6 Elements To Make A Family Budget That Actually Works

Have you been talking about setting up a family budget but are unsure where to actually start your family budgeting?

Sometimes it’s good to just start with the basics. Outline the budgeting categories which you want to include for your family.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

Every family is different and will have different expenses, however, there are some core things to consider when developing your budget.

Here are some tips to help you formulate a simple and easy to follow family budget plan.

How To Make A Family Budget You Can Stick To

The first step in making a family budget is to get real about where your money comes from, and where it goes. You need to have a visual money map in front of you, leaving nothing missed.

To help you do this, I’ve created a Family Budget Planner that guides you through each step. Download it for free, below:

Family Budget Planner + Book, Free Download:

What you need to know to get started with a family budget

When you are establishing a family budget there are some basic principles that you should adhere to.

1. Make A Goal

Knowing the reason WHY you want to put yourself and your family into a smarter financial situation is the first step.

What is your savings goal? What id your debt-payoff goal? When is your goal due? Do you aim for weekly savings numbers? Why do you want to reach that goal? What will it feel like when you get there?

Write this all out in your Family Budget Planner (download it above).

Related: How to have a successful no-spend month.

2. Know Your Income

Let’s break down the different categories that you should consider including in your family budget.

The next place to start when outlining your budget is your income. There might be some estimation or fluctuation here, but make sure you are being realistic here as the rest of your budget depends on your income.

Therefore, a good way to do this is to take your net income from the last three months, add it together and divide it by three. This will give you your monthly average income.

If your income remains pretty consistent each month, this should be pretty easy to figure out and be pretty accurate.

If you are an entrepreneur and/or blogger, your income likely comes from various places.

In your downloadable Family Budget planner (above), I’ve included prompts for your ebooks, courses, services, ad and affiliate income, as well as space for you to fill in all other revenue streams you may have.

3. Know Your Expenses

Your next category to dive into is your expenses. It’s a good idea to include enough detail that you have a clear grasp of things.

Don’t worry about splitting your expenses into dozens of different categories, this will only frustrate you and you will likely give up on your budget before you have even started.

Furthermore, try and make your categories pretty general. For example, “entertainment,” can include things like going to the movies, going out to dinner, taking the kids to a museum, etc. rather than listing all these things in separate categories.

As you break down your expenses into understandable categories and numbers, remember to include things you might not otherwise think to put into your family budget.

Include all of your blog and business expenses (your web hosting, Tailwind, MiloTree, SmarterQueue, ConvertKit, ect) as these are all tax write-offs.

You should also include annual expenses, charitable giving, a new saving, and the like.

4. Then, Know Your Actual Expenses

Tracking your actual expenses is where people tend to get a real wake up call.

Estimating your expenses gives way to “real” numbers when you write down your actual expenses during the month. This is the last section of your budget plan. Keep a running tally of what you are actually spending on things over a couple weeks.

5. Distinguish between your needs and wants

This can be hard for many, but it is vital to creating and sticking to a properly functioning budget. Beware of convincing yourself that a want is a need when it is not. You may just be trying to find an excuse to buy something or spend money where you actually could be saving.

Real needs are things like rent or mortgage, food, gas or public transportation, or clothing.

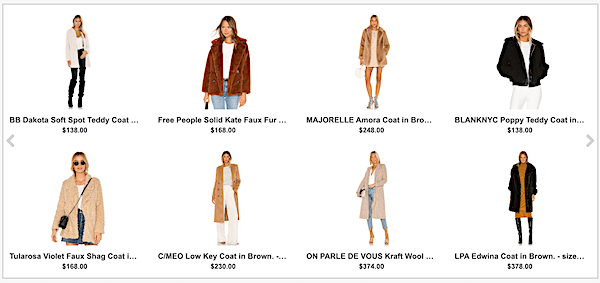

But again, for things like clothing, you should be able to distinguish between needs and wants there as well. You might need a new winter coat, but does it really have cost $500? No!

You can buy a stylish coat from Revolve for less than $175 that will last you a decade. I bought mine 10 years ago and I’m still wearing it, and can’t see any reason why I wouldn’t still be wearing it in Winter 10 years from now!

6. Your expenses should not exceed your income

This seems obvious, but if you are spending more than you are earning, there is a problem!

You may find yourself surprised the first time you do a budget and discover that you actually don’t make enough money to cover your expenses.

If you discover this, you need to take a careful look at our income section and see where you can increase it, and look at your expenses just as carefully and see where you can make some cuts.

How To Make A Family Budget You Can Stick To – Conclusion

The biggest thing to remember when making a family budget is to know that every bit of effort you can put in, counts.

The fact that you are taking the steps to get in control of your finances now means that you will be in a much better situation in a year from now.

So it’s never too late to start! Here’s a trick to paying off debt faster.

And of course, you should have many income streams running, don’t ever just depend on your salary as an employee alone.

Read these super-helpful resources about how you can create more income for yourself:

Have you started your family budget yet?

Let me know how your Family Budget planning is going, on Instagram using hashtag #herpaperroutetribe

Please pin this article, and share it on your personal Facebook page to help your friends improve their family budgeting plan too!

Follow along on Instagram!