How Much Do I Need To Retire? 7 Steps To Save For Retirement

How much do I need to retire? It really doesn’t matter your age, you can start saving for retirement. But, how much money should you actually save for retirement?

I share all sorts of money management tips for early retirement planning here at this entrepreneurship blog, HerPaperRoute.com.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer | Advertise With Us

But if you are in a less-than-great job, have no self-made revenue streams, and are in a state of financial stress, then saving for retirement might not be the first thing on your list.

It can be overwhelming to think about saving for retirement when you might hardly have enough to cover your bills right now. However, you should at least have some kind of retirement savings plan in place.

Free Budget And Retirement Savings Planner

Before we begin, here’s your free copy of the budget planner. Use this to help you pay off debt and save for retirement for years to come.

How Much Do I Need To Retire? 7 Steps To Save For Retirement

The financial tips below aim to answer the question: how much do I need to retire?

These tips take into account what your salary is if you are working a regular job.

But, I always recommend that you should be in charge of your own income, and make money outside of employment. Either as having side hustles, or running your own business.

If you are making passive income online, then you could essentially still be making money for the rest of your life, without having to actually have a job.

This is especially true if you want to retire early.

So considering that…how much should you save for retirement?

How much should you save for retirement?

Many people dream of retirement as jet-setting around the globe, lounging on a beach on a small tropical island, or spending their days creating things in their workshops.

However, this is not the case for so many retirees.

All too often after one retires they are met with health issues, restricted funds, and dwindling savings accounts.

With some advanced planning, many of these hardships can be avoided.

And in fact, you should be setting yourself up to make substantial money now so that you can be your own boss and live that good life NOW. Not just when you are a senior.

How much do I need to retire?

Michael Craig from Wealthsimple is here today to share some tips on how much you should save for retirement.

7 Steps For Retirement Planning

One of the most common questions I get asked is how much should I save for retirement?

Everyone wants to retire. The sooner the better!

But how do you get there? The calculation rests on a number of future circumstances that nobody can predict.

Things like the cost of living (inflation), your salary and how long you’ll live to name a few.

While there’s no way to know the exact outcome of these future circumstances you can plan for how you think they’ll play out in order to put a retirement plan together.

If you’re looking for a quick and general rule of thumb on how much to save, there’s one rule that’s often cited:

How much should you have saved by 30?

How much should I have saved by 30? Well, financial experts often recommend that by age 35, you should have twice your annual salary saved.

How much should I have saved by 40?

How much should I have saved by 40? They say that by age 40, you should have three times your annual salary saved.

How much should I have saved by 65?

By age 65, you should have eight times your annual salary saved.

This is a basic way to estimate how much to save, but of course, it’s not personal to you.

To get a better estimate of how much to save you can follow these steps.

1. Find out how much you’ll spend when you retire

The first step is thinking about what your life will look like when you retire. Do you intend to spend more or less than you currently do?

Many people think they will spend less and forecast they’ll need 80% of their current income in retirement.

This is because they’ll save on some expenses in retirement.

Those expenses might include supporting your kids, paying a mortgage or commuting to and from work every day.

Remember that some expenses might also increase when you retire. Expenses like healthcare or hobbies you plan to take up.

The joys of retirement! There’s no time like the present. Get a pen and paper and start figuring out how much you’ll need when you retire.

2. Figure out how much you’ve saved

Next figure out what you already saved for retirement. Have multiple retirement accounts lying around?

Now is the time to find them and figure out how much of a nest egg you have. If you haven’t saved anything as of now don’t panic.

The next best time to get started saving for retirement is right now!

Once you know how much money you’ve saved and how much you need in retirement you’ll be able to figure out how much you need to save to make up the shortfall.

If that sounds hard, don’t be put off there are lots of tools to lend a helping hand.

Related: The 12 Personal Finance Books You Should Read If You Want To Get Rich

3. Calculate how much you need

The answer to “How much do I need to retire?” Really comes down to your personal spending and saving habits.

To calculate how much you need to save you’ll need to take into account many other factors aside from your retirement spending and savings.

You’ll need to factor in:

- the returns you make on investments

- how much fees you’ll be charged

- the taxes you’ll pay

- the age you’ll retire

- salary increases you’ll have

- your life expectancy

- …the list goes on

I know what you’re thinking, but that long list should not put you off.

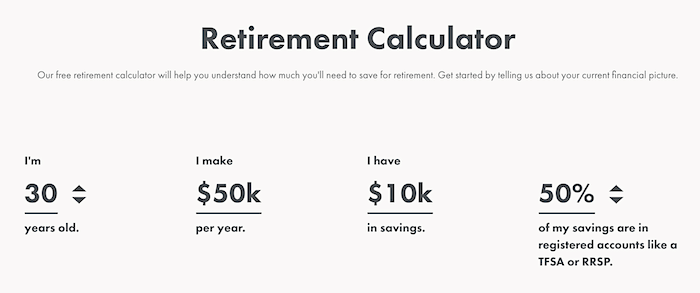

The wonder of modern technology has given rise to many online retirement calculators that can do all the math for you.

Should you live in Canada check out this Wealthsimple retirement calculator.

Retirement calculator

Go here and enter your digits, and the app will tell you how much you should save for retirement, based on your goals.

Wealthsimple offers retirement planning, investment management and will even roundup and invest your spare change.

If you live in the US you’re spoiled for choice in terms of retirement calculators to choose from.

If you reside elsewhere, try and find one specific to your country so that it takes into account your local tax rates.

Free tools are incredibly useful but they rely on assumptions that won’t be suited to everyone so it’s wise to check in with a financial advisor before making any retirement decisions.

Now that you’ve figured out how much to save for retirement, here are a few tips to help you get retirement ready.

4. Save as much as you can

It goes without saying the best way to get retirement ready is to start saving as much as you can as soon as you can.

One painless way to do this is by auto-depositing money from your checking account to a retirement account on payday.

You’ll hardly miss the money! If you’re struggling to find enough money to put away for retirement, try creating a budget.

You’ll see where you’re spending your cash and it will help you think of ways to cut back on spending.

Related: 12 Tactics To Stop Financial Stress And Money Problems For Good

5. Contribute to registered accounts

A registered account is an account specifically created for retirement savings.

They often come with nice benefits like tax breaks. In Canada, an RRSP is a popular registered retirement account and in the US a 401(k) or IRA is a popular choice.

You should aim to max out these accounts to avail of the tax savings before putting your retirement savings anywhere else.

6. Get the help of an investing service or advisor

Now that you plan to save money for retirement you’ll need somewhere to keep it.

An online investment service or a financial advisor will be able to help invest the money for you.

Rather than go all in on a stock or a handful of them select multiple equities and you’ll benefit from diversification.

This means if one part of your investment portfolio takes a hit it won’t pull down your entire portfolio.

Related: Interesting and lucrative side hustle ideas

7. Watch out for high fees

Fees are how financial institutions and advisors like myself make money.

There’s absolutely nothing wrong with paying a fee for someone to help you with investing or retirement planning.

I’d recommend it as you’re getting a solid financial plan, which everyone should have.

That said it’s important to know what you’re getting for your fees and to make sure you’re not being overcharged.

Michael Craig is a Chartered Investment Manager and Associate Portfolio Manager at Wealthsimple. He’s been working in the financial services industry for 15 years. Michael holds a Masters Degree in Business Administration from the Rotman School of Management.

How much do I need to retire? Conclusion

Wondering how much do I need to retire is a concern of many. By now you should have a good understanding of how much money you should start saving for retirement.

Be sure to download the free Wealthsimple app to guide you through your retirement planning.

The next step is to start putting money away, investing and above all, go make more money.

See the links below for tips on how to start making more money, in addition to your paycheck.

More Ways To Save Money For Retirement

- How to become a millionaire

- 21 Passive Income Ideas

- Best Work From Home jobs

- How to stop living paycheck to paycheck

- Money saving tips to save $19,000 /year

- How to start investing your spare change

- 24 Fiverr Gig Ideas That Aren’t Techy

- Pay off debt fast with this tip from Dave Ramsey

Did You Find These Retirement Planning Tips Helpful?

If so, please click the share buttons below to show your friends how financially savvy and responsible you are!

I appreciate your support.

If you’d like to stay in touch, you can find me on Facebook and Pinterest.

We also offer many other free resources and training, when you become a HerPaperRoute member.

==> Come see what our members get here

(And yes, it’s free to be a member!)

– Chelsea

Follow along on Instagram!