with an estate planner so that you are following any state-mandated rules and won’t have to worry about legal battles.

A few things to consider when estate planning:

- Current beneficiaries listed on retirement, insurance policies, and bank accounts

- Property deeds and leases in both your names

- Appointed power of attorneys

- Trust funds

- A will that spells everything out

15. Compromise, Consideration, Consistency

Keep in mind that the goal is creating a system for managing finances that works for both partners. Know that compromise will be required.

Plan to have money talks at least once a month. This should be time set aside with no distractions.

16. Seek A Pro

Coming to terms with your thoughts and feelings around money can be difficult. If several attempts to have rational discussions about your mutual finances end in an argument, get professional help.

There are marriage counselors that specialize in helping couples with money talks, and financial planners who have experience in working with couples in conflict.

How To Talk To Your Spouse About Money Without It Getting Weird – Conclusion

More often than not, money issues within relationships aren’t all about money. There are often underlying issues at hand that manifest in the form of arguments about money.

More often than not, money issues within relationships aren’t all about money. There are often underlying issues at hand that manifest in the form of arguments about money.When it comes to knowing how to talk to your spouse about money, just remember to be understanding and communicate with one another about these issues and how you feel about them.

- Tip: Use “I” statements to discuss your feelings about finances and keep the lines of communication open.

- Learn the basics of sticking to a budget: Budget basics

Start where you are and work your way towards building a healthy relationship with each other and your money.

Don’t forget to celebrate your small wins. It really keeps the motivation going.

Completing these steps will take time and trust in one another.

Was that as bad as you thought it would be? I didn’t think it would be. You’ll enjoy one another all the more since you’ve had the talk money session.

Want to get started paying down your debt and achieving small wins?

Check out my podcast episode where I share 12 Ways To Beat Financial Stress and this post on how to stop living paycheck to paycheck.

Plus, this sneaky trick to paying down debt using the Debt Snowball Method to become debt-free!

Go ahead, talk to your spouse about money!

What have you done to ensure that you and your partner have developed a healthy financial plan? Do you feel confident that you now know how to talk to your spouse about money?

While having frank conversations with your spouse about getting your financial house in order can be difficult, the payoff can be huge.

Follow along on Instagram!

![Where to Get Quarters [10 Easy Places] 12 US quarters on an old computer showing answer to Where to Get Quarters](https://herpaperroute.com/wp-content/uploads/2021/11/Where-to-Get-Quarters-768x410.jpeg)