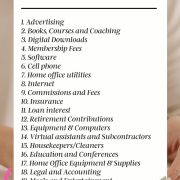

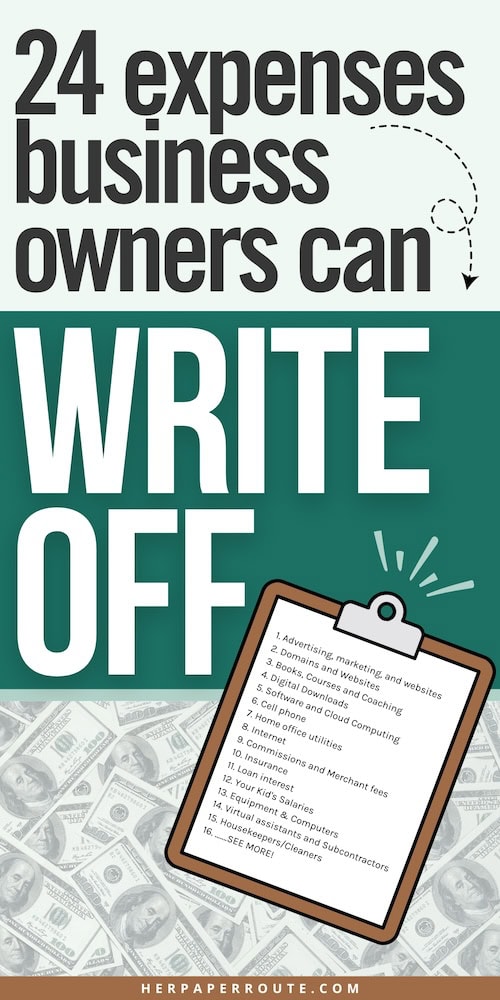

24 Expenses Entrepreneurs Can Write Off On Their Taxes

Did you know that as an entrepreneur and content creator, there are many expenses you can write off on your taxes?

With tax season upon us, I know how navigating the various deductions and write-offs applicable to your business can feel daunting. The upside is that business owners can access numerous deductions that can enhance tax savings by reducing tax liability.

As an affiliate partner of various brands and sponsored content, HerPaperRoute may earn commission on qualifying purchases. Disclaimer

Business owners and self-employed workers get the perk of deducting business expenses from their taxes, which ultimately means paying less tax. (Yay!)

To simplify your tax filing this year, I’ve compiled a list of innovative tax deductions for small businesses that you may not have considered. Let’s talk about some expenses entrepreneurs can write off on their taxes, now.

Note: I am not a financial advisor and the content here is not to be considered financial advice. Always consult with your own tax professional to get advice that relates to your personal situation, and the tax laws in your country.

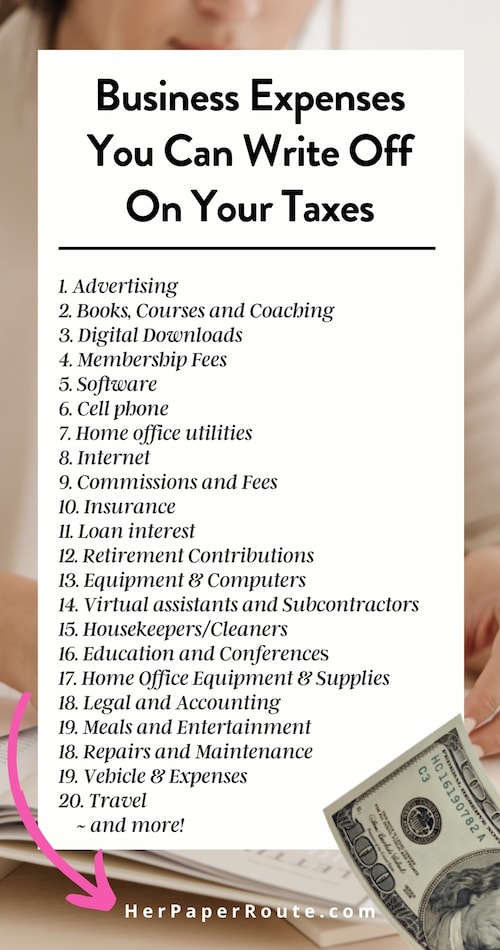

1. Advertising, marketing, and websites

Good news – the cost of advertising your business is a tax write-off. This may include:

- Social media ads

- Print ads

- Sponsorships

- Working with influencers

- Web hosting costs

- Buying domains and websites (see below)

- Shopify

- and any other tools required to promote your brand.

2. Domains and Websites

Do you want to buy an established website and merge it into your other site, to take over the customers, followers, products and content?

Maybe you want to buy a few websites and operate a profitable website portfolio? Or maybe your dream is to flip websites for profit?

Well then good news, because websites and domains are a tax write-off business expense. Learn how to buy an established website, and get miles ahead of the competition this year.

3. Books, Courses and Coaching

As you build your company, there’s a continuous need to stay updated with industry trends and knowledge. This often involves investing in resources like courses or hiring coaches and consultants for strategic insights, all of which can be tax deductible.

🔑 Want to book me for a strategy consultation, to gain fresh insight into your business growth, marketing and offers? Let’s do it!

4. Digital Downloads

Any digital assets you buy for your website, programs, social media or marketing will be considered project costs, and are tax deductible. This can be stock photos, audio effects, Lightroom Presents, and so on,

5. Software and Cloud Computing

The software and online subscriptions you use for your business may be a tax write-off.

Some examples could be:

- Digital tools like Thrivecart, or ConvertBox

- Cloud storage like Google Drive, Dropbox, or OneDrive

- Adobe Creative Suite, Microsoft Office

- Digital subscriptions like Canva, Lasso, or RankIQ

- CRM tools like HoneyBook or Kajabi

6. Cell phone

As a digital creator, your cell phone is often used more for your business than it is for making personal calls. This is especially true if you post TikTok and Instagram content. The cost of your phone and the monthly bills can be claimed on your taxes.

7. Home office utilities

Did you know that if you work from home, a portion of your home utilities, electricity and other expenses can be written off?

You’ll need to determine the square footage of your dedicated workspace, compared to the size of the rest of your home, to get the right calculation. Your accountant can work this out for you.

For example, if your workspace takes up 30% of your home, then 30% of your total utility costs for the year are tax-deductible.

Your workspace could be your office, the room where you record your TikToks, podcasts, etc.

There are many tax benefits afforded to you when you run a business, but many people don't know about them. But not knowing is simply stealing money from yourself.8. Internet

Your business relies on the Internet, so of course it’s a tax write-off.

9. Commissions and Merchant fees

Do you have an affiliate team that promotes your programs on commission? Do you have PayPal and Stripe transaction fees? Claim those expenses on your taxes!

10. Insurance

Look into this closely with your accountant, as you may be able to claim business insurance, home insurance, and your family’s health insurance.

11. Loan interest

Did you acquire a business with the help of a small business loan or seller financing? The interest on that loan may be tax deductible.

12. Your Kid’s Salaries

Do your kids appear in your videos? Do they help with managing your content calendar? Maybe they create graphics for your social media in Canva? Put them on your payroll!

As employees or independent contractors, your children’s salaries become a tax write-off for you just like any other employee or contractor, but the money they earn is also tax-free for them so long as its under a certain amount a year.

Every country will have different rules. In Canada, minors don’t have to pay income tax until they earn more than $15,000 CAD in a year (as of 2023). In USA, minors don’t have to pay income tax until they earn $13,850 USD (as of 2023).

The money can be paid into a savings account in the child’s name, and you can decide if they have full access to the funds now, or if its their education savings to be accessed only when they are college-aged.

Another benefit to this, is it is sort of like paying your children a living will, tax-free. So instead of putting money aside, into a traditional trust or inheritance from your own already-taxed savings, that they would one day get access to and pay taxes on again; they get the money in their name now.

However, the money won’t make much in interest sitting in a savings account, so you may want to put it into an official registered education savings fund. Speak with a licensed financial advice to get the best advice tailored to your goals.

13. Equipment & Computers

Creators and business owners need to stay on top of the best technology to continue to produce high-quality content. Things such as computers, mics and other audio recording equipment, lighting kits, greenscreens, etc are all tax deductible for your business.

14. Virtual assistants and Subcontractors

Don’t wait to hire the help you need to manage and grow your business. Your virtual assistant, ads manager, Pinterest manager and other independent subcontractors are all expenses that are tax deductible.

15. Housekeepers/Cleaners

Need someone to clean your kitchen after you’ve spent the day filming cooking content for your Youtube channel? Your housekeeper is a tax write-off and falls under subcontractors.

16. Education and conference expenses

Educating yourself as a business owner is crucial for your company’s growth, and it’s also a tax-deductible business expense.

Books, online courses, seminars and conferences are typically all acceptable forms of education – but speak with your accountant for the specifics that apply to your unique situation.

17. Home office equipment and supplies

All the things you need to manage your home office from printers to paper to lighting to furniture can be tax deductible.

18. Legal and accounting services

Working with lawyers, accountants and advisors for tax and legal advice is a tax-deductible expense, as is the cost of bookkeeping, tax filing, etc.

19. Meals and entertainment

When taking someone out for a business meeting, or having a meal while traveling, food and drink expenses incurred are deductible business expenses.

In some cases, reasonable entertainment costs may be as well. But hold the filet mignon and private jet to Paris – because in most cases there are limits to how much can be written off.

In some countries it 50-100% of the bill, or it’s a daily dollar amount limit.

20. Repairs and maintenance

Expenses related to repairing or maintaining your equipment, business vehicle, or office space could potentially be deductions you can claim on your tax return.

21. Car or truck expenses

In Canada, you may be able to lease a new car via your business and have the lease payments be 100% written off (so long as the monthly payments are under a certain amount, and meet other criteria).

In the USA, the IRS says that you can deduct a part of each lease payment that is for business use of the vehicle.

22. Travel

One of the best tax perks of being an entrepreneur has to be the ability to write off travel expenses. This can be airline, ferry and train tickets, hotels, baggage fees, airport lounges, taxis/Ubers and more.

23. Retirement contributions

Saving for retirement is important, but it’s often hard to do when you are a small business owner with so many other expenses to cover.

That’s why it’s helpful to know that funding your registered retirement savings plan can help reduce your tax owing. You may be able to set up a SEP IRA, SIMPLE IRA, or solo 401k as a small business owner in USA, or an RRSP in Canada.

24. Membership Dues/Fees

Yes, that’s right! Your business mastermind, group programs, and any business memberships (like FoundersCard!) that you are a part of may also be written off.

Expenses Entrepreneurs Can Write Off On Their Taxes – Conclusion

Now that you know the many expenses entrepreneurs can write off on their taxes, it’s time to take action and start claiming the ones that affect your business.

Know that tax deductions serve a dual purpose: they enable you to operate your business effectively and save money on taxes simultaneously.

Understanding the specific types of business expenses eligible for write-offs is crucial for tax filing. By keeping track of receipts and knowing your business expenses, you can maximize deductions to maintain and continue to grow your company.

Follow along on Instagram!