How To Manifest Success And Money In Your Life

Do you want to pick up some tips for how to manifest money and success in your life, today?

I recently have been learning about manifesting and using affirmations to attract exactly what I want out of life.

It has been surprisingly eye-opening and I just have to share my experiences.

In this article, I will share some practical tips for getting started with attracting money and success. Let’s get started!

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer | Advertise With Us

How To Manifest Success And Money In Your Life

Written by guest writer Jessica Sears.

First things first, before you can start attracting what you want, you have to sort through the emotional blocks that are keeping you down.

Because if you are bogged down by gunk, you will only attract more gunk!

What are blocks? They are beliefs that have been pushed on us either through our family, friends, social media, or life experiences in general.

These blocks stop us from living at our highest vibrations, we feed our ego instead of our soul.

For example, your money beliefs are most likely keeping you from becoming successful and earning more money.

…I am still working on my own money blocks because I have SO many!

They take time, and you have to change your entire thinking pattern. For example, I used to say “I can’t afford that/” But now I say “The universe will provide” and then I just let it be.

When my practical side kicks in I just change it to “How can I afford it?!” And so I will start looking for ways to make more money to match it.

Look For Proof That Manifesting Works

Before I set out to remove my blocks I was a bit skeptical that this manifesting stuff actually worked.

I love learning new things so I began researching like crazy.

Once I started hearing other stories about how we make our own reality and future I began thinking back to when I first noticed manifesting (didn’t know it was this at the time):

I worked in a nursing home and I was always a very paranoid person, I hated the thought of one of the residents falling.

Whenever I watched a resident walking I would begin to worry they would fall I would feel how horrible it would be.

Then they would fall!

I started forcing myself to look away and not pay attention then they wouldn’t fall. I thought I was controlling things with my mind!

Which, in a way I kind of was, I was manifesting my own reality.

Since then I have worked on my mindset and I am more aware of when I manifest things.

You, yourself have probably manifested things into your life that you aren’t even aware of.

OK, So How Do You Manifest Your Most Amazing Life?

Editor’s Note: To manifest money and success into your life, it starts by truly believing that everything always works out for you, and focusing on the good. You need to put yourself into the frequency of a successful, wealthy person.

This is where scripting can help. Get a pen and paper and create a life for yourself like you are a character in a movie and write out everything she would do, say, wear, look like, etc. Then start living your life as that character!

– Chelsea Clarke

Jessica Sears: Yes! And it is not going to happen overnight. You can’t just repeat “I’m gonna win the lottery” every day but then never buy a ticket.

You cannot achieve your manifesting goals if you don’t do the work or put yourself out there to receive.

Just being aware is a good step to take in the right direction, this alone made me start to notice how I was manifesting things that I already put a lot of feeling into.

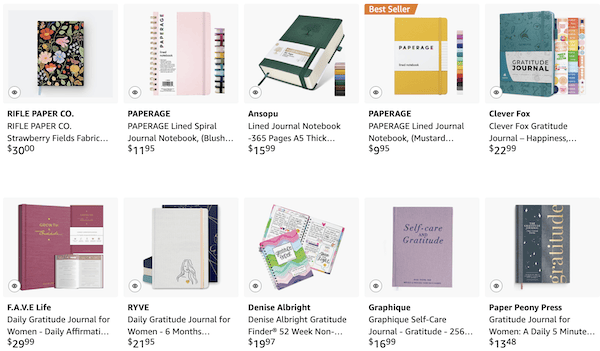

I have also started a daily routine. I will journal in the morning and then try to meditate even if it’s only for 5 mins.

Find your own way of adding these practices into your daily life.

Here Are Some Money Affirmations You Can Use Daily:

- Money comes to me easily and effortlessly.

- I am excited to be making money.

- My life is full of financial security.

- I noticed new possible income sources.

- Manifesting more money comes naturally.

- It is safe for me to make shit tons of money.

- I am a money magnet.

- I have more money coming in than going out.

In short, you need to work on your self-care and I find meditation is the key to unlocking your higher self.

Journaling is also very rewarding when trying to manifest your dreams and goals. If you aren’t sure yet about meditating then start off with a Journal and write down anything you want.

You probably have so much floating around in your brain. It really helps to get it all out on paper.

If I had to make a suggestion I would say to start with journaling 3 things you are grateful for either every morning or before bed.

Be More Aware

This is another important step to take when it comes to LOA (Law of Attraction).

You need to become aware of not only your thoughts. But also, when certain opportunities present themselves, you can notice the action step(s) you need to take in order to manifest your money goals.

Again you can relate this back to journaling and use your journal to record any thoughts that come up when dealing with money.

Here are some great questions to ask yourself regarding money:

- How does spending money make you feel? Good or bad?

- Where do those beliefs come from?

- What would your perfect life look like? Don’t let judgment hold you back, really write out anything.

- When you look at your bills how do they make you feel?

Clearing Out Space

When life is hectic and busy we normally don’t notice how our surroundings affect our mindset.

This is why clearing out your junk is a good way to release old beliefs and create room for more abundance.

Some things to start decluttering are:

Your wallet: This is where we keep all our money and cards that store our money. This is a perfect place to start, don’t forget all those old wallets and purses you have stored away. Donate or toss the ones you never use and choose just one to keep.

Your Vehicle: If you have a vehicle you can clear it out as well, I know some of us also store a lot of change in our cupholders.

Junk Drawers: I am sure most of us have a junk drawer or two, this is another good start because it is easy and usually holds a lot of old mail or other items we would like to forget about.

Clearing it out and making room is a great healing process, you will feel much lighter afterward.

Even after accomplishing just those three, I bet you have accumulated more money than you thought you had.

Being more aware of how much you actually have and respecting all money will pave the way for a better relationship with your finances.

How To Manifest Success And Money In Your Life – Conclusion

If you take anything from this I hope you understand that money is an object and has no hold over us.

Human beings are gifted the right to choose for themselves. Don’t forget that the energy we put into money will come back to us.

Being grateful for what you already have is the strongest energy belief you can put out to the universe.

I hope this helps you better understand how to manifest success and money into your life.

Read This Next:

Pin this:

![9 Best Types of Personal Budgets [How to Choose the Right One for You] 10 9 Best Types of Personal Budgets [How to Choose the Right One for You]](https://herpaperroute.com/wp-content/uploads/2021/11/Best-Types-of-Personal-Budgets-768x410.jpeg)